Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Schulte family has made the decision to purchase a house. They qualify for a $147,000 mortgage. The lender offers them a thirty year morigage

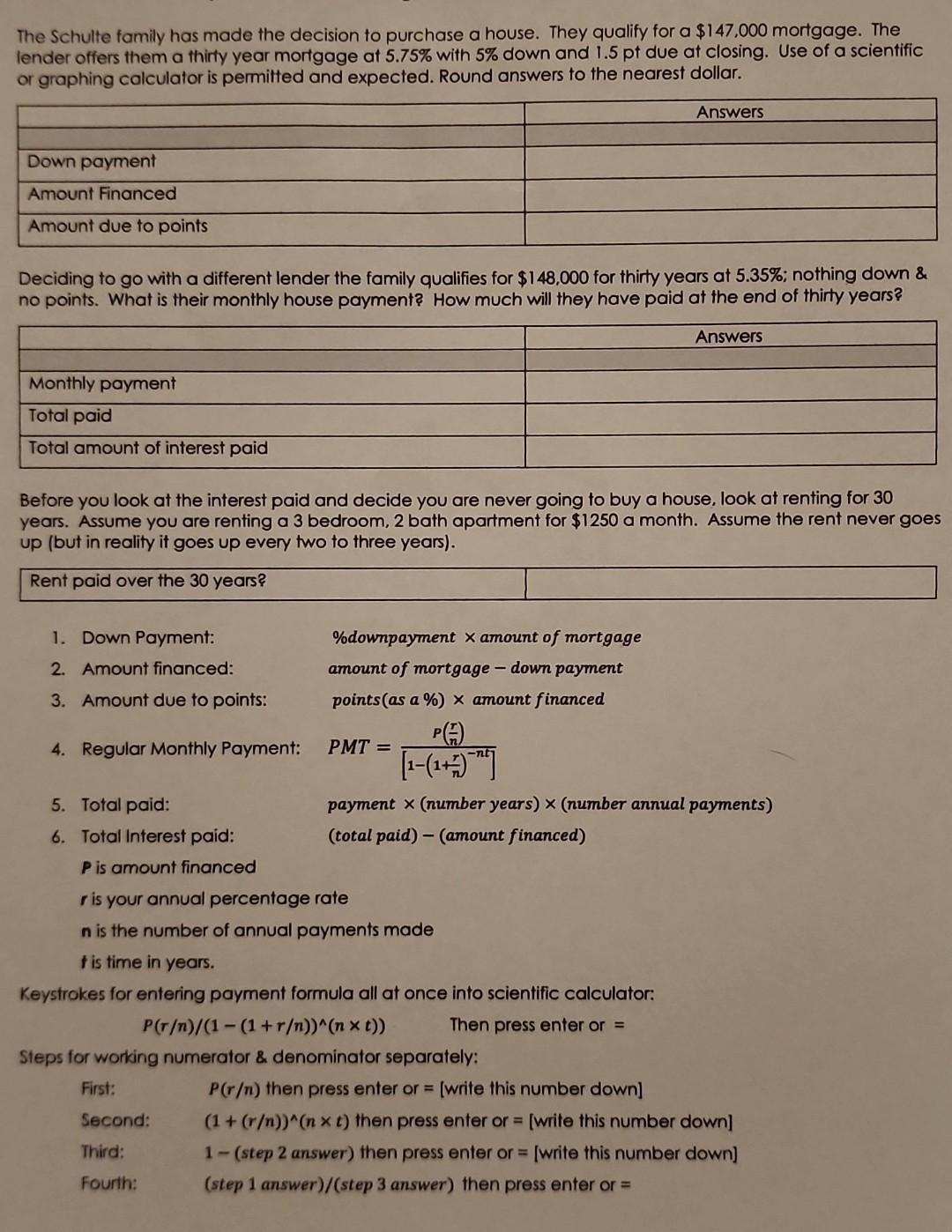

The Schulte family has made the decision to purchase a house. They qualify for a $147,000 mortgage. The lender offers them a thirty year morigage at 5.75% with 5% down and 1.5 pt due at closing. Use of a scientific or graphing colculator is permitted and expected. Round answers to the nearest dollar. Deciding to go with a different lender the family qualifies for $148,000 for thirty years at 5.35%; nothing down \& no points. What is their monthly house payment? How much will they have paid at the end of thirty years? Before you look at the interest paid and decide you are never going to buy a house, look at renting for 30 years. Assume you are renting a 3 bedroom, 2 bath apartment for $1250 a month. Assume the rent never goes up (but in reality it goes up every two to three years). Rent paid over the 30 years? 1. Down Payment: 2. Amount financed: 3. Amount due to points: 4. Regular Monthly Payment: 5. Total paid: 6. Total Interest paid: P is amount financed \%downpayment amount of mortgage amount of mortgage - down payment points (as a \%) amount financed PMT=[1(1+nr)nt]P(nr) payment ( number years )( number annual payments ) (total paid) - (amount financed ) r is your annual percentage rate n is the number of annual payments made t is time in years. Keystrokes for entering payment formula all at once into scientific calculator: P(r)/(1(1+r))(nt))Thenpressenteror= Steps for working numerator \& denominator separately: First: P(r) then press enter or = [write this number down] Second: (1+(r))(nt) then press enter or = [write this number down] Third: 1( step 2 answer) then press enter or = [write this number down] Fourth: ( step 1 answer) /( step 3 answer) then press enter or =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started