Answered step by step

Verified Expert Solution

Question

1 Approved Answer

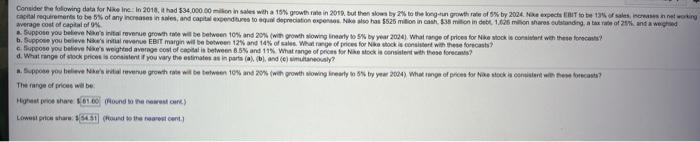

the screen shot for the question is a little bit vague, but i tried my best to make it clear. Consider the following data for

the screen shot for the question is a little bit vague, but i tried my best to make it clear.

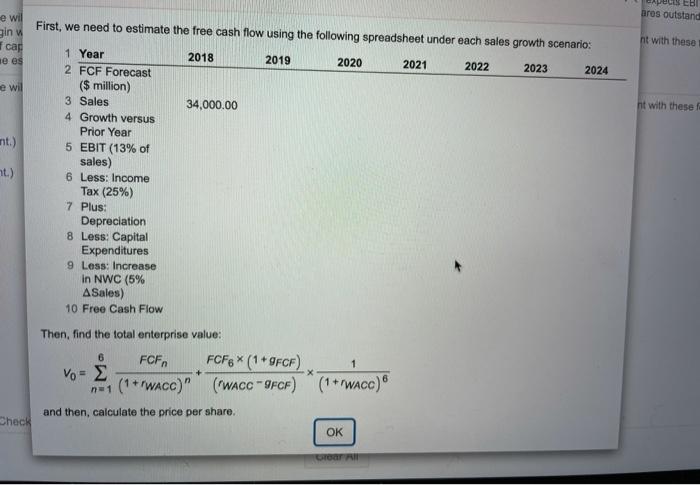

Consider the following data for Nine Inc. In 2016, it had 534,000.00 in sales with a 15 growth rate in 2018. But then slows by to the long-un growth rate of by 2024. ape Toscane working ahal requirements to be 5% of any increases and capital excedure to equal depreciation Beso has $626 million in cash 38 million in debt 1.626 milion shares standing, taxeot 206 and we average cost of capital of 0% Suppose you believes initial revenue grown will be between 10% and 20% (with growth owng into bear 2024) What range of prices for Nike Woek is consistent with these forecasts? b. Suppose you believe til revenue EBIT marginwilt between 12% and 14% of all Watrange of prices for Nowock consistent with the forect? e Bose you believe weighted average cost of crois between 85% and 11 What range of prors for Nike stock le content with these forecasts? d. What range of stock price is consist you very the estimates as inputs (blande me? ...pe you believe we growth rate will be between 10% and 2 with growth owing treaty to 384 by year 2004) Whange of prom for rent content to? The range of prices will be Highest phare 6160 Pound to restant) Lowest price shaw 1541 Round to the restent EBI bros outstand First, we need to estimate the free cash flow using the following spreadsheet under each sales growth scenario: e wil gin cap e es nt with these 2018 2019 2020 2021 2022 2023 2024 e wil 34,000.00 nt with these nt.) t.) 1 Year 2 FCF Forecast ($ million) 3 Sales 4 Growth versus Prior Year 5 EBIT (13% of sales) 6 Less: Income Tax (25%) 7 Plus: Depreciation 8 Less: Capital Expenditures 9 Less: Increase in NWC (5% ASales) 10 Free Cash Flow 1 Then, find the total enterprise value: 6 FCF FCF* (1 * 9FCF) Vo (WACC FCF) and then, calculate the price per share. + n=1 (1+'WACC)" (1+rwacc) Check OK Consider the following data for Nine Inc. In 2016, it had 534,000.00 in sales with a 15 growth rate in 2018. But then slows by to the long-un growth rate of by 2024. ape Toscane working ahal requirements to be 5% of any increases and capital excedure to equal depreciation Beso has $626 million in cash 38 million in debt 1.626 milion shares standing, taxeot 206 and we average cost of capital of 0% Suppose you believes initial revenue grown will be between 10% and 20% (with growth owng into bear 2024) What range of prices for Nike Woek is consistent with these forecasts? b. Suppose you believe til revenue EBIT marginwilt between 12% and 14% of all Watrange of prices for Nowock consistent with the forect? e Bose you believe weighted average cost of crois between 85% and 11 What range of prors for Nike stock le content with these forecasts? d. What range of stock price is consist you very the estimates as inputs (blande me? ...pe you believe we growth rate will be between 10% and 2 with growth owing treaty to 384 by year 2004) Whange of prom for rent content to? The range of prices will be Highest phare 6160 Pound to restant) Lowest price shaw 1541 Round to the restent EBI bros outstand First, we need to estimate the free cash flow using the following spreadsheet under each sales growth scenario: e wil gin cap e es nt with these 2018 2019 2020 2021 2022 2023 2024 e wil 34,000.00 nt with these nt.) t.) 1 Year 2 FCF Forecast ($ million) 3 Sales 4 Growth versus Prior Year 5 EBIT (13% of sales) 6 Less: Income Tax (25%) 7 Plus: Depreciation 8 Less: Capital Expenditures 9 Less: Increase in NWC (5% ASales) 10 Free Cash Flow 1 Then, find the total enterprise value: 6 FCF FCF* (1 * 9FCF) Vo (WACC FCF) and then, calculate the price per share. + n=1 (1+'WACC)" (1+rwacc) Check OK Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started