Answered step by step

Verified Expert Solution

Question

1 Approved Answer

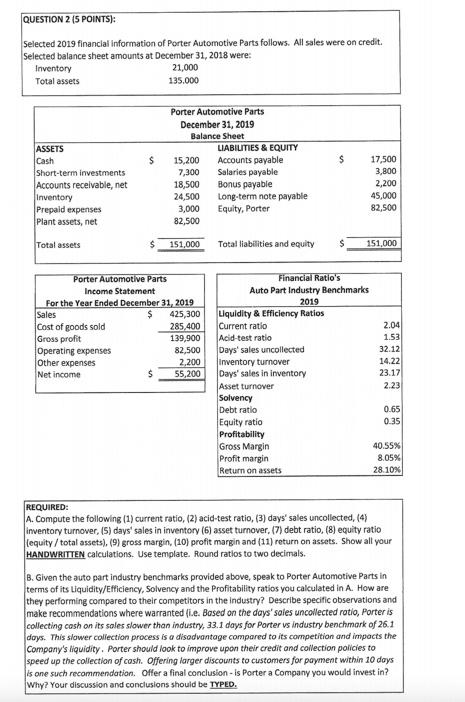

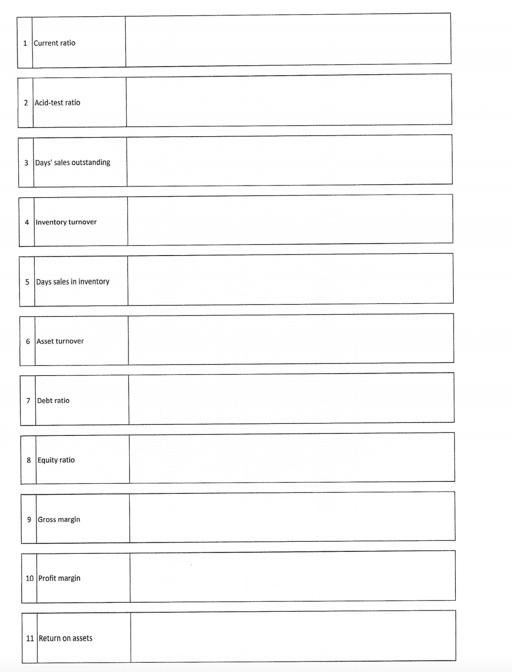

the second picture is a template, not a question QUESTION 2 (S POINTS): Selected 2019 financial Information of Porter Automotive Parts follows. All sales

\

\

the second picture is a template, not a question

QUESTION 2 (S POINTS): Selected 2019 financial Information of Porter Automotive Parts follows. All sales were on credit. Selected balance sheet amounts at December 31, 2018 were: Inventory 21,000 Total assets 135.000 $ ASSETS Cash Short-term investments Accounts receivable, net Inventory Prepaid expenses Plant assets, net Porter Automotive Parts December 31, 2019 Balance Sheet LIABILITIES & EQUITY 15,200 Accounts payable 7,300 Salaries payable 18,500 Bonus payable 24,500 Long-term note payable 3,000 Equity, Porter 82,500 17,500 3,800 2,200 45,000 82,500 Total assets 151,000 Total liabilities and equity 151,000 Porter Automotive Parts Income Statement For the Year Ended December 31, 2019 Sales $ 425,300 Cost of goods sold 285,400 Gross profit 139,900 Operating expenses 82,500 Other expenses 2,200 Net income $ 55,200 Financial Ratio's Auto Part Industry Benchmarks 2019 Liquidity & Efficiency Ratios Current ratio 2.04 Acid-test ratio 1.53 Days' sales uncollected 32.12 Inventory turnover 14.22 Days' sales in inventory 23.17 Asset turnover 2.23 Solvency Debt ratio 0.65 Equity ratio 0.35 Profitability Gross Margin 40.55% Profit margin 8.05% Return on assets 28.10% REQUIRED: A. Compute the following (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected (4) inventory turnover, (5) days' sales in inventory (6) asset turnover, (7) debt ratio, (8) equity ratio (equity/total assets), (9) gross margin (10) profit margin and (11) return on assets. Show all your HANDWRITTEN calculations. Use template. Round ratios to two decimals. B. Given the auto part industry benchmarks provided above, speak to Porter Automotive Parts in terms of its Liquidity/Efficiency, Solvency and the Profitability ratios you calculated in A. How are they performing compared to their competitors in the industry? Describe specific observations and make recommendations where warranted i.e. Based on the days' sales uncollected ratio, Porter is collecting cash on its soles slower than industry, 33.1 days for Porter vs industry benchmark of 26.1 days. This slower collection process is a disadvantage compared to its competition and impacts the Company's liquidity. Porter should look to improve upon their credit and collection policies to speed up the collection of cash. Offering larger discounts to customers for payment within 10 days is one such recommendation Offer a final conclusion - is Porter a Company you would invest in? Why? Your discussion and conclusions should be TYPED. 1 Current ratio 2 Acid-test ratio 3 Days' sales outstanding 4 inventory turnover 5 Days sales in Inventory 6 Asset turnover 7 Debt ratio & Equity ratio 9 Gross margin 10 Profit margin 11 Return on assetsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started