Question

The selected amounts that follow were taken from Hawk Corporation's accounting records: Raw materials used Direct labor $ 25,000 33,000 120, 000 Total manufacturing

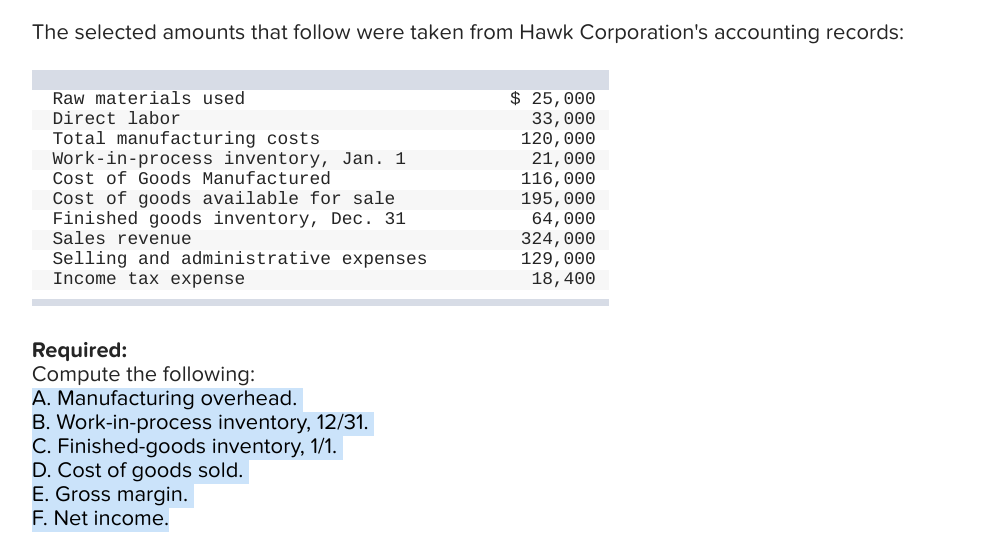

The selected amounts that follow were taken from Hawk Corporation's accounting records: Raw materials used Direct labor $ 25,000 33,000 120, 000 Total manufacturing costs Work-in-process inventory, Jan. 1 Cost of Goods Manufactured 21,000 116, 000 195, 000 Cost of goods available for sale Finished goods inventory, Dec. 31 Sales revenue 64,000 324, 000 129, 000 Selling and administrative expenses Income tax expense 18, 400 Required: Compute the following: A. Manufacturing overhead. B. Work-in-process inventory, 12/31. C. Finished-goods inventory, 1/1. D. Cost of goods sold. E. Gross margin. F. Net income.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A Manufacturing overhead Total manufacturing cost Raw material used Direct labo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Managerial Accounting Concepts

Authors: Edmonds, Tsay, olds

6th Edition

71220720, 78110890, 9780071220729, 978-0078110894

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App