Answered step by step

Verified Expert Solution

Question

1 Approved Answer

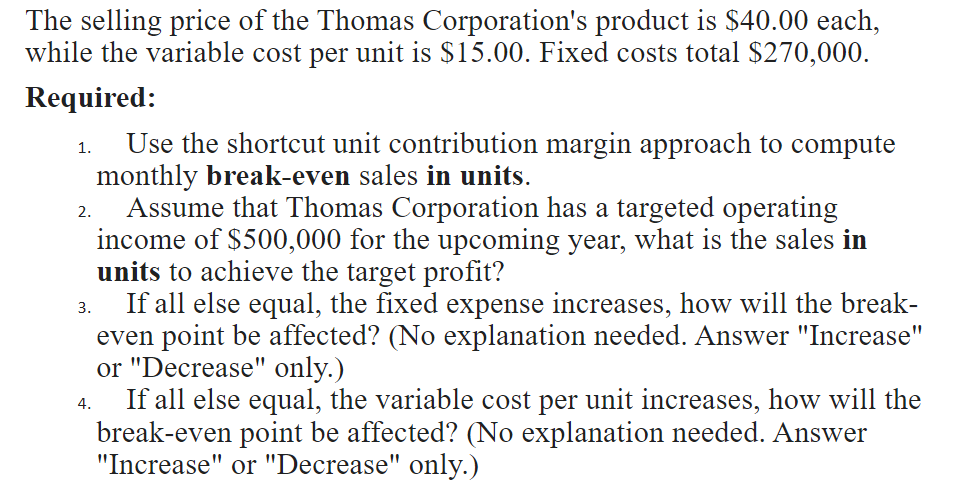

The selling price of the Thomas Corporation's product is $40.00 each, while the variable cost per unit is $15.00. Fixed costs total $270,000. Required:

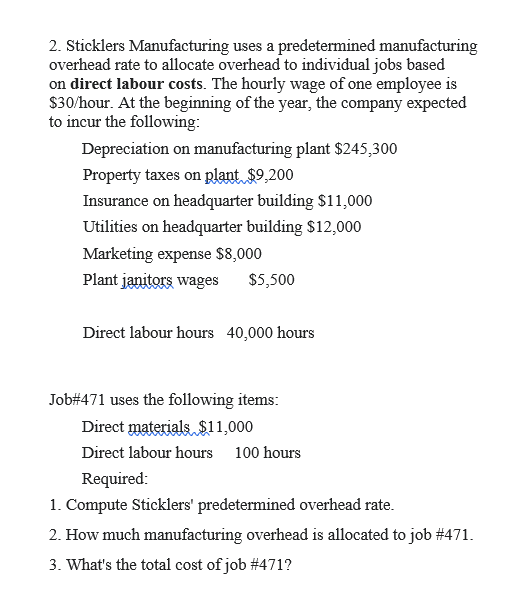

The selling price of the Thomas Corporation's product is $40.00 each, while the variable cost per unit is $15.00. Fixed costs total $270,000. Required: 1. 2. Assume that Thomas Corporation has a targeted operating income of $500,000 for the upcoming year, what is the sales in units to achieve the target profit? If all else equal, the fixed expense increases, how will the break- even point be affected? (No explanation needed. Answer "Increase" or "Decrease" only.) 3. Use the shortcut unit contribution margin approach to compute monthly break-even sales in units. 4. If all else equal, the variable cost per unit increases, how will the break-even point be affected? (No explanation needed. Answer "Increase" or "Decrease" only.) 2. Sticklers Manufacturing uses a predetermined manufacturing overhead rate to allocate overhead to individual jobs based on direct labour costs. The hourly wage of one employee is $30/hour. At the beginning of the year, the company expected to incur the following: Depreciation on manufacturing plant $245,300 Property taxes on plant. $9.200 Insurance on headquarter building $11,000 Utilities on headquarter building $12,000 Marketing expense $8,000 Plant janitors wages $5,500 Direct labour hours 40,000 hours Job#471 uses the following items: Direct materials $11,000 Direct labour hours 100 hours Required: 1. Compute Sticklers' predetermined overhead rate. 2. How much manufacturing overhead is allocated to job # 471. 3. What's the total cost of job #471?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the monthly breakeven sales in units using the shortcut unit contribution margin approach ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started