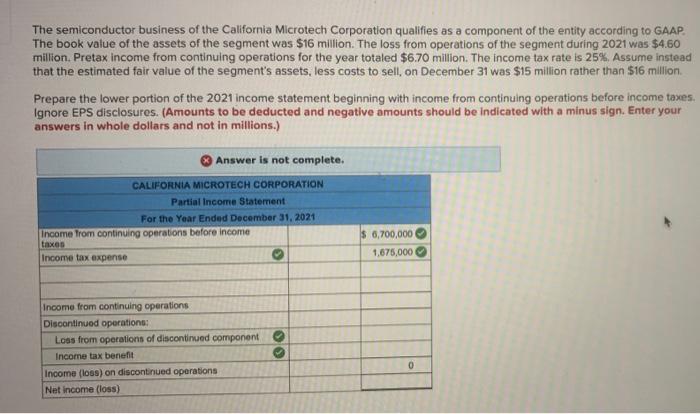

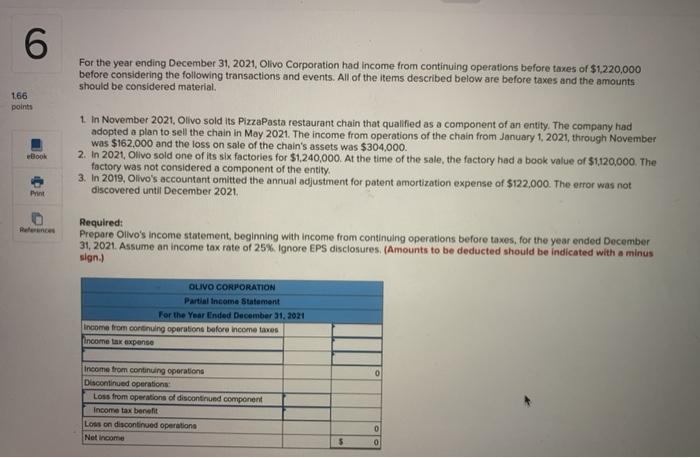

The semiconductor business of the California Microtech Corporation qualifies as a component of the entity according to GAAP The book value of the assets of the segment was $16 million. The loss from operations of the segment during 2021 was $4.60 million. Pretax income from continuing operations for the year totaled $6.70 million. The income tax rate is 25%. Assume instead that the estimated fair value of the segment's assets, less costs to sell, on December 31 was $15 million rather than $16 million Prepare the lower portion of the 2021 income statement beginning with income from continuing operations before income taxes. Ignore EPS disclosures. (Amounts to be deducted and negative amounts should be indicated with a minus sign. Enter your answers in whole dollars and not in millions.) Answer is not complete. CALIFORNIA MICROTECH CORPORATION Partial Income Statement For the Year Ended December 31, 2021 Income from continuing operations before income taxes Income tax expense $ 6,700,000 1.675,000 Income from continuing operations Discontinued operations Loss from operations of discontinued component Income tax benefit Income (loos) on discontinued operations Net Income (loss) 0 6 For the year ending December 31, 2021, Olivo Corporation had income from continuing operations before taxes of $1.220,000 before considering the following transactions and events. All of the items described below are before taxes and the amounts should be considered material. 166 points Book 1. In November 2021, Olivo sold its PizzaPasta restaurant chain that qualified as a component of an entity. The company had adopted a plan to sell the chain in May 2021. The income from operations of the chain from January 1, 2021, through November was $162,000 and the loss on sale of the chain's assets was $304,000. 2. In 2021. Olivo sold one of its six factories for $1.240,000. At the time of the sale, the factory had a book value of 120,000. The 3. in 2019, Olivo's accountant omitted the annual adjustment for patent amortization expense of $122,000. The error was not discovered until December 2021. Print Required: Prepare Olivo's income statement, beginning with income from continuing operations before taxes, for the year ended December 31, 2021. Assume an income tax rate of 25% ignore EPS disclosures. (Amounts to be deducted should be indicated with a minus sign.) OLIVO CORPORATION Partial income Statement For the Year Ended December 31, 2021 Income from continuing operations before income taxes Income tax expense 0 Income from continuing operations Discontinued operations Loss from operations of discontinued component Income tax benefit Lots on discontinued operations Net income 0 5 0