Question

The senior management team at Bettis Company is working on setting its dividend payout policy for the current year. The team is debating whether to

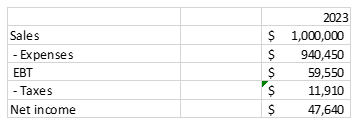

The senior management team at Bettis Company is working on setting its dividend payout policy for the current year. The team is debating whether to pay out 75% or 25% of its net income as a dividend. Bettis is an all-equity financed company, and it has $700 million of assets at the end of its most recent year. Bettis has a cost of equity of 6.81%. The following shows a simplified income statement forecast for the coming year.

a. Calculate Bettiss growth rate of assets if the company pays out 75% of its net income as a dividend.

b. Calculate Bettiss growth rate of assets if the company pays out 25% of its net income as a dividend.

c. Does the value of Bettiss shares change depending on the choice of dividend payout? Please provide a basic example demonstrating why or why not.

Please show your work.

Thanks for any help!

\begin{tabular}{|l|r|r|} \hline & & 2023 \\ \hline Sales & $ & 1,000,000 \\ \hline - Expenses & $ & 940,450 \\ \hline EBT & $ & 59,550 \\ \hline - Taxes & $ & 11,910 \\ \hline Net income & $ & 47,640 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started