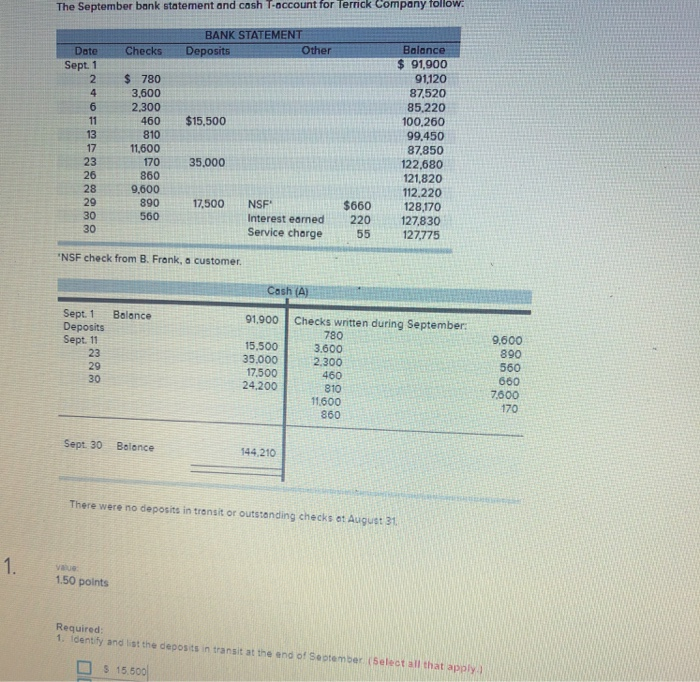

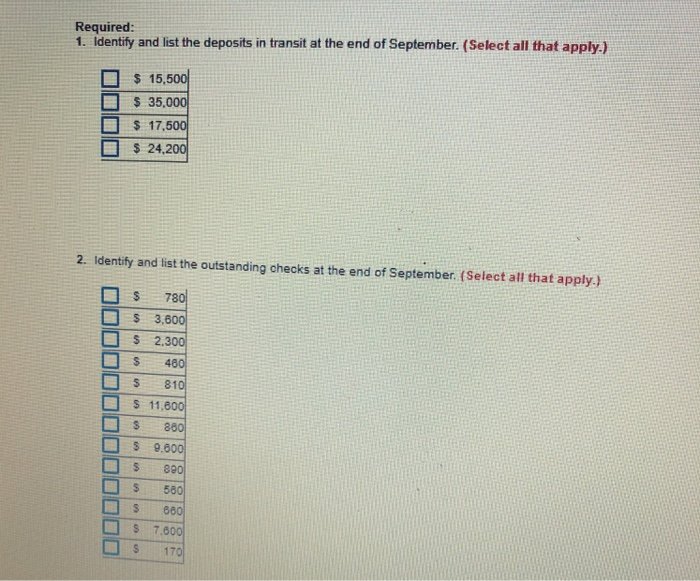

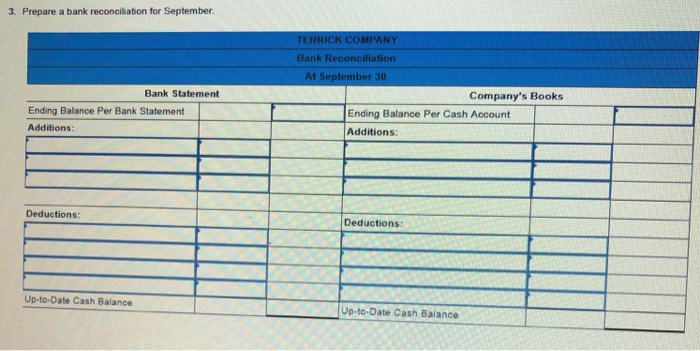

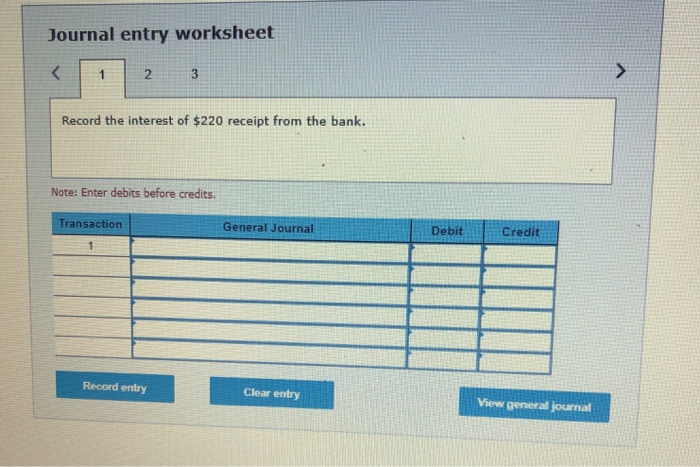

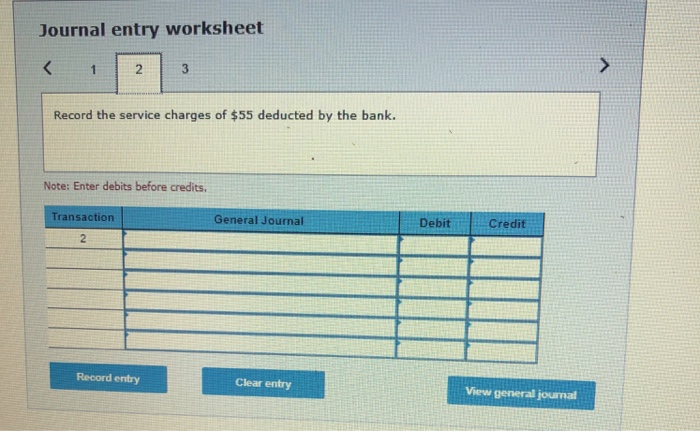

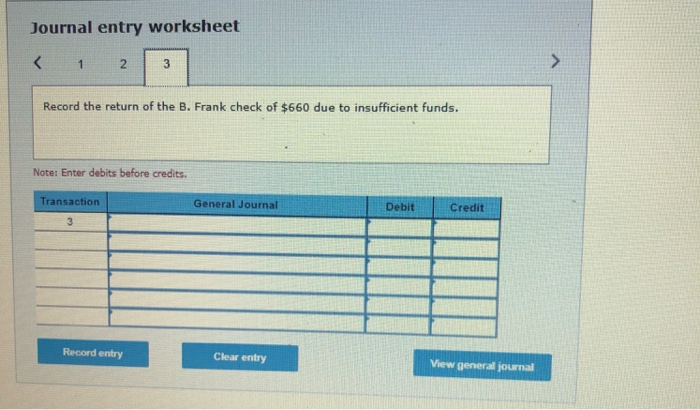

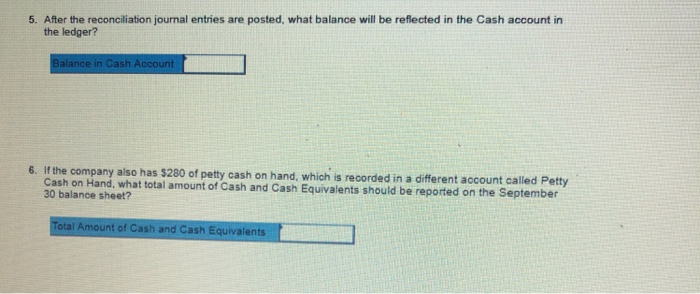

The September bank statement and cash T-occount for Terrick Company tollow BANK STATEMENT Balance $91,900 91120 87520 85,220 100,260 99.450 87,850 122,680 21,820 112.220 $660128,170 Interest earned 220 127830 Service charge 55 127,775 Date Checks Deposits Sept. 1 2 $ 780 4 3,600 6 2.300 460 $15,500 810 13 17 11,600 23 26 28 9.600 29 30 30 170 35.000 860 890 17,500 NSF 560 'NSF check from B. Frank, a customer Cash (A) Sept. 1 Balance 91,900 Checks written during September Deposits 23 30 780 3.600 2.300 460 810 11600 860 9,600 890 560 660 Sept. 11 15,500 35.000 17,500 24.200 7600 Sept 30 Balance 144.210 There were no deposits in trensit or outstanding checks ot August 31 1.50 points Required 1. idently and list the deposits in transit at the end of Seotember (Seleot all that apply S 15.50 Required 1. identify and list the deposits in transit at the end of September. (Select all that apply.) $15,500 35,000 s 17,500 24.200 2. Identify and list the outstanding checks at the end of September. (Select all that apply S 780 3,800 $ 2.300 5810 S 11,600 S 860 5 9.600 S 890 S 580 S 660 $ 7.600 S170 3. Prepare a bank reconciliation for September TERRICK COMPANY Bank Reconciliation At September 30 Bank Statement Company's Books Ending Balance Per Bank Statement Additions Ending Balance Per Cash Account Additions: Deductions Deductions Up-to-Date Cash Balance Up-to-Date Cash Balance Journal entry worksheet Record the interest of $220 receipt from the bank. Note: Enter debits before credits. DebitCredit Transaction General Journal Record entry Clear entry View general journal Journal entry worksheet 2 Record the service charges of $55 deducted by the bank. Note: Enter debits before credits ransaction General Journal Debit Credit 2 Record entry Clear entry View general journal Journal entry worksheet 2 Record the return of the B. Frank check of $660 due to insufficient funds. Note: Enter debits before credits. ransaction General Journal Debit Credit Record entry Clear entry View general journal 5. After the reconciliation journal entries are posted, what balance will be reflected in the Cash account in the ledger? Balance in Cash Account 6. If the company also has $280 of petty cash on han d. which is recorded in a different account called Petty Cash on Hand. what total amount of Cash and Cash Equivalents should be reported on the September 30 balance sheet? Total Amount of Cash and Cash Equivalents