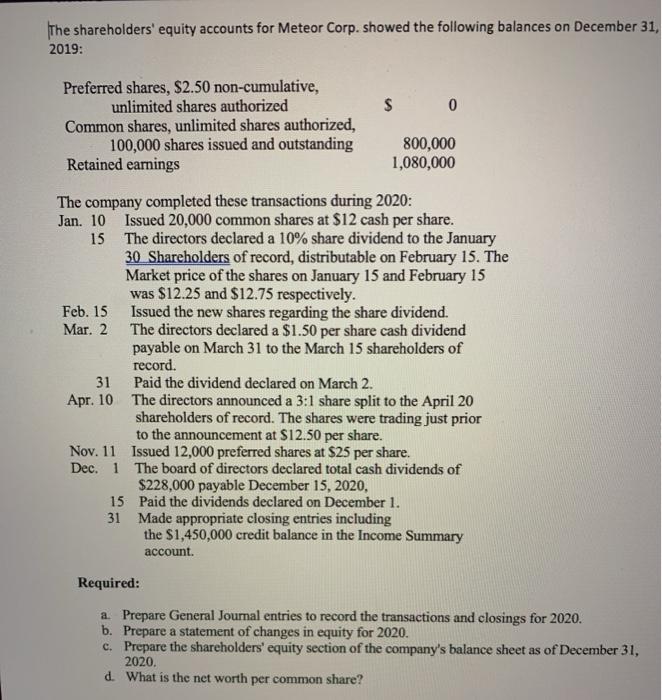

The shareholders' equity accounts for Meteor Corp. showed the following balances on December 31, 2019: $ 0 Preferred shares, $2.50 non-cumulative, unlimited shares authorized Common shares, unlimited shares authorized, 100,000 shares issued and outstanding Retained earnings 800,000 1,080,000 The company completed these transactions during 2020: Jan. 10 Issued 20,000 common shares at $12 cash per share. 15 The directors declared a 10% share dividend to the January 30 Shareholders of record, distributable on February 15. The Market price of the shares on January 15 and February 15 was $12.25 and $12.75 respectively. Feb. 15 Issued the new shares regarding the share dividend. Mar. 2 The directors declared a $1.50 per share cash dividend payable on March 31 to the March 15 shareholders of record. 31 Paid the dividend declared on March 2. Apr. 10 The directors announced a 3:1 share split to the April 20 shareholders of record. The shares were trading just prior to the announcement at $12.50 per share. Nov. 11 Issued 12,000 preferred shares at $25 per share. Dec. 1 The board of directors declared total cash dividends of $228,000 payable December 15, 2020, 15 Paid the dividends declared on December 1. 31 Made appropriate closing entries including the $1,450,000 credit balance in the Income Summary account. Required: a. Prepare General Journal entries to record the transactions and closings for 2020. b. Prepare a statement of changes in equity for 2020. c. Prepare the shareholders' equity section of the company's balance sheet as of December 31, 2020. d. What is the net worth per common share? The shareholders' equity accounts for Meteor Corp. showed the following balances on December 31, 2019: $ 0 Preferred shares, $2.50 non-cumulative, unlimited shares authorized Common shares, unlimited shares authorized, 100,000 shares issued and outstanding Retained earnings 800,000 1,080,000 The company completed these transactions during 2020: Jan. 10 Issued 20,000 common shares at $12 cash per share. 15 The directors declared a 10% share dividend to the January 30 Shareholders of record, distributable on February 15. The Market price of the shares on January 15 and February 15 was $12.25 and $12.75 respectively. Feb. 15 Issued the new shares regarding the share dividend. Mar. 2 The directors declared a $1.50 per share cash dividend payable on March 31 to the March 15 shareholders of record. 31 Paid the dividend declared on March 2. Apr. 10 The directors announced a 3:1 share split to the April 20 shareholders of record. The shares were trading just prior to the announcement at $12.50 per share. Nov. 11 Issued 12,000 preferred shares at $25 per share. Dec. 1 The board of directors declared total cash dividends of $228,000 payable December 15, 2020, 15 Paid the dividends declared on December 1. 31 Made appropriate closing entries including the $1,450,000 credit balance in the Income Summary account. Required: a. Prepare General Journal entries to record the transactions and closings for 2020. b. Prepare a statement of changes in equity for 2020. c. Prepare the shareholders' equity section of the company's balance sheet as of December 31, 2020. d. What is the net worth per common share