Answered step by step

Verified Expert Solution

Question

1 Approved Answer

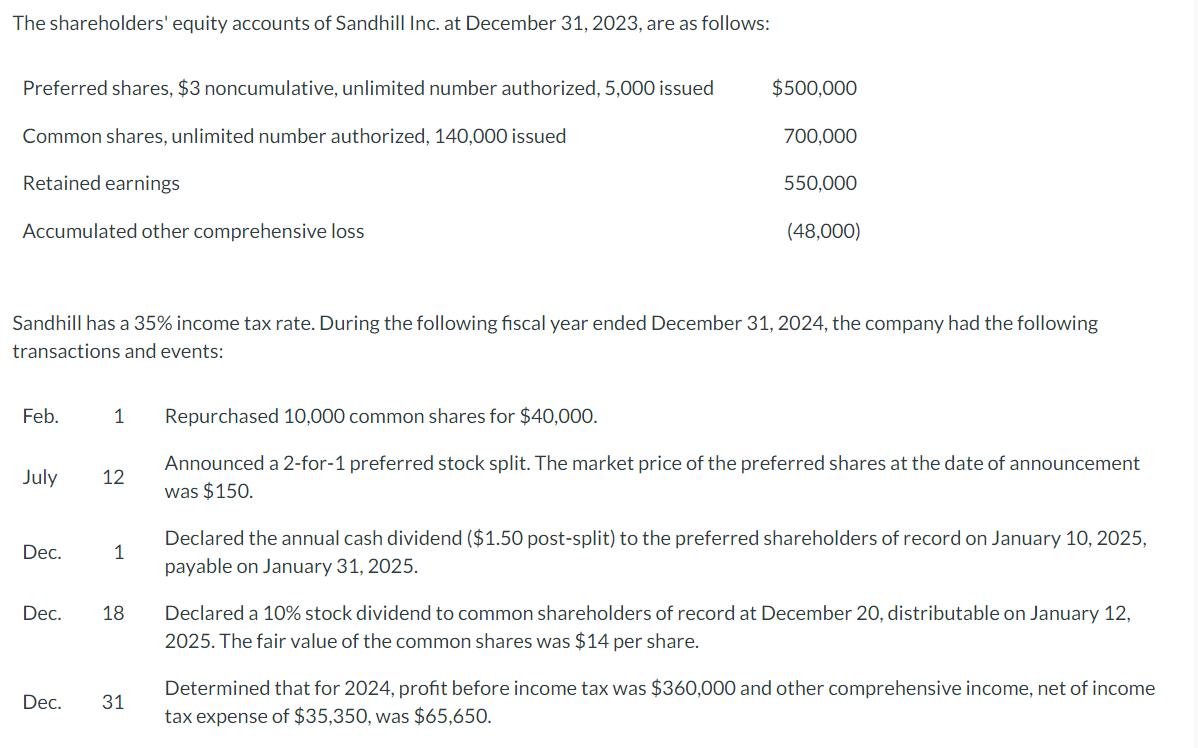

The shareholders' equity accounts of Sandhill Inc. at December 31, 2023, are as follows: Preferred shares, $3 noncumulative, unlimited number authorized, 5,000 issued $500,000

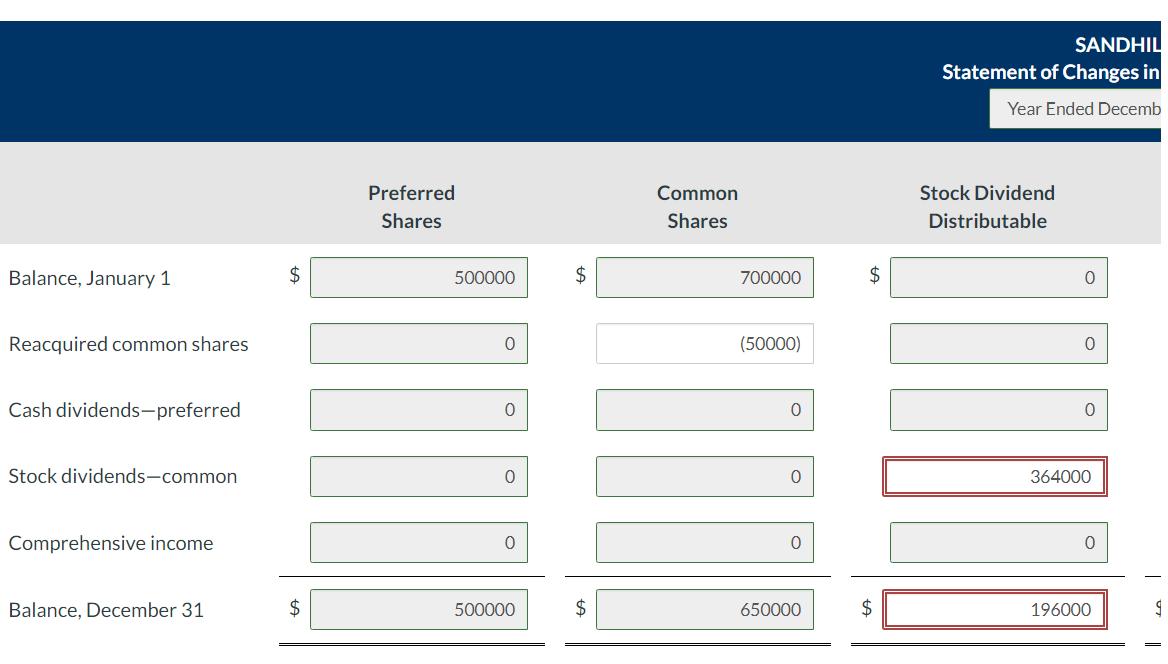

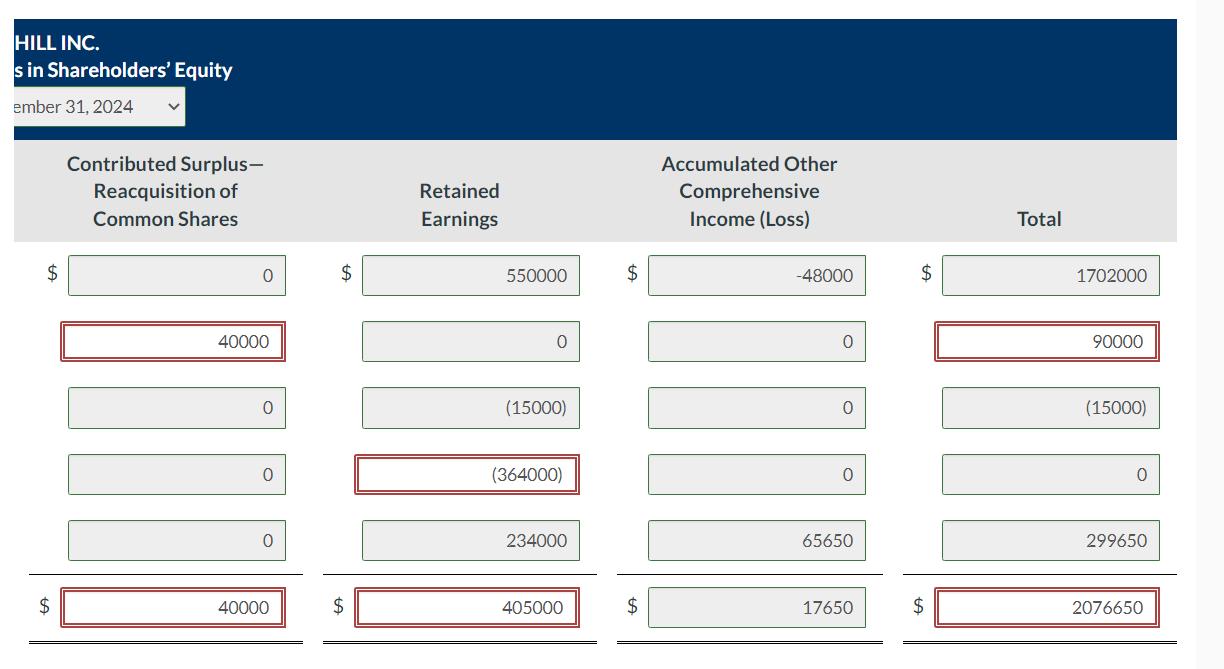

The shareholders' equity accounts of Sandhill Inc. at December 31, 2023, are as follows: Preferred shares, $3 noncumulative, unlimited number authorized, 5,000 issued $500,000 Common shares, unlimited number authorized, 140,000 issued Retained earnings Accumulated other comprehensive loss 700,000 550,000 (48,000) Sandhill has a 35% income tax rate. During the following fiscal year ended December 31, 2024, the company had the following transactions and events: Feb. 1 Repurchased 10,000 common shares for $40,000. July Dec. 1 12 Announced a 2-for-1 preferred stock split. The market price of the preferred shares at the date of announcement was $150. Declared the annual cash dividend ($1.50 post-split) to the preferred shareholders of record on January 10, 2025, payable on January 31, 2025. Declared a 10% stock dividend to common shareholders of record at December 20, distributable on January 12, 2025. The fair value of the common shares was $14 per share. Determined that for 2024, profit before income tax was $360,000 and other comprehensive income, net of income tax expense of $35,350, was $65,650. Dec. 18 Dec. 31 Balance, January 1 Reacquired common shares Cash dividends-preferred Stock dividends-common Comprehensive income Preferred Shares 500000 $ 0 0 Common Shares 700000 $ (50000) 0 SANDHIL Statement of Changes in Year Ended Decemb Stock Dividend Distributable 0 0 0 0 0 364000 0 0 0 Balance, December 31 $ 500000 $ 650000 $ 196000 = HILL INC. s in Shareholders' Equity ember 31, 2024 Contributed Surplus- Reacquisition of Common Shares 40000 0 $ Retained Earnings 550000 $ 0 0 (15000) 0 (364000) 0 234000 Accumulated Other Comprehensive Income (Loss) -48000 0 Total 1702000 90000 0 (15000) 0 65650 0 299650 $ 40000 $ 405000 $ 17650 $ 2076650

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started