Question

The shareholders' equity of MLS Enterprises includes $230 million of no par common stock and $460 million of 5% cumulative preferred stock. The board

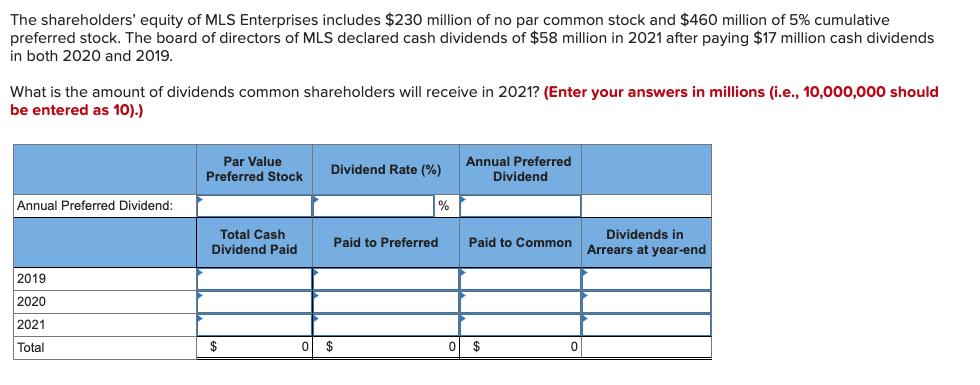

The shareholders' equity of MLS Enterprises includes $230 million of no par common stock and $460 million of 5% cumulative preferred stock. The board of directors of MLS declared cash dividends of $58 million in 2021 after paying $17 million cash dividends in both 2020 and 2019. What is the amount of dividends common shareholders will receive in 2021? (Enter your answers in millions (i.e., 10,000,000 should be entered as 10).) Par Value Dividend Rate (%) Annual Preferred Dividend Preferred Stock Annual Preferred Dividend: Total Cash Dividend Paid Dividends in Arrears at year-end Paid to Preferred Paid to Common 2019 2020 2021 Total $ 0 $ 0 $

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: J. David Spiceland, James Sepe, Mark Nelson

6th edition

978-0077328894, 71313974, 9780077395810, 77328892, 9780071313971, 77395816, 978-0077400163

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App