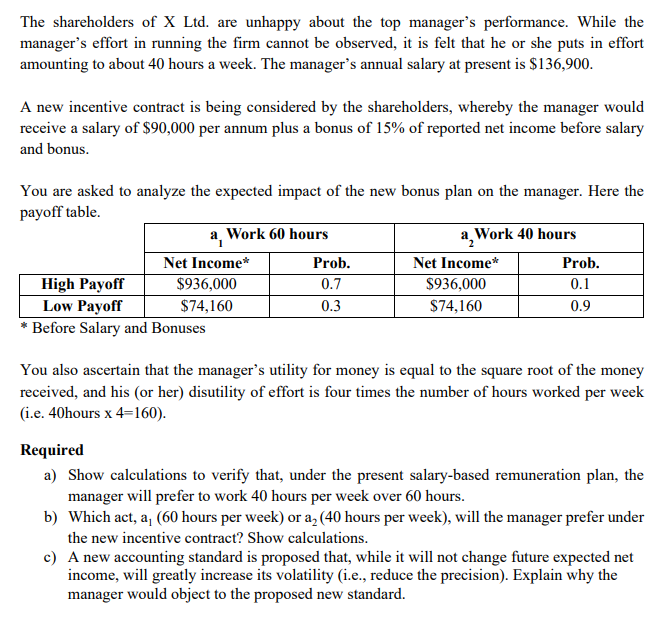

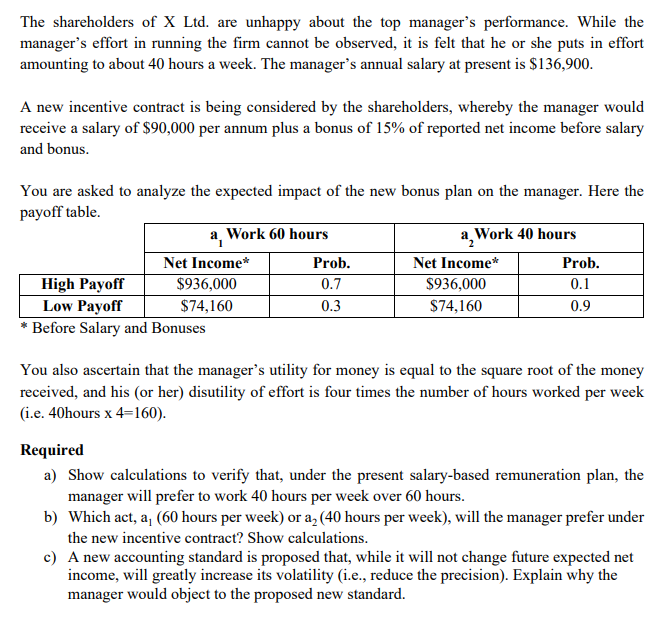

The shareholders of X Ltd. are unhappy about the top manager's performance. While the manager's effort in running the firm cannot be observed, it is felt that he or she puts in effort amounting to about 40 hours a week. The manager's annual salary at present is $136,900. A new incentive contract is being considered by the shareholders, whereby the manager would receive a salary of $90,000 per annum plus a bonus of 15% of reported net income before salary and bonus. You are asked to analyze the expected impact of the new bonus plan on the manager. Here the payoff table. a Work 60 hours a Work 40 hours Net Income* Prob. Net Income* Prob. High Payoff $936,000 0.7 $936,000 0.1 | Low Payoff $74,160 0.3 T $74.160 * Before Salary and Bonuses 0.9 You also ascertain that the manager's utility for money is equal to the square root of the money received, and his or her) disutility of effort is four times the number of hours worked per week (i.e. 40hours x 4=160). Required a) Show calculations to verify that, under the present salary-based remuneration plan, the manager will prefer to work 40 hours per week over 60 hours. b) Which act, a, 60 hours per week) or az (40 hours per week), will the manager prefer under the new incentive contract? Show calculations. c) A new accounting standard is proposed that, while it will not change future expected net income, will greatly increase its volatility (i.e., reduce the precision). Explain why the manager would object to the proposed new standard. The shareholders of X Ltd. are unhappy about the top manager's performance. While the manager's effort in running the firm cannot be observed, it is felt that he or she puts in effort amounting to about 40 hours a week. The manager's annual salary at present is $136,900. A new incentive contract is being considered by the shareholders, whereby the manager would receive a salary of $90,000 per annum plus a bonus of 15% of reported net income before salary and bonus. You are asked to analyze the expected impact of the new bonus plan on the manager. Here the payoff table. a Work 60 hours a Work 40 hours Net Income* Prob. Net Income* Prob. High Payoff $936,000 0.7 $936,000 0.1 | Low Payoff $74,160 0.3 T $74.160 * Before Salary and Bonuses 0.9 You also ascertain that the manager's utility for money is equal to the square root of the money received, and his or her) disutility of effort is four times the number of hours worked per week (i.e. 40hours x 4=160). Required a) Show calculations to verify that, under the present salary-based remuneration plan, the manager will prefer to work 40 hours per week over 60 hours. b) Which act, a, 60 hours per week) or az (40 hours per week), will the manager prefer under the new incentive contract? Show calculations. c) A new accounting standard is proposed that, while it will not change future expected net income, will greatly increase its volatility (i.e., reduce the precision). Explain why the manager would object to the proposed new standard