Question

The shares and debt in the firm K&L are traded on a given capital market The asset cost of capital (also called unlevered cost of

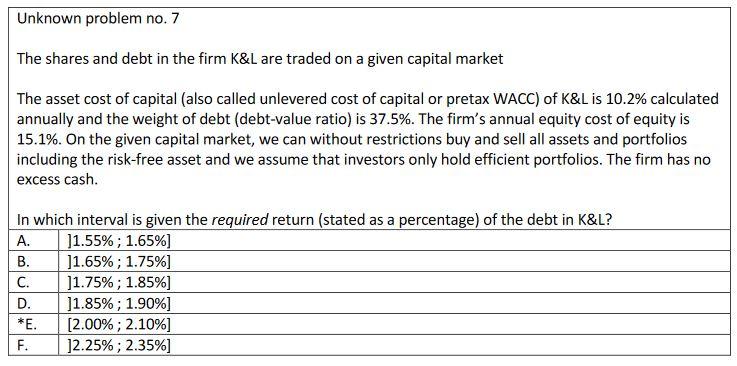

The shares and debt in the firm K&L are traded on a given capital market The asset cost of capital (also called unlevered cost of capital or pretax WACC) of K&L is 10.2% calculated annually and the weight of debt (debt-value ratio) is 37.5%. The firms annual equity cost of equity is 15.1%. On the given capital market, we can without restrictions buy and sell all assets and portfolios including the risk-free asset and we assume that investors only hold efficient portfolios. The firm has no excess cash.In which interval is given the requiredreturn (stated as a percentage) ofthe debt in K&L?

Unknown problem no. 7 The shares and debt in the firm K&L are traded on a given capital market The asset cost of capital (also called unlevered cost of capital or pretax WACC) of K&L is 10.2% calculated annually and the weight of debt (debt-value ratio) is 37.5%. The firm's annual equity cost of equity is 15.1%. On the given capital market, we can without restrictions buy and sell all assets and portfolios including the risk-free asset and we assume that investors only hold efficient portfolios. The firm has no excess cash. In which interval is given the required return (stated as a percentage) of the debt in K&L? A. ]1.55%; 1.65%) B. ]1.65%; 1.75%] C. 11.75%; 1.85%] D. 11.85%; 1.90%] *E. [2.00%; 2.10%] F. 12.25%; 2.35%]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started