Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Sharpe Co. just paid a dividend of $1.70 per share of stock. Its target payout ratio is 50 percent. The company expects to

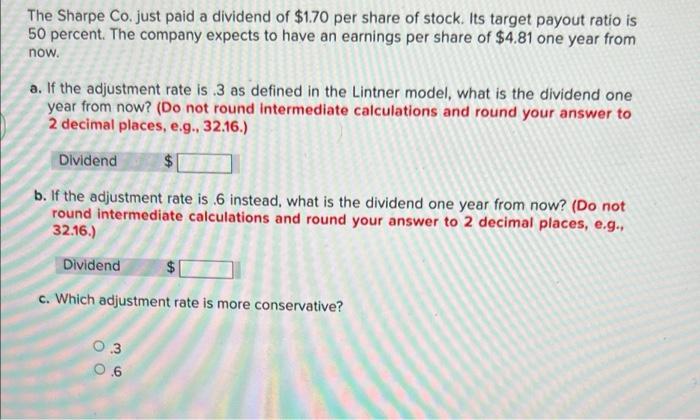

The Sharpe Co. just paid a dividend of $1.70 per share of stock. Its target payout ratio is 50 percent. The company expects to have an earnings per share of $4.81 one year from now. a. If the adjustment rate is .3 as defined in the Lintner model, what is the dividend one year from now? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Dividend b. If the adjustment rate is .6 instead, what is the dividend one year from now? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Dividend c. Which adjustment rate is more conservative? 36 O O

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lintner Model Dividend Calculation The Lintner model helps estimate future dividends based on a comp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started