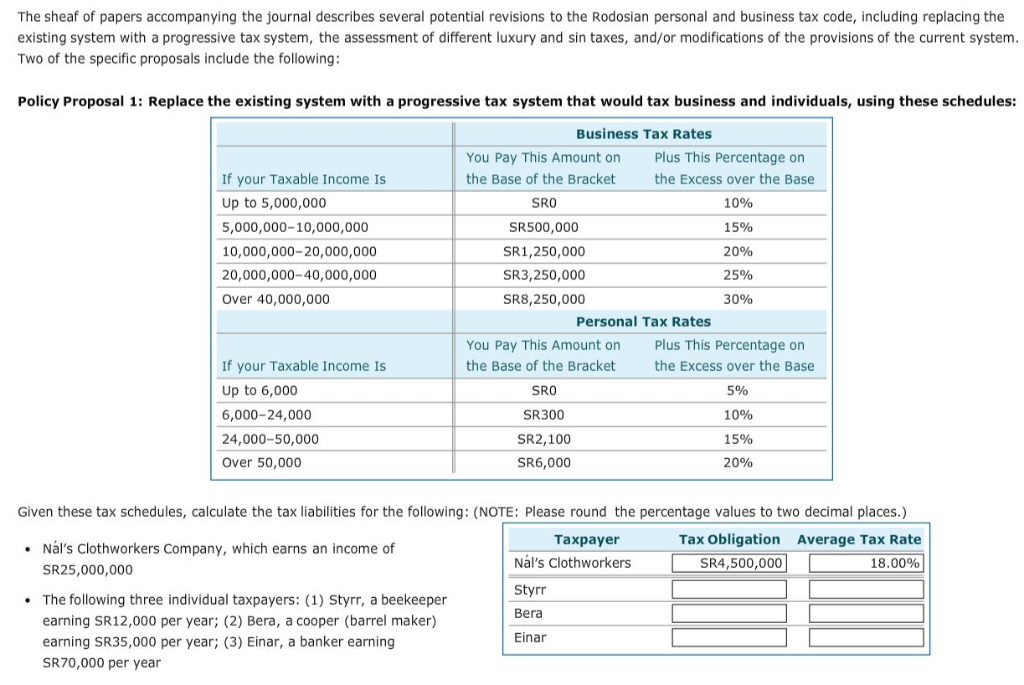

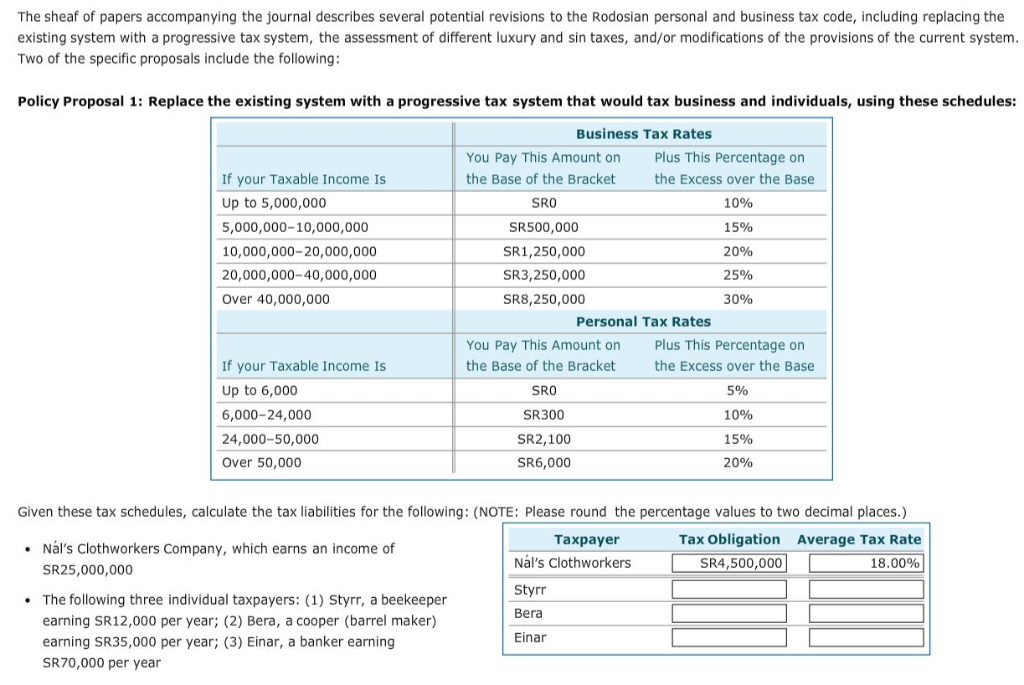

The sheaf of papers accompanying the journal describes several potential revisions to the Rodosian personal and business tax code, including replacing the existing system with a progressive tax system, the assessment of different luxury and sin taxes, and/or modifications of the provisions of the current system Two of the specific proposals include the following Policy Propos 1: Replace the existing system with a progressive tax system that would tax business and individuals, using these schedules: Business Tax Rates You Pay This Amount on the Base of the Bracket SRO SR500,000 SR1,250,000 SR3,250,000 SR8,250,000 Plus This Percentage on If your Taxable Income Is Up to 5,000,000 5,000,000-10,000,000 10,000,000-20,000,000 20,000,000-40,000,000 Over 40,000,000 the Excess over the Base 10% 15% 20% 25% 30% Personal Tax Rates You Pay This Amount on the Base of the Bracket SRO SR300 SR2,100 SR6,000 Plus This Percentage on If your Taxable Income Is Up to 6,000 6,000-24,000 24,000-50,000 Over 50,000 the Excess over the Base 596 10% 15% 20% Given these tax schedules, calculate the tax liabilities for the following: (NOTE: Please round the percentage values to two decimal places.) Tax obligation Average Tax Rate SR4,500,000! 18.00% Taxpayer Nal's Clothworkers Company, which earns an income of SR25,000,000 Nl's Clothworkers Styrr Bera Einar The following three individual taxpayers: (1) Styrr, a beekeeper earning SR12,000 per year; (2) Bera, a cooper (barrel maker) earning SR35,000 per year; (3) Einar, a banker earning SR70,000 per year Assume that Styrr owes the same tax liability under both the current tax system and the proposed (progressive) system. As an economically rational taxpayer, why should he prefer the current system? Because under the progressive tax system the next sodor earned would be taxed at the rate of 10%; under the current system, it would not be subject to any tax Because under the progressive tax system the next sodor earned would be taxed at the highest tax rate (20%); under the current system, it would be exempt from additional taxes. Because under the current system the next sodor earned would be taxed at the rate of 1.2%; under the progressive system, it would not be subject to any tax. Policy Proposal 2: Impose a special tax on Rodosian manufacturers, sellers, and consumers of sweet candies and pastries. What effect will this tax have on Rodosian taxpayers, citizens, and businesses? O This luxury tax is designed to encourage the purchase and consumption of sweet foods. O This is an example of a fair tax because it is levied on only those Rodosians that consume sweet foods. O This sin tax effectively punishes manufacturers, sellers, and consumers of sweet foods and benefits the Rodosian Treasury at their expense