The charterer currently in negotiations with Ocean Carriers for a three-year time charter starting in 2003 had offered a rate of $20,000 per day with

The charterer currently in negotiations with Ocean Carriers for a three-year time charter starting in 2003 had offered a rate of $20,000 per day with an annual escalation of $200 per day. The expected rate of inflation was 3%.

The vessels in Ocean Carriers’ current fleet could not be committed to a time charter beginning in 2003 because the ships were either already leased during that period or were too small to meet the customer’s needs. Moreover, there were no sufficiently large capesizes available in the second-hand market. Ocean Carriers had to decide immediately if it should commission a new 180,000 deadweight ton ship for delivery in early 2003. The ship would cost $39 million, with 10% of the purchase price payable immediately and 10% due in a year’s time. The balance would be due on delivery. A new ship would be depreciated on a straight-line basis over 25 years. In addition, Linn expected to make a $500,000 initial investment in net working capital, which she anticipated would grow with inflation.

Linn was also confident that the charterer would honor his proposed contract with Ocean Carriers if the company agreed to the terms. While there is always a risk that the charterer would stop paying before the end of the contract or terminate the contract early, Linn considered that the risk was small. Ocean Carriers had long established relationships with its charterers and only contracted with reputable charterers.

The proposed contract, though, was only for three years, and it was Linn’s responsibility to decide if future market conditions warranted the considerable investment in a new ship.

It is your job to evaluate the commisioning of a new capesize carrier by ocean carriers in response to a lease, as described in the case study write up. In answering the below questions, assume ocean carrier's discount rate is 9%.

1. Should Ms. Linn purchase the $39M capesize? Make 2 different assumptions. First assume that Ocean Carriers is a U.S. firm subject to 35% taxation. Second assume that Ocean Carriers is located in Hong Kong, where owners oh Hong Kong ships are not required to pay any tax on profits made overseas and are also exempted from paying any tax on profit made on cargo uplifted from Hong Kong. Show Calculations & explanation

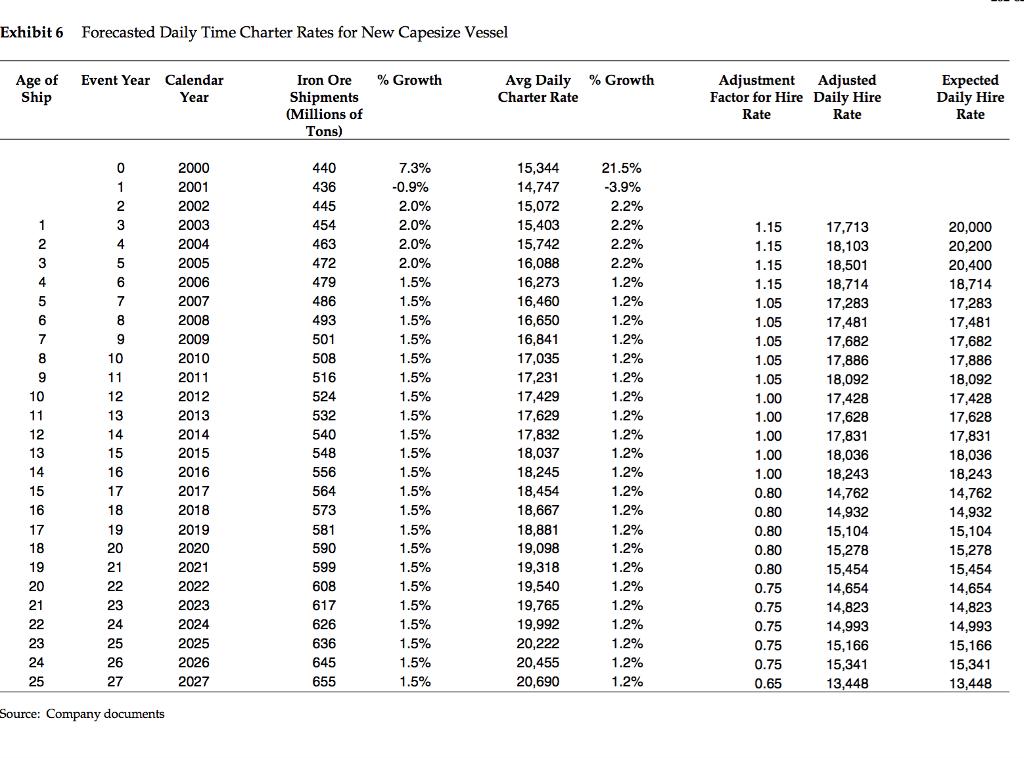

Exhibit 6 Forecasted Daily Time Charter Rates for New Capesize Vessel Age of Ship 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 Event Year Calendar Year 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 Source: Company documents 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 Iron Ore Shipments (Millions of Tons) 440 436 445 454 463 472 479 486 493 501 508 516 524 532 540 548 556 564 573 581 590 599 608 617 626 636 645 655 % Growth 7.3% -0.9% 2.0% 2.0% 2.0% 2.0% 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% Avg Daily % Growth Charter Rate 15,344 14,747 15,072 15,403 15,742 16,088 16,273 16,460 16,650 16,841 17,035 17,231 17,429 17,629 17,832 18,037 18,245 18,454 18,667 18,881 19,098 19,318 19,540 19,765 19,992 20,222 20,455 20,690 21.5% -3.9% 2.2% 2.2% 2.2% 2.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% Adjustment Factor for Hire Rate 1.15 1.15 1.15 1.15 1.05 1.05 1.05 1.05 1.05 1.00 1.00 1.00 1.00 1.00 0.80 0.80 0.80 0.80 0.80 0.75 0.75 0.75 0.75 0.75 0.65 Adjusted Daily Hire Rate 17,713 18,103 18,501 18,714 17,283 17,481 17,682 17,886 18,092 17,428 17,628 17,831 18,036 18,243 14,762 14,932 15,104 15,278 15,454 14,654 14,823 14,993 15,166 15,341 13,448 Expected Daily Hire Rate 20,000 20,200 20,400 18,714 17,283 17,481 17,682 17,886 18,092 17,428 17,628 17,831 18,036 18,243 14,762 14,932 15,104 15,278 15,454 14,654 14,823 14,993 15,166 15,341 13,448

Step by Step Solution

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Should Ms Linn purchase the 39M capesize Make two different assumptions First assume that Ocean Carr...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started