Question

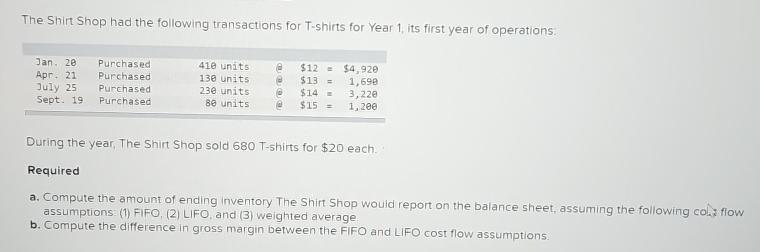

The Shirt Shop had the following transactions for T-shirts for Year 1, its first year of operations. Jan. 20 Purchased 410 units $12= $4,920

The Shirt Shop had the following transactions for T-shirts for Year 1, its first year of operations. Jan. 20 Purchased 410 units $12= $4,920 Apr. 21 Purchased 130 units $13= 1,690 July 25 Purchased 230 units $14= 3,220 Sept. 19 Purchased 80 units $15 = 1,200 During the year, The Shirt Shop sold 680 T-shirts for $20 each. Required a. Compute the amount of ending inventory The Shirt Shop would report on the balance sheet, assuming the following col flow assumptions (1) FIFO, (2) LIFO, and (3) weighted average b. Compute the difference in gross margin between the FIFO and LIFO cost flow assumptions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Survey Of Accounting

Authors: Thomas Edmonds, Christopher Edmonds, Philip Olds

6th Edition

1260575292, 978-1260575293

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App