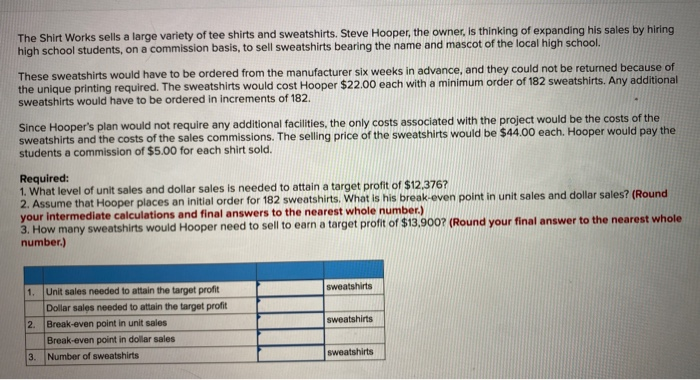

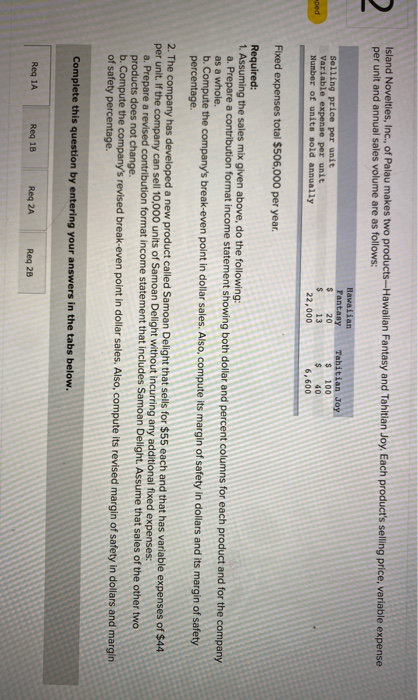

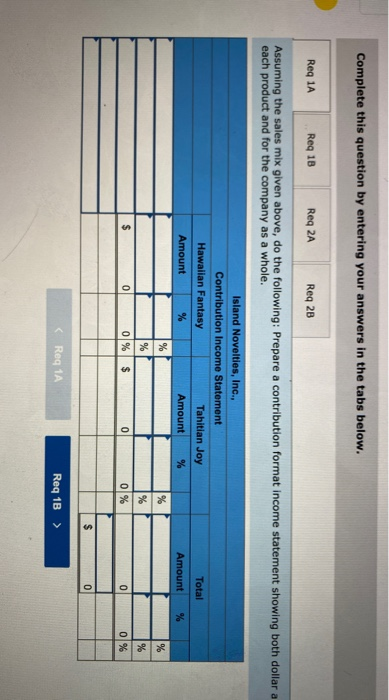

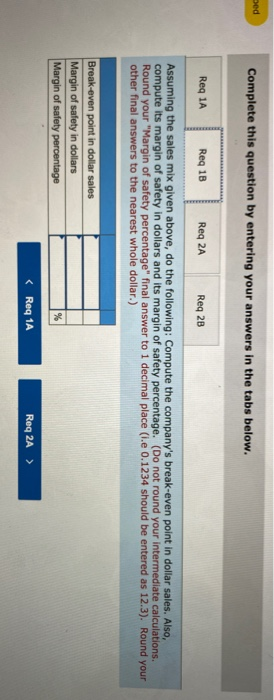

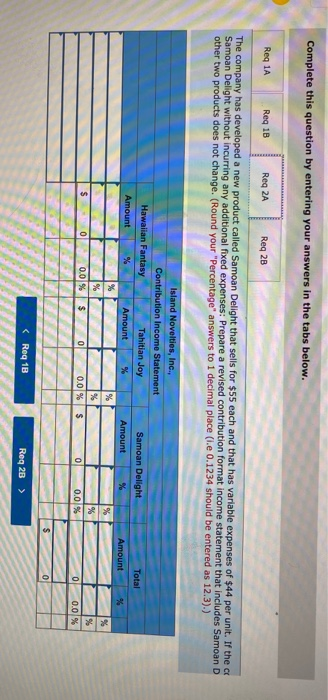

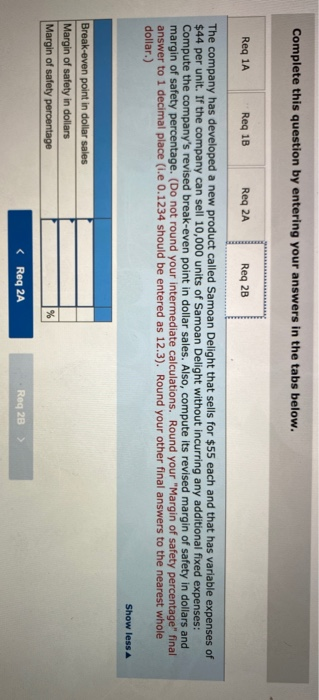

The Shirt Works sells a large variety of tee shirts and sweatshirts. Steve Hooper, the owner, is thinking of expanding his sales by hiring high school students, on a commission basis, to sell sweatshirts bearing the name and mascot of the local high school. These sweatshirts would have to be ordered from the manufacturer six weeks in advance, and they could not be returned because of the unique printing required. The sweatshirts would cost Hooper $22.00 each with a minimum order of 182 sweatshirts. Any additional sweatshirts would have to be ordered in increments of 182. Since Hooper's plan would not require any additional facilities, the only costs associated with the project would be the costs of the sweatshirts and the costs of the sales commissions. The selling price of the sweatshirts would be $44.00 each. Hooper would pay the students a commission of $5.00 for each shirt sold. Required: 1. What level of unit sales and dollar sales is needed to attain a target profit of $12,376? 2. Assume that Hooper places an initial order for 182 sweatshirts. What is his break-even point in unit sales and dollar sales? (Round your intermediate calculations and final answers to the nearest whole number.) 3. How many sweatshirts would Hooper need to sell to earn a target profit of $13,900? (Round your final answer to the nearest whole number.) sweatshirts 1. Unit sales needed to attain the target profit Dollar sales needed to attain the target profit Break-even point in unit sales Break-even point in dollar sales Number of sweatshirts 2 sweatshirts sweatshirts 3. 2 Island Novelties, Inc., of Palau makes two products---Hawaiian Fantasy and Tahitian Joy. Each product's selling price, variable expense per unit and annual sales volume are as follows: Selling price per unit Variable expense per unit Number of units sold annually Hawaiian Fantasy $ 20 $ 13 22.000 Tahitian Joy $ 100 $ 40 6,600 aped Fixed expenses total $506,000 per year. Required: 1. Assuming the sales mix given above, do the following: a. Prepare a contribution format income statement showing both dollar and percent columns for each product and for the company as a whole. b. Compute the company's break-even point in dollar sales. Also, compute its margin of safety in dollars and its margin of safety percentage. 2. The company has developed a new product called Samoan Delight that sells for $55 each and that has variable expenses of $44 per unit. If the company can sell 10,000 units of Samoan Delight without incurring any additional fixed expenses: a. Prepare a revised contribution format income statement that includes Samoan Delight. Assume that sales of the other two products does not change. b. Compute the company's revised break-even point in dollar sales. Also, compute its revised margin of safety in dollars and margin of safety percentage. Complete this question by entering your answers in the tabs below. Req 1A Reg 1B Reg 2A Reg 28 Complete this question by entering your answers in the tabs below. Req 1A Reg 1B Reg 2A Req 2B Assuming the sales mix given above, do the following: Prepare a contribution format income statement showing both dollar a each product and for the company as a whole. Island Novelties, Inc., Contribution Income Statement Hawaiian Fantasy Tahitian Joy Total Amount Amount % Amount % % % % % % $ 0 0 % $ 0 0 % 0 0 % $ 0 Bed Complete this question by entering your answers in the tabs below. Reg 1A Reg 18 Reg 2A Reg 28 Assuming the sales mix given above, do the following: Compute the company's break-even point in dollar sales. Also, compute its margin of safety in dollars and its margin of safety percentage. (Do not round your intermediate calculations. Round your "Margin of safety percentage" final answer to 1 decimal place (1.e 0.1234 should be entered as 12.3). Round your other final answers to the nearest whole dollar.) Break-even point in dollar sales Margin of safety in dollars Margin of safety percentage % Complete this question by entering your answers in the tabs below. Reg 1A Reg 1B Reg 2A Reg 2B The company has developed a new product called Samoan Delight that sells for $55 each and that has variable expenses of $44 per unit. If the a Samoan Delight without incurring any additional fixed expenses: Prepare a revised contribution format income statement that includes Samoan D other two products does not change. (Round your "Percentage" answers to 1 decimal place (I.e 0.1234 should be entered as 12.3).) Total Island Novelties, Inc., Contribution Income Statement Hawaiian Fantasy Tahitian Joy Amount % Amount % % % % $ 0 0.0 % $ 0 0.0 % Samoan Delight Amount % Amount % % % S 0 % 0.0 % 0 0.0 % $ 0 Complete this question by entering your answers in the tabs below. Reg 1A Reg 1B Reg 2A Reg 2B The company has developed a new product called Samoan Delight that sells for $55 each and that has variable expenses of $44 per unit. If the company can sell 10,000 units of Samoan Delight without incurring any additional fixed expenses: Compute the company's revised break-even point in dollar sales. Also, compute its revised margin of safety in dollars and margin of safety percentage. (Do not round your intermediate calculations. Round your "Margin of safety percentage" final answer to 1 decimal place (1.e 0.1234 should be entered as 12.3). Round your other final answers to the nearest whole dollar.) Show less Break-even point in dollar sales Margin of safety in dollars Margin of safety percentage