Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The signage area renovation will cost $100,000. The renovations can be depreciated using straight-line depreciation over 39 years. The company's tax rate is 21%.

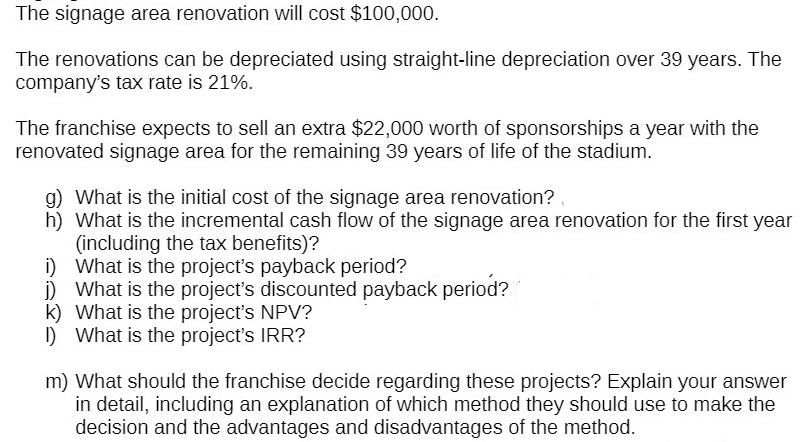

The signage area renovation will cost $100,000. The renovations can be depreciated using straight-line depreciation over 39 years. The company's tax rate is 21%. The franchise expects to sell an extra $22,000 worth of sponsorships a year with the renovated signage area for the remaining 39 years of life of the stadium. g) What is the initial cost of the signage area renovation? h) What is the incremental cash flow of the signage area renovation for the first year (including the tax benefits)? i) What is the project's payback period? 1) What is the project's discounted payback period? k) What is the project's NPV? 1) What is the project's IRR? m) What should the franchise decide regarding these projects? Explain your answer in detail, including an explanation of which method they should use to make the decision and the advantages and disadvantages of the method.

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

g The initial cost of the signage area renovation is 100000 h The incremental cash flow of the signage area renovation for the first year including th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started