Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The single family home you are appraising is a 25 year old, 180 m bungalow, with 3 bedrooms and a single 3 piece bathroom.

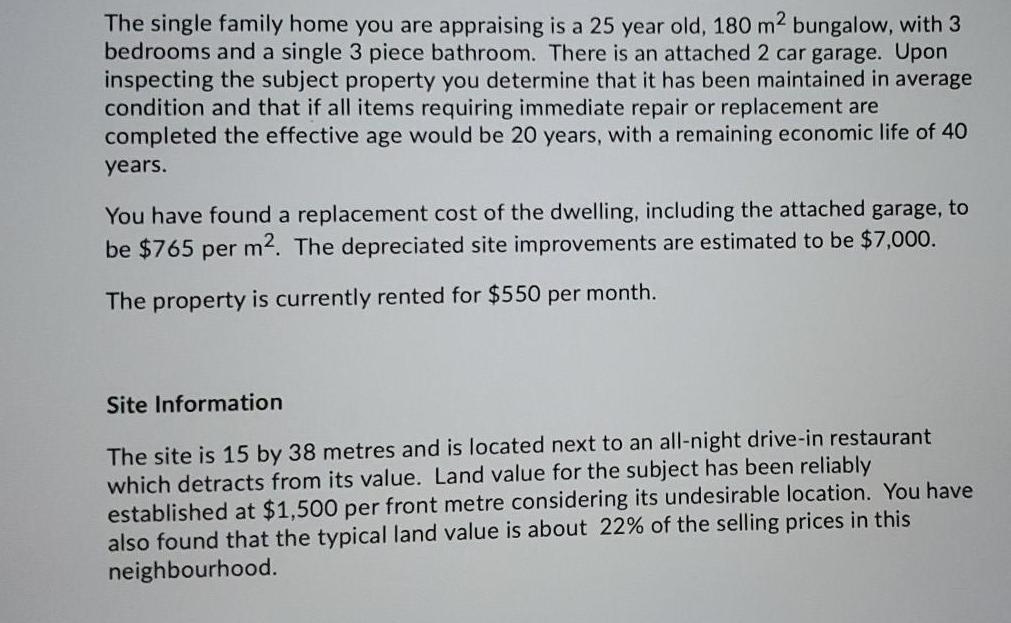

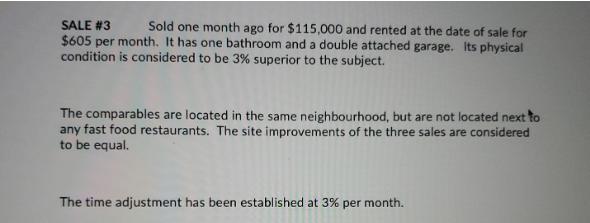

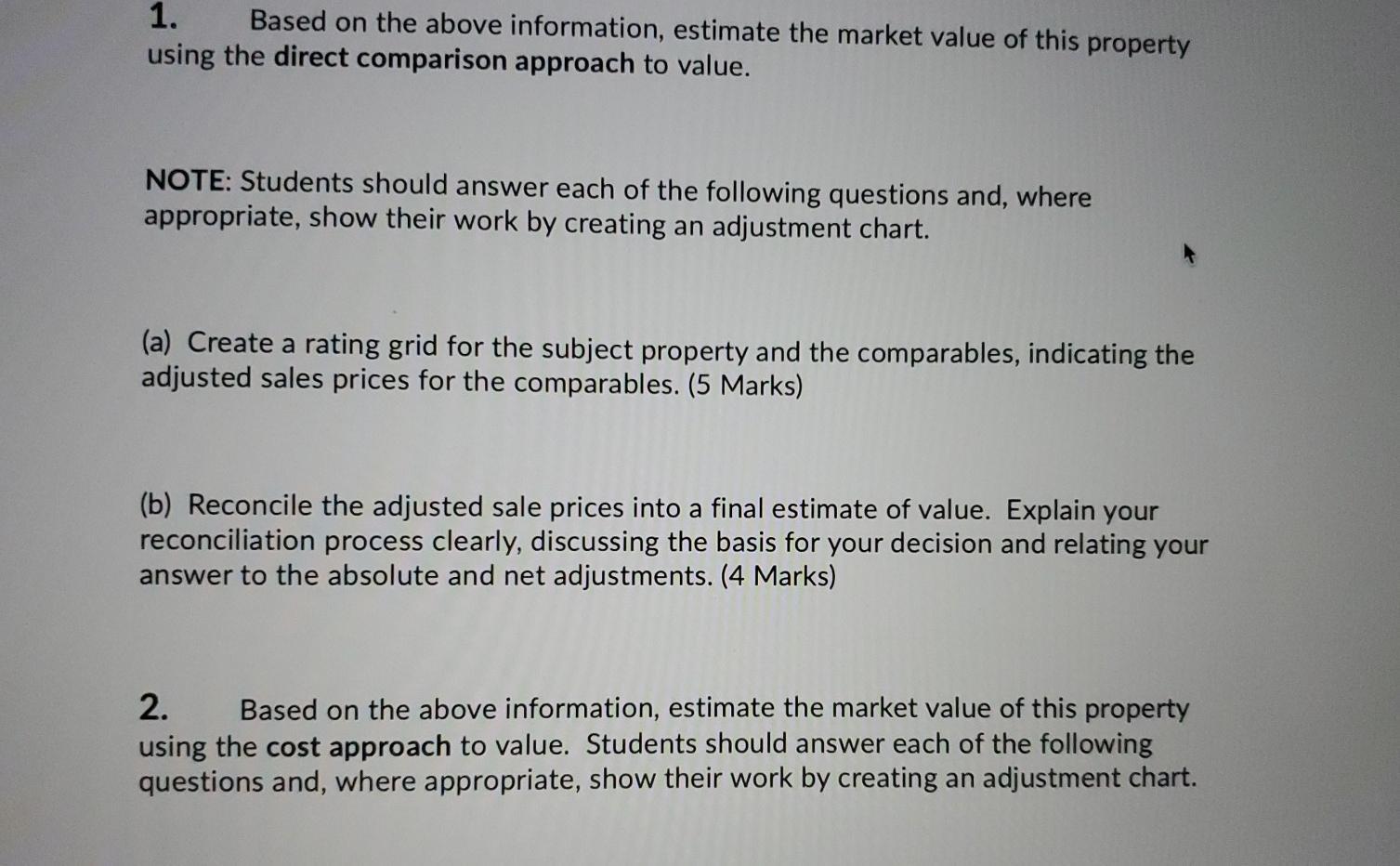

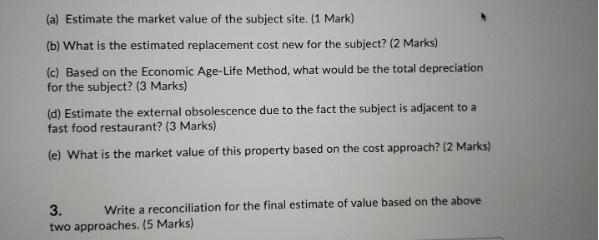

The single family home you are appraising is a 25 year old, 180 m bungalow, with 3 bedrooms and a single 3 piece bathroom. There is an attached 2 car garage. Upon inspecting the subject property you determine that it has been maintained in average condition and that if all items requiring immediate repair or replacement are completed the effective age would be 20 years, with a remaining economic life of 40 years. You have found a replacement cost of the dwelling, including the attached garage, to be $765 per m2. The depreciated site improvements are estimated to be $7,000. The property is currently rented for $550 per month. Site Information The site is 15 by 38 metres and is located next to an all-night drive-in restaurant which detracts from its value. Land value for the subject has been reliably established at $1,500 per front metre considering its undesirable location. You have also found that the typical land value is about 22% of the selling prices in this neighbourhood. Comparable Sales Information SALE #1 Sold three months ago for $116,000 and rented at the date of sale for $600 per month. It is 18 years old and its condition makes it 12% superior to the subject. It has an extra two piece bathroom and a attached single car garage. The extra bathroom adds $2,500 to the sale price. The difference between a one and two car garage is $6,000. SALE #2 Sold four months ago for $115,000 and was rented at the date of sale at $600 per month. It is 17 years old, has only one bathroom, and a two car attached garage. Its location within the neighbourhood is 5% inferior to the subject s location. The overall condition of the house is 15% superior to the subject. SALE #3 Sold one month ago for $115,000 and rented at the date of sale for $605 per month. It has one bathroom and a double attached garage. Its physical condition is considered to be 3% superior to the subject. The comparables are located in the same neighbourhood, but are not located next to any fast food restaurants. The site improvements of the three sales are considered to be equal. The time adjustment has been established at 3% per month. 1. Based on the above information, estimate the market value of this property using the direct comparison approach to value. NOTE: Students should answer each of the following questions and, where appropriate, show their work by creating an adjustment chart. (a) Create a rating grid for the subject property and the comparables, indicating the adjusted sales prices for the comparables. (5 Marks) (b) Reconcile the adjusted sale prices into a final estimate of value. Explain your reconciliation process clearly, discussing the basis for your decision and relating your answer to the absolute and net adjustments. (4 Marks) 2. Based on the above information, estimate the market value of this property using the cost approach to value. Students should answer each of the following questions and, where appropriate, show their work by creating an adjustment chart. (a) Estimate the market value of the subject site. (1 Mark) (b) What is the estimated replacement cost new for the subject? (2 Marks) (c) Based on the Economic Age-Life Method, what would be the total depreciation for the subject? (3 Marks) (d) Estimate the external obsolescence due to the fact the subject is adjacent to a fast food restaurant? (3 Marks) (e) What is the market value of this property based on the cost approach? (2 Marks) 3. Write a reconciliation for the final estimate of value based on the above two approaches. (5 Marks)

Step by Step Solution

★★★★★

3.39 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

Direct Comparison Approach a Rating Grid b Reconciliation To reconcile the adjusted sale prices we need to consider both the absolute adjustments and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started