Question

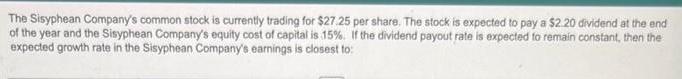

The Sisyphean Company's common stock is currently trading for $27.25 per share. The stock is expected to pay a $2.20 dividend at the end

The Sisyphean Company's common stock is currently trading for $27.25 per share. The stock is expected to pay a $2.20 dividend at the end of the year and the Sisyphean Company's equity cost of capital is 15%. If the dividend payout rate is expected to remain constant, then the expected growth rate in the Sisyphean Company's earnings is closest to: An annuity pays $51 per year for 11 years. What is the future value (FV) of this annuity at the end of those 11 years, given that the discount rate is 8%? come

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate the expected growth rate in the Sisyphean Companys earnings we can use the Gordon Gro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Loren A Nikolai, D. Bazley and Jefferson P. Jones

10th Edition

324300980, 978-0324300987

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App