Question

The Smiths are a married couple in their mid-20s. Jane is an associate at a small law firm in downtown Chicago. Her gross salary is

The Smiths are a married couple in their mid-20s. Jane is an associate at a small law firm in downtown Chicago. Her gross salary is $132,000. Her husband John is a human resources associate at a large manufacturing firm in the suburbs. His gross salary is $61,000. Since getting married three years ago, they have been living comfortably. Their income has consistently exceeded their expenses and they have accumulated a net worth of about $55,000, primarily as a result of rising home prices increasing the amount of equity in their downtown condo that they purchased after their wedding. As a result of not having any cash flow issues, Jane and John have done no financial planning beyond making sure there is money left in the bank at the end of the month.

Jane has just learned she is pregnant. They are excited about the prospect of having a child but are concerned about how they will make ends meet if, as they had always talked about, John stays at home to run the household and be the primary caretaker of the child. Jane has no aspirations to stay home and is seen as a rising star within her firm. She hopes to make partner in 7-8 years.

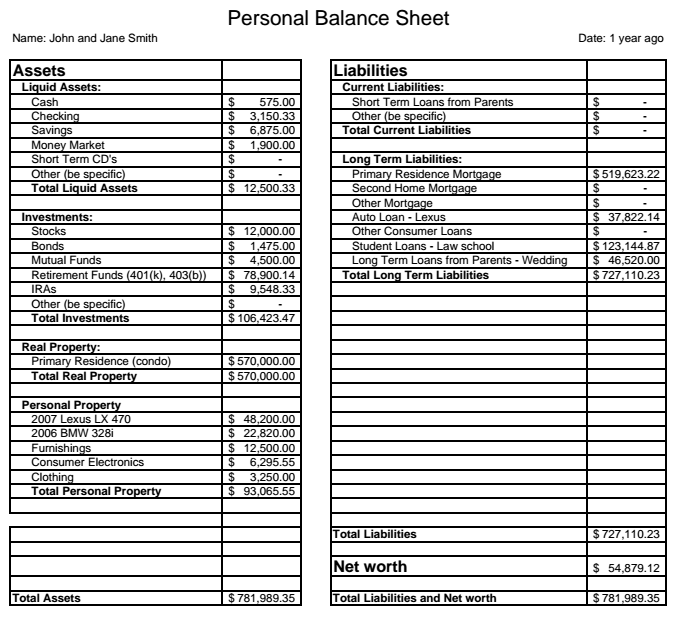

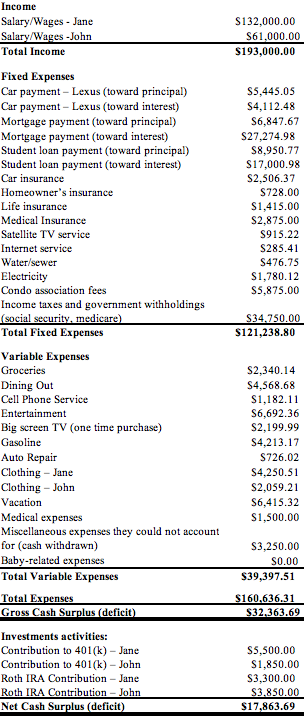

Each time that Jane broaches the topic of financial planning with John, he replies that dont worry, weve always paid the bills on time. Since Johns income would go away completely, Jane is not satisfied with this conclusion. Together, they document their financial situation by using the balance sheet they built one year ago and a listing of expenses incurred during the last year. Since they primarily use a debit card, this information was easily pulled from their bank statements.

1. Using last years balance sheet and the income and expense statement from, create a new balance sheet that reflects their financial position today

Last Years Balance Sheet:

Income & Expense Statement:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started