Answered step by step

Verified Expert Solution

Question

1 Approved Answer

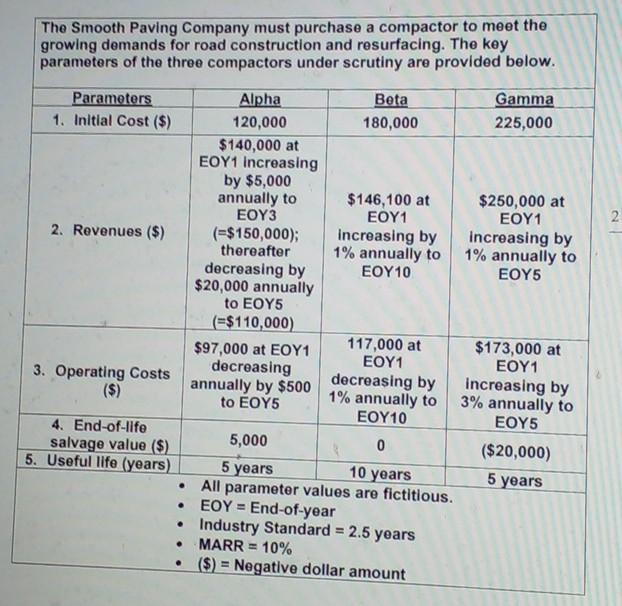

The Smooth Paving Company must purchase a compactor to meet the growing demands for road construction and resurfacing. The key parameters of the three

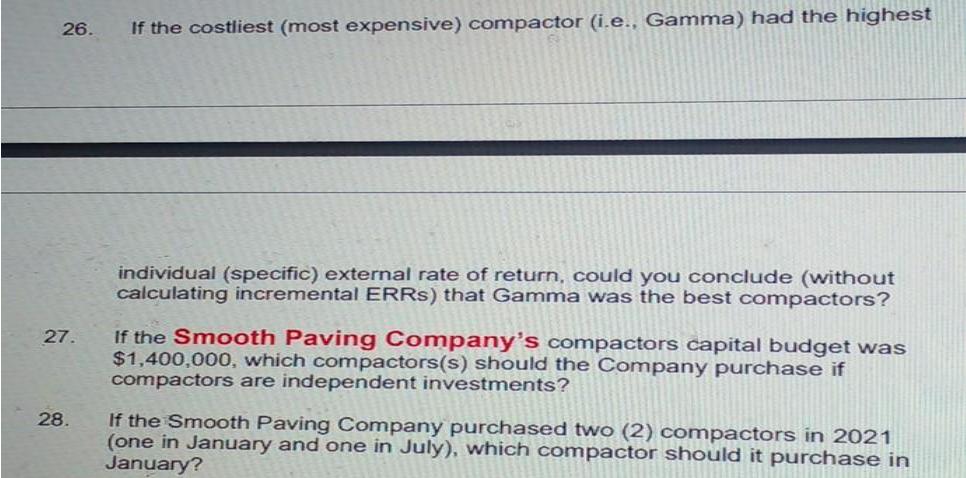

The Smooth Paving Company must purchase a compactor to meet the growing demands for road construction and resurfacing. The key parameters of the three compactors under scrutiny are provided below. Parameters Alpha Beta Gamma 1. Initial Cost ($) 120,000 180,000 225,000 $140,000 at EOY1 increasing by $5,000 annually to 3 (=$150,000); thereafter decreasing by $20,000 annually to EOY5 (=$110,000) $146,100 at 1 $250,000 at 1 increasing by 1% annually to 5 2. Revenues ($) increasing by 1% annually to 10 117,000 at 1 $173,000 at 1 3. Operating Costs ($) $97,000 at EOY1 decreasing annually by $500 decreasing by 1% annually to 10 increasing by 3% annually to EOY5 to EOY5 4. End-of-life salvage value ($) 5. Useful life (years) 5,000 ($20,000) 5 years All parameter values are fictitious. EOY = End-of-year Industry Standard = 2.5 years 10 years 5 years MARR = 10% %3D ($) = Negative dollar amount 2. 26. If the costliest (most expensive) compactor (i.e., Gamma) had the highest individual (specific) external rate of return, could you conclude (without calculating incremental ERRS) that Gamma was the best compactors? If the Smooth Paving Company's compactors capital budget was $1,400,000, which compactors(s) should the Company purchase if compactors are independent investments? 27. If the Smooth Paving Company purchased two (2) compactors in 2021 (one in January and one in July), which compactor should it purchase in January? 28.

Step by Step Solution

★★★★★

3.38 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Solution Since the useful life of the three options is not the same we will use the AEW Annual Equivalent Worth approach instead of the net present va...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started