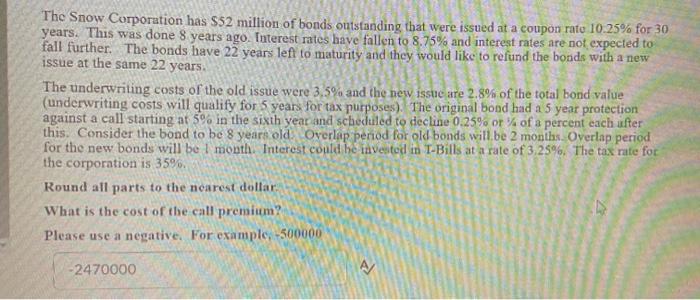

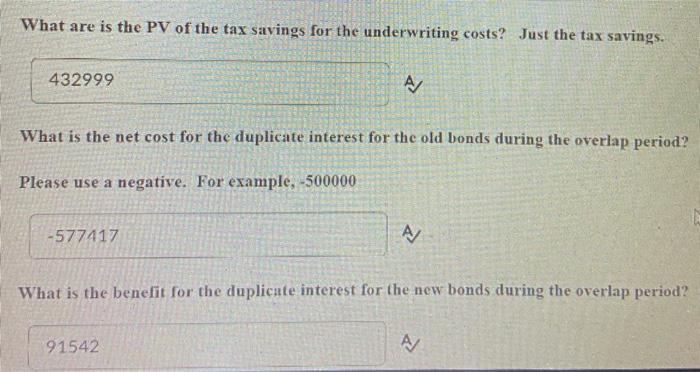

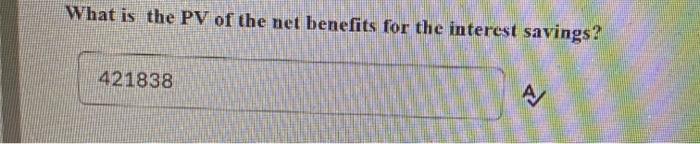

The Snow Corporation has $52 million of bonds outstanding that were issued at a coupon rato 10.25% for 30 years. This was done 8 years ago. Interest rates have fallen to 8.75% and interest rates are not expected to fall further. The bonds have 22 years left to maturity and they would like to refund the bonds with a new issue at the same 22 years The underwriting costs of the old issue were 3,5% and the new issue are 2.8% of the total bond value (underwriting costs will qualify for 5 years for tax purposes). The original bond had a 5 year protection against a call starting at 5% in the sixth year and scheduled to decline 0.25% or of a percent each after this. Consider the bond to be 8 years old. Overlap period for old bonds will be 2 months. Overlap period for the new bonds will be I mouth. Interest could be invested in T-Bills at a rate of 3.25%. The tax rate for the corporation is 35%. Round all parts to the nearest dollar. What is the cost of the call premium? Please use a negative. For example, 500000 -2470000 What are is the PV of the tax savings for the underwriting costs? Just the tax savings. 432999 A What is the net cost for the duplicate interest for the old bonds during the overlap period? Please use a negative. For example, -500000 -577417 A What is the benefit for the duplicate interest for the new bonds during the overlap period? 91542 What is the PV of the net benefits for the interest savings? 421838 4 The Snow Corporation has $52 million of bonds outstanding that were issued at a coupon rato 10.25% for 30 years. This was done 8 years ago. Interest rates have fallen to 8.75% and interest rates are not expected to fall further. The bonds have 22 years left to maturity and they would like to refund the bonds with a new issue at the same 22 years The underwriting costs of the old issue were 3,5% and the new issue are 2.8% of the total bond value (underwriting costs will qualify for 5 years for tax purposes). The original bond had a 5 year protection against a call starting at 5% in the sixth year and scheduled to decline 0.25% or of a percent each after this. Consider the bond to be 8 years old. Overlap period for old bonds will be 2 months. Overlap period for the new bonds will be I mouth. Interest could be invested in T-Bills at a rate of 3.25%. The tax rate for the corporation is 35%. Round all parts to the nearest dollar. What is the cost of the call premium? Please use a negative. For example, 500000 -2470000 What are is the PV of the tax savings for the underwriting costs? Just the tax savings. 432999 A What is the net cost for the duplicate interest for the old bonds during the overlap period? Please use a negative. For example, -500000 -577417 A What is the benefit for the duplicate interest for the new bonds during the overlap period? 91542 What is the PV of the net benefits for the interest savings? 421838 4