Answered step by step

Verified Expert Solution

Question

1 Approved Answer

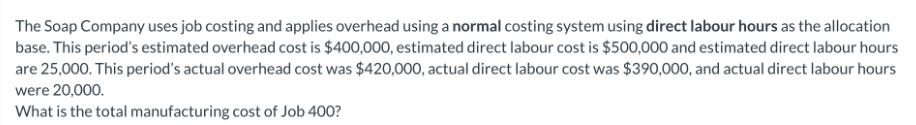

The Soap Company uses job costing and applies overhead using a normal costing system using direct labour hours as the allocation base. This period's

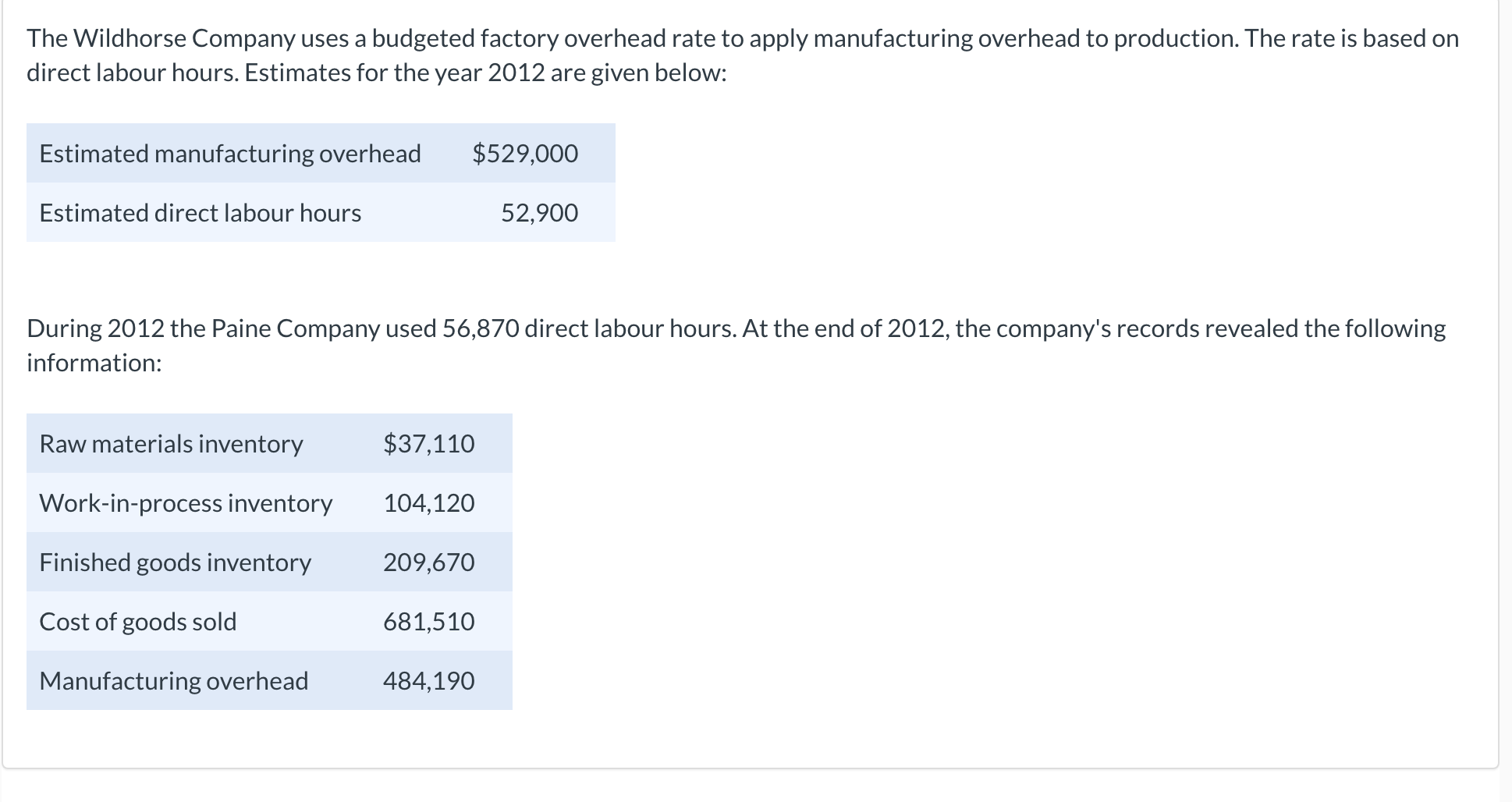

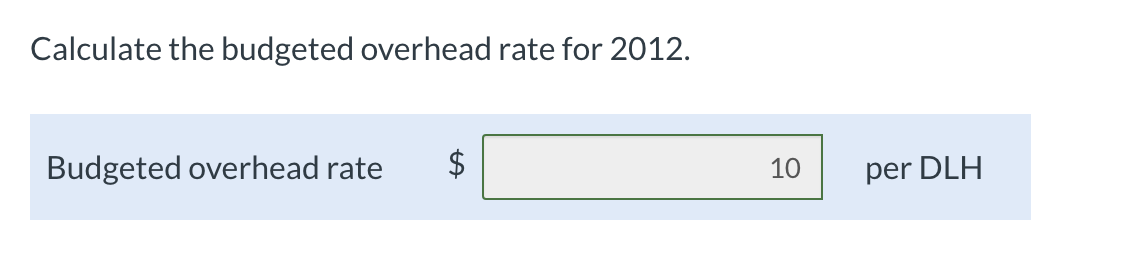

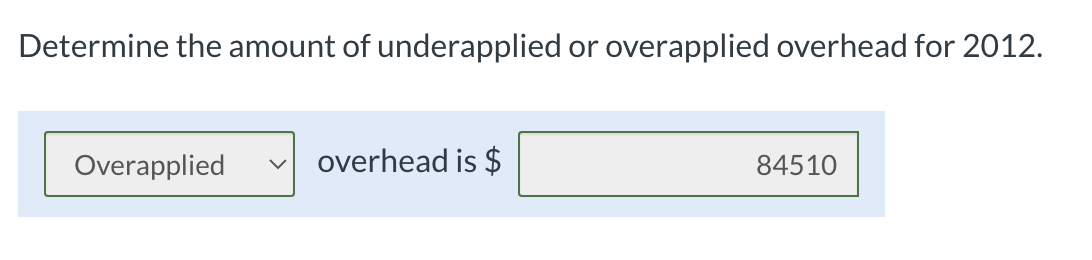

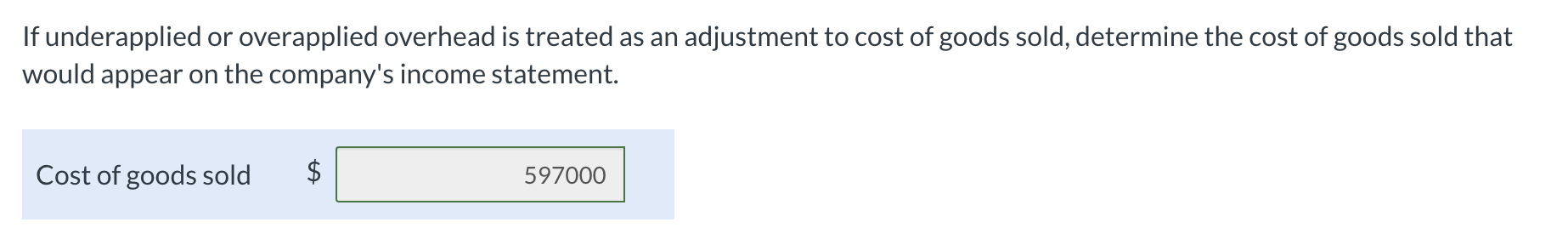

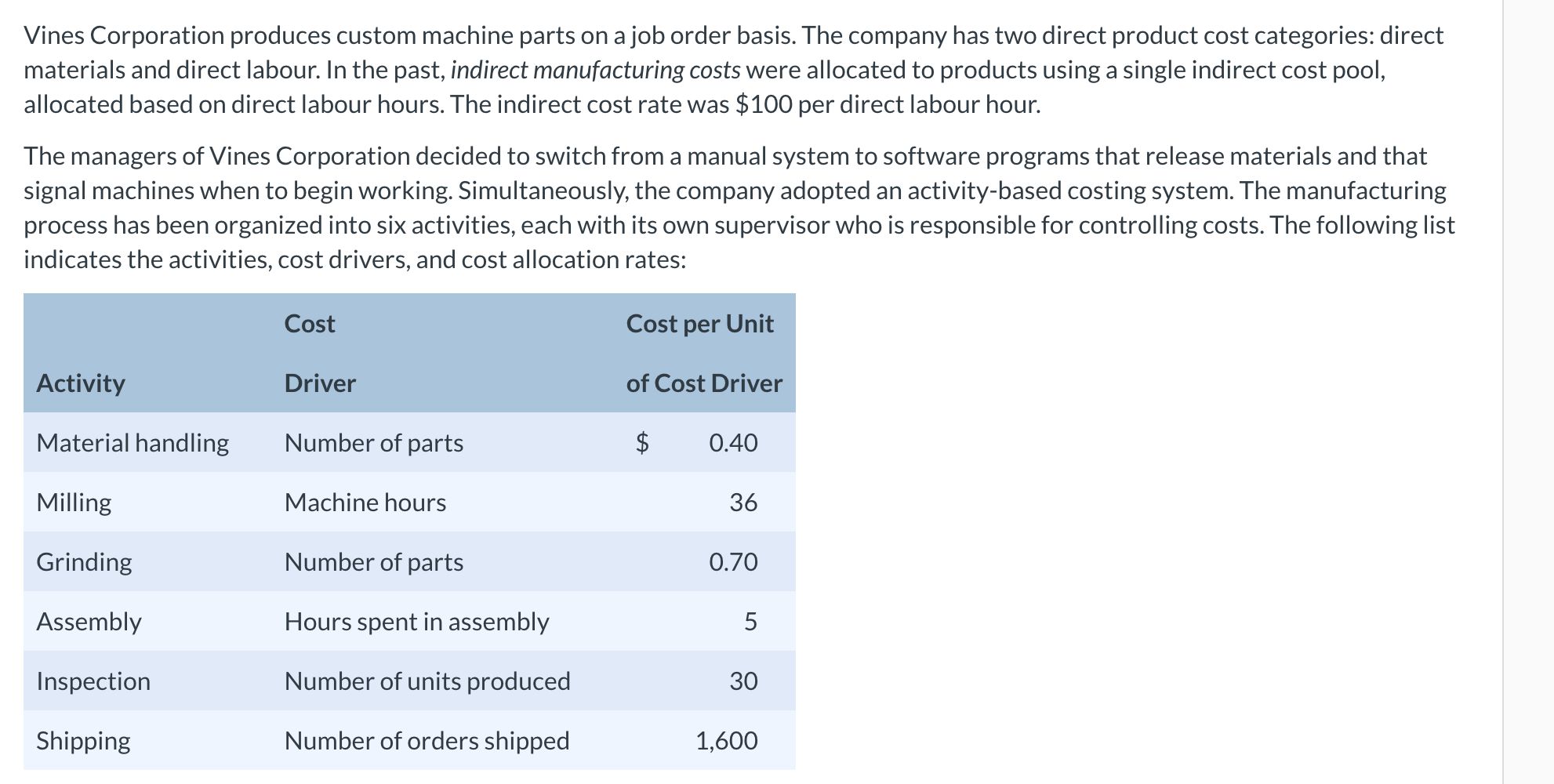

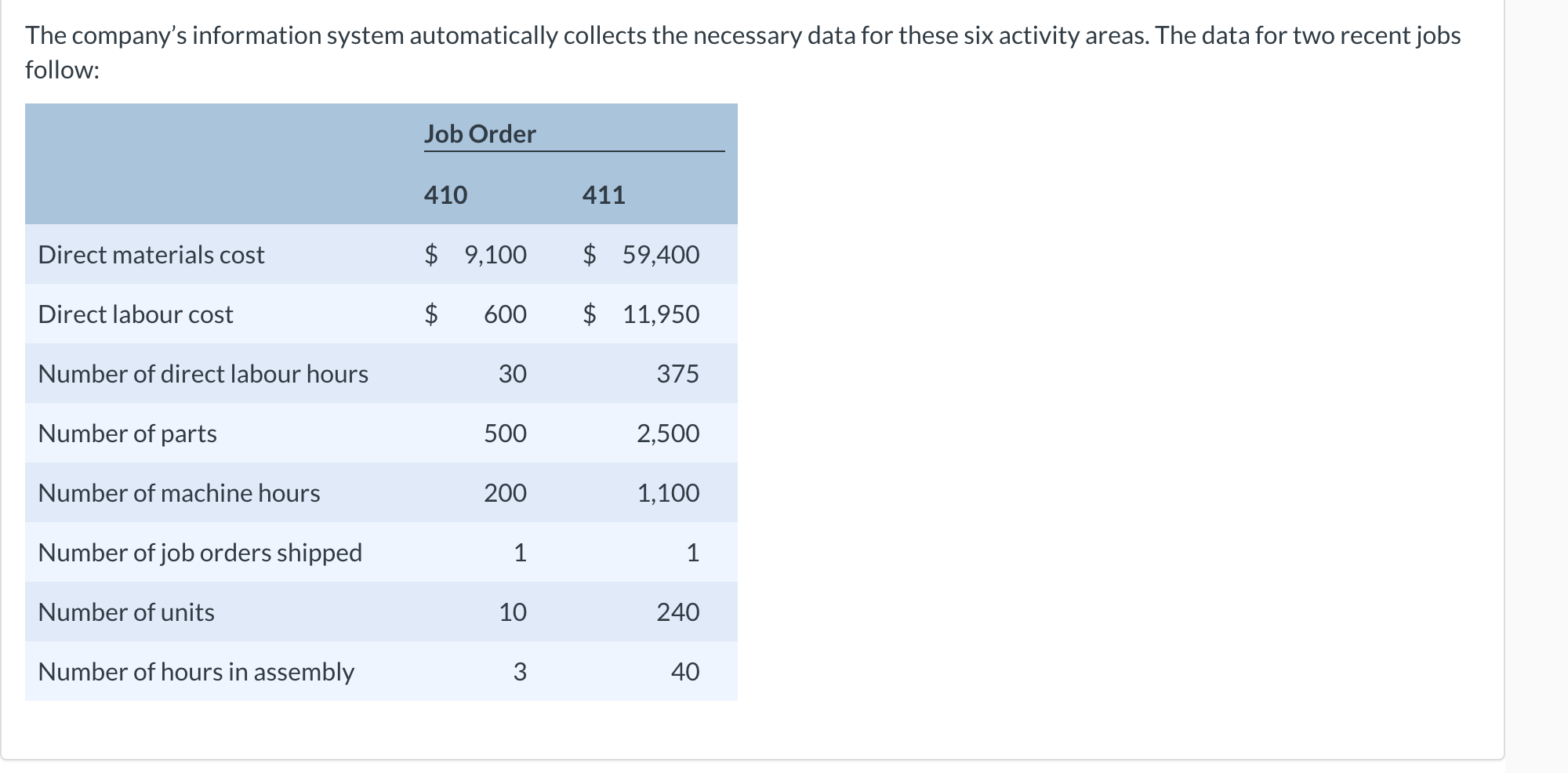

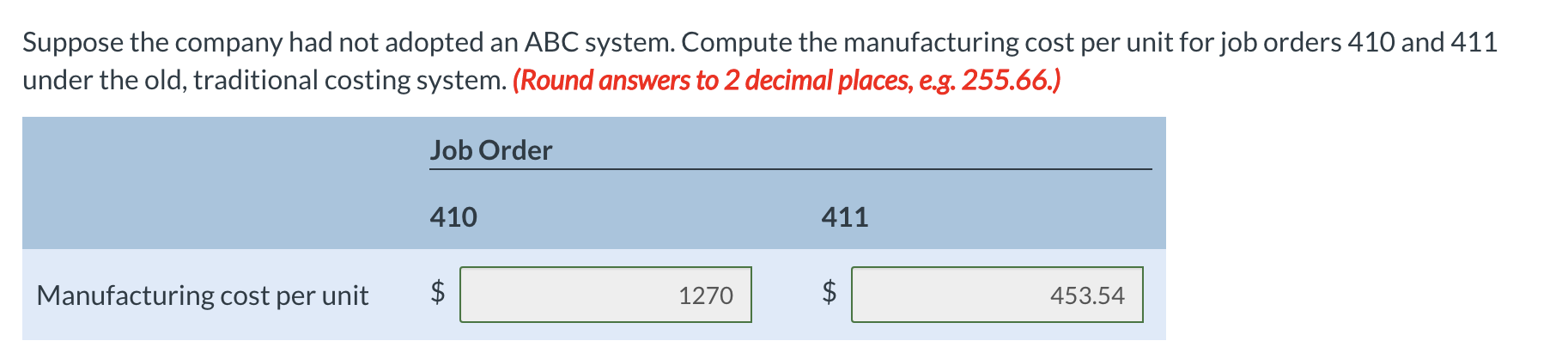

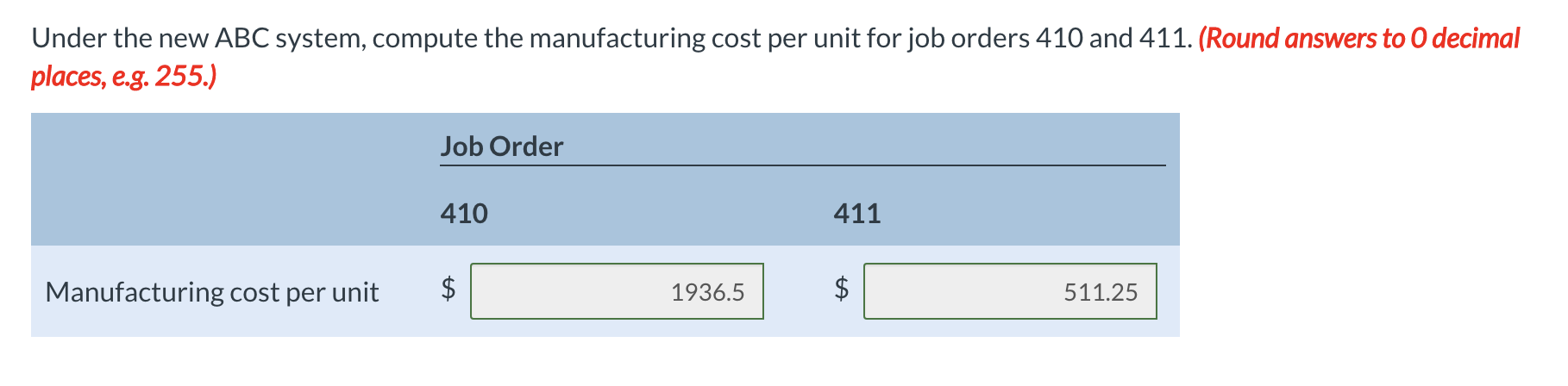

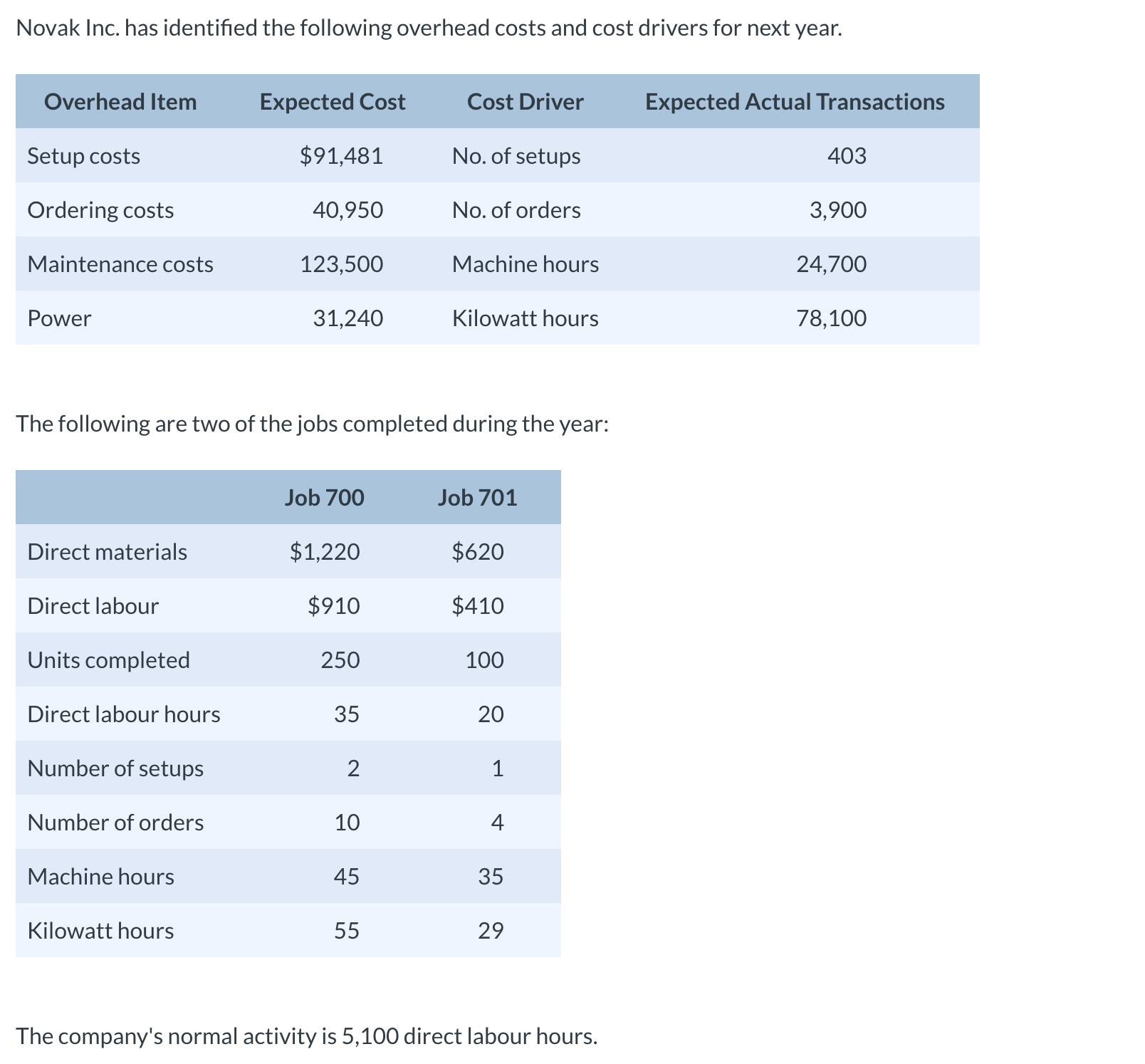

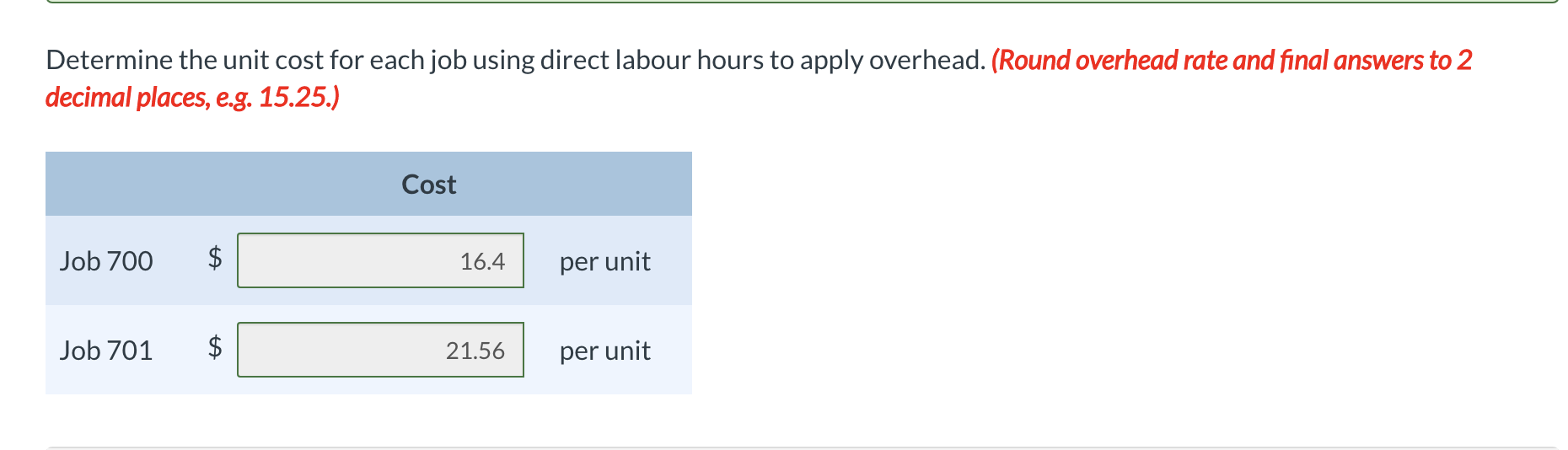

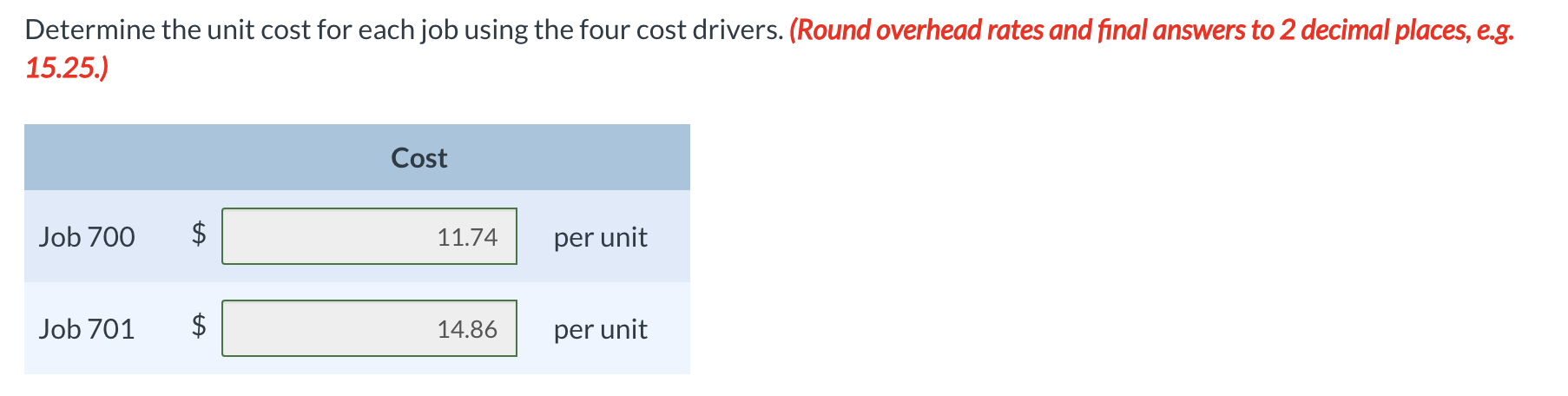

The Soap Company uses job costing and applies overhead using a normal costing system using direct labour hours as the allocation base. This period's estimated overhead cost is $400,000, estimated direct labour cost is $500,000 and estimated direct labour hours are 25,000. This period's actual overhead cost was $420,000, actual direct labour cost was $390,000, and actual direct labour hours were 20,000. What is the total manufacturing cost of Job 400? Direct Materials Direct Labour Cost Direct Labour Hours Job 400 $200 $800 40 Job 401 250 200 10 Job 402 500 600 32 The Wildhorse Company uses a budgeted factory overhead rate to apply manufacturing overhead to production. The rate is based on direct labour hours. Estimates for the year 2012 are given below: Estimated manufacturing overhead $529,000 Estimated direct labour hours 52,900 During 2012 the Paine Company used 56,870 direct labour hours. At the end of 2012, the company's records revealed the following information: Raw materials inventory $37,110 Work-in-process inventory 104,120 Finished goods inventory 209,670 Cost of goods sold 681,510 Manufacturing overhead 484,190 Calculate the budgeted overhead rate for 2012. Budgeted overhead rate A 10 per DLH Determine the amount of underapplied or overapplied overhead for 2012. Overapplied overhead is $ 84510 If underapplied or overapplied overhead is treated as an adjustment to cost of goods sold, determine the cost of goods sold that would appear on the company's income statement. Cost of goods sold $ 597000 Vines Corporation produces custom machine parts on a job order basis. The company has two direct product cost categories: direct materials and direct labour. In the past, indirect manufacturing costs were allocated to products using a single indirect cost pool, allocated based on direct labour hours. The indirect cost rate was $100 per direct labour hour. The managers of Vines Corporation decided to switch from a manual system to software programs that release materials and that signal machines when to begin working. Simultaneously, the company adopted an activity-based costing system. The manufacturing process has been organized into six activities, each with its own supervisor who is responsible for controlling costs. The following list indicates the activities, cost drivers, and cost allocation rates: Cost Cost per Unit Activity Driver of Cost Driver Material handling Number of parts 0.40 Milling Machine hours 36 Grinding Number of parts 0.70 Assembly Hours spent in assembly 5 Inspection Number of units produced 30 Shipping Number of orders shipped 1,600 The company's information system automatically collects the necessary data for these six activity areas. The data for two recent jobs follow: Job Order 410 411 Direct materials cost $ 9,100 $ 59,400 Direct labour cost 600 $ 11,950 Number of direct labour hours 30 375 Number of parts 500 2,500 Number of machine hours 200 1,100 Number of job orders shipped 1 1 Number of units 10 240 Number of hours in assembly 3 40 Suppose the company had not adopted an ABC system. Compute the manufacturing cost per unit for job orders 410 and 411 under the old, traditional costing system. (Round answers to 2 decimal places, e.g. 255.66.) Job Order 410 411 Manufacturing cost per unit $ 1270 AA $ 453.54 Under the new ABC system, compute the manufacturing cost per unit for job orders 410 and 411. (Round answers to O decimal places, e.g. 255.) Job Order 410 Manufacturing cost per unit $ 1936.5 411 511.25 Novak Inc. has identified the following overhead costs and cost drivers for next year. Overhead Item Expected Cost Cost Driver Expected Actual Transactions Setup costs $91,481 No. of setups 403 Ordering costs 40,950 No. of orders 3,900 Maintenance costs 123,500 Machine hours 24,700 Power 31,240 Kilowatt hours 78,100 The following are two of the jobs completed during the year: Job 700 Job 701 Direct materials $1,220 $620 Direct labour $910 $410 Units completed 250 100 Direct labour hours 35 20 Number of setups 2 1 Number of orders 10 4 Machine hours 45 35 Kilowatt hours 55 29 The company's normal activity is 5,100 direct labour hours. Determine the unit cost for each job using direct labour hours to apply overhead. (Round overhead rate and final answers to 2 decimal places, e.g. 15.25.) Job 700 Cost 16.4 per unit Job 701 $ 21.56 per unit Determine the unit cost for each job using the four cost drivers. (Round overhead rates and final answers to 2 decimal places, e.g. 15.25.) Job 700 Job 701 A +A Cost 11.74 per unit $ 14.86 per unit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started