Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Solemio is an exporter of Italian products to England. The company has just invoiced one of most important customer for an amount of

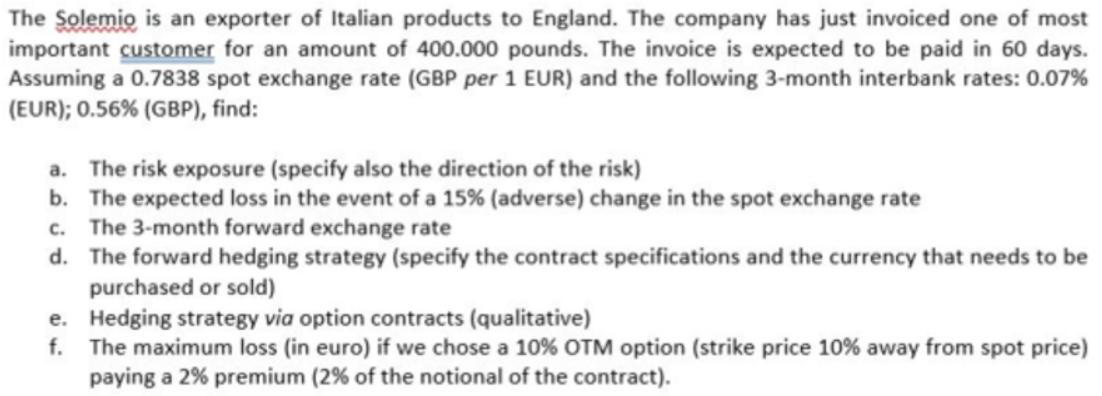

The Solemio is an exporter of Italian products to England. The company has just invoiced one of most important customer for an amount of 400.000 pounds. The invoice is expected to be paid in 60 days. Assuming a 0.7838 spot exchange rate (GBP per 1 EUR) and the following 3-month interbank rates: 0.07% (EUR); 0.56% (GBP), find: a. The risk exposure (specify also the direction of the risk) b. The expected loss in the event of a 15% (adverse) change in the spot exchange rate c. The 3-month forward exchange rate d. The forward hedging strategy (specify the contract specifications and the currency that needs to be purchased or sold) e. Hedging strategy via option contracts (qualitative) f. The maximum loss (in euro) if we chose a 10% OTM option (strike price 10% away from spot price) paying a 2% premium (2% of the notional of the contract).

Step by Step Solution

★★★★★

3.50 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the various components related to the risk exposure and hedging strategies well use the given information and perform the necessary calcu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started