Question

The solution of all the questions below should definitely be with the excel solver. You can also share photos of the actions you have done

The solution of all the questions below should definitely be with the excel solver. You can also share photos of the actions you have done in the excel solver.

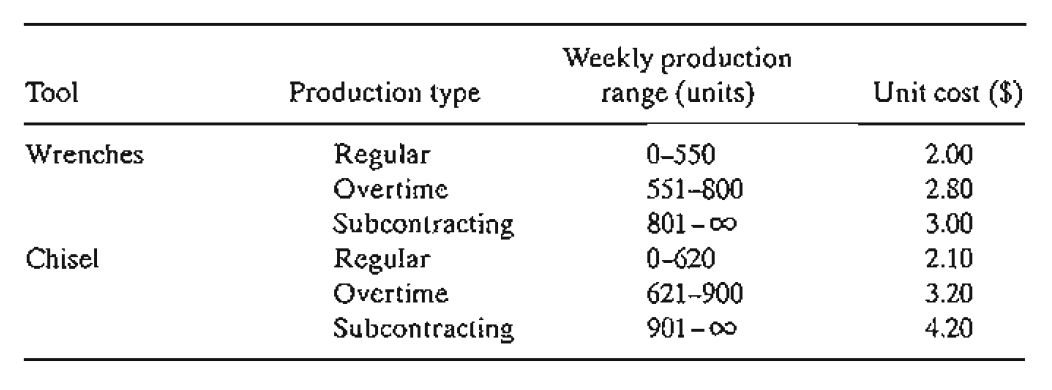

A)Tooleo has contracted with AutoMate to supply their automotive discount stores with wrenches and chisels. AutoMate's weekly demand consists of at least 1500 wrenches and 1200 chisels. Tooleo cannot produce all the requested units with its present one-shift capacity and must use overtime and possibly subcontract with other tool shops. The result is an increase in the production cost per unit, as shown in the following table. Market demand restricts the ratio of chisels to wrenches to at least 2:1.

Please make a solution with excel solver.

*) Formulate and solve the LP for the minimum cost production schedule for each tool.

*) What is the effect on total weekly production cost of increasing the regular and overtime capacities for each tool by one unit?

B) A realtor is developing a rental housing and retail area. The housing area consists of efficiency apartments, duplexes, and single-family homes. Maximum demand by potential renters is estimated to be 500 efficiency apartments, 300 duplexes, and 250 single-family homes, but the number of duplexes must equal at least 50% of the number of efficiency apartments and single homes. Retail space is proportionate to the number of home units at the rates of at least 10 ft2, 15 ft2 and 18 ft2 for efficiency, duplex, and single family units, respectively. However, land availability limits retail space to no more than 10,000 ft2. The monthly rental income is estimated at $600, $750, and $1200 for efficiency, duplex, and single-family units, respectively. The retail space rents for $100 / ft2 . Determine the optimal retail space area and the number of family residences.

Please make a solution with excel solver.

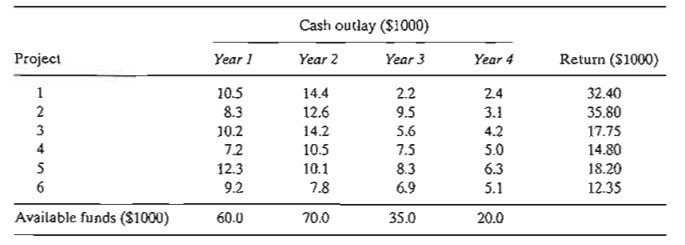

C) Fox Enterprises is considering six projects for possible construction over the next four years. The expected (present value) returns and cash outlays for the projects are given below. Fox can undertake any of the projects partially or completely. A partial undertak-ing of a project will prorate both the return and cash outlays proportionately.

Please make a solution with excel solver.

*).Formulate the problem as a linear program, and determine the optimal project mix that maximizes the total return. Ignore the time value of money.

*).Suppose that if a portion of project 2 is undertaken then at least an equal portion of project 6 must undertaken. Modify the formulation of the model and find the new optimal solution.

*).In the original model, suppose that any funds left at the end of a year are used in the next year. Find the new optimal solution, and determine how much each year "borrows" from the preceding year. For simplicity, ignore the time value of money.

*).Suppose in the original model that the yearly funds available for any year can be exceeded, if necessary, by borrowing from other financial activities within the company. Ignoring the time value of money, reformulate the LP model, and find the optimum solution. Would the new solution require borrowing in any year? If so, what is the rate of return on borrowed money?

D)The demand for an item over the next four quarters is 300, 400, 450 and 250 units, respectively. The price per unit starts at $ 20 in the first quarter and increases by $ 2 each quarter thereafter. The supplier can provide no more than 400 units in any one quarter. Although we can take advantage of lower prices in early quarters, a storage cost of $ 3.5 is incurred per unit per quarter. In addition, the maximum number of units that can be held over from one quarter to the next cannot exceed 100. Develop the model to find the optimum schedule for purchasing the item to meet the demand.

Please make a solution with excel solver.

E)Traffic Light Control. (Stark and Nicholes, 1972) Automobile traffic from three highways, HI, H2, and H3, must stop and wait for a green light before exiting to a toll road. The tolls are $3, $4, and $5 for cars exiting from HI, H2, and H3, respectively. The flow rates from HI, H2, and H3 are 500,600, and 400 cars per hour. The traffic light cycle may not exceed 2.2 minutes, and the green light on any highway must be at least 25 seconds. The yellow light is on for 10 seconds. The toll gate can handle a maximum of 510 cars per hour. Assuming that no cars move on yellow, determine the optimal green time interval for the three highways that will maximize toll gate revenue per traffic cycle.

Please make a solution with excel solver.

Tool Production type Weekly production range (units) Unit cost ($) Wrenches Regular Overtime Subcontracting Regular Overtime Subcontracting 0-550 551-800 801-00 0-620 621-900 901-00 2.00 2.80 3.00 2.10 3.20 4.20 Chisel Cash outlay ($1000) Project Year! Year 2 Year 3 Year 4 22 10.5 8.3 auAN 10.2 72 14.4 12.6 14.2 10.5 10.1 7.8 9.5 5.6 7.5 8.3 6.9 2.4 3.1 4.2 5.0 6.3 5.1 20.0 Return (51000) 32.40 35.80 17.75 14.80 18.20 12.35 12.3 5 6 Available funds ($1000) 9.2 60.0 70.0 35.0 Tool Production type Weekly production range (units) Unit cost ($) Wrenches Regular Overtime Subcontracting Regular Overtime Subcontracting 0-550 551-800 801-00 0-620 621-900 901-00 2.00 2.80 3.00 2.10 3.20 4.20 Chisel Cash outlay ($1000) Project Year! Year 2 Year 3 Year 4 22 10.5 8.3 auAN 10.2 72 14.4 12.6 14.2 10.5 10.1 7.8 9.5 5.6 7.5 8.3 6.9 2.4 3.1 4.2 5.0 6.3 5.1 20.0 Return (51000) 32.40 35.80 17.75 14.80 18.20 12.35 12.3 5 6 Available funds ($1000) 9.2 60.0 70.0 35.0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started