Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the solving process of a, b, c&d - Question 1 (75 marks) Moonlight Ltd (Moonlight is in the business of designing, manufacturing and supplying various

the solving process of a, b, c&d

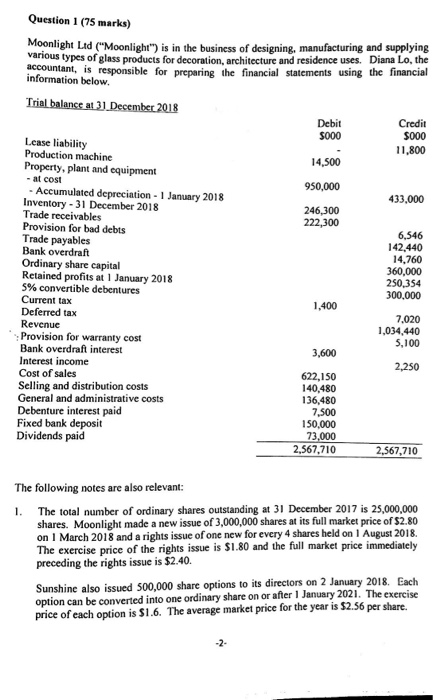

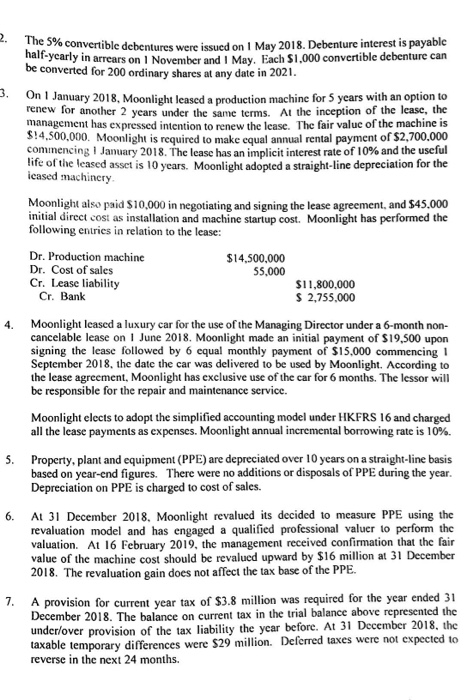

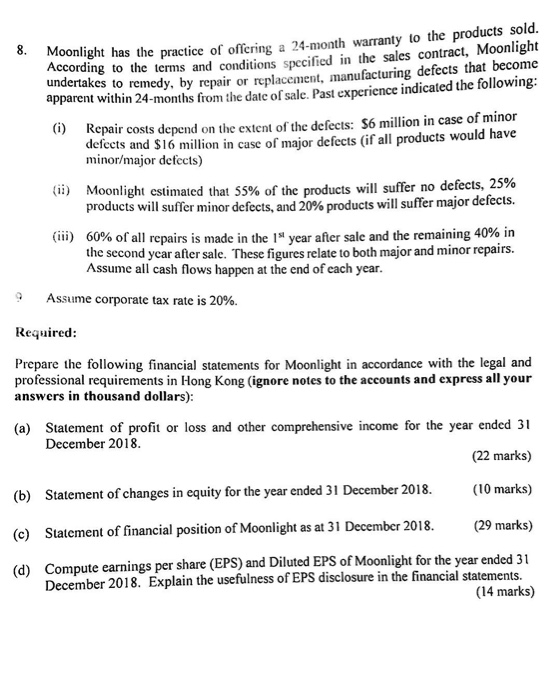

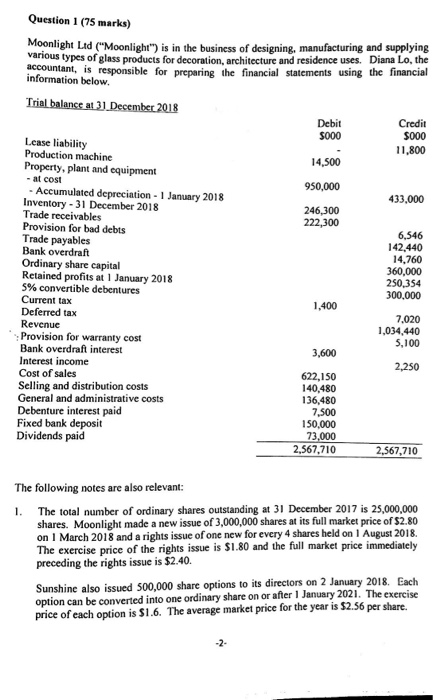

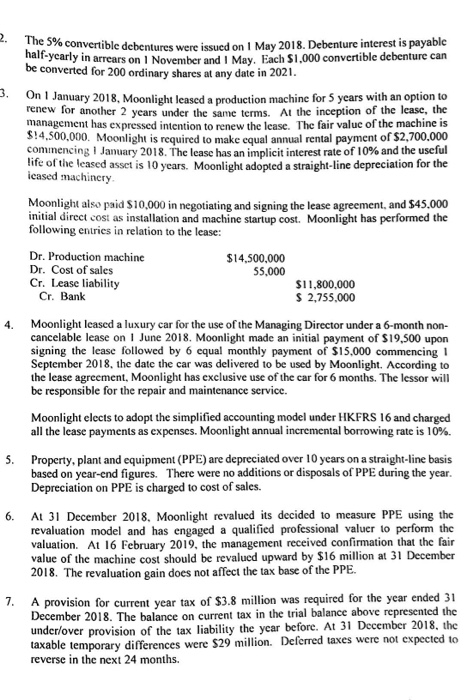

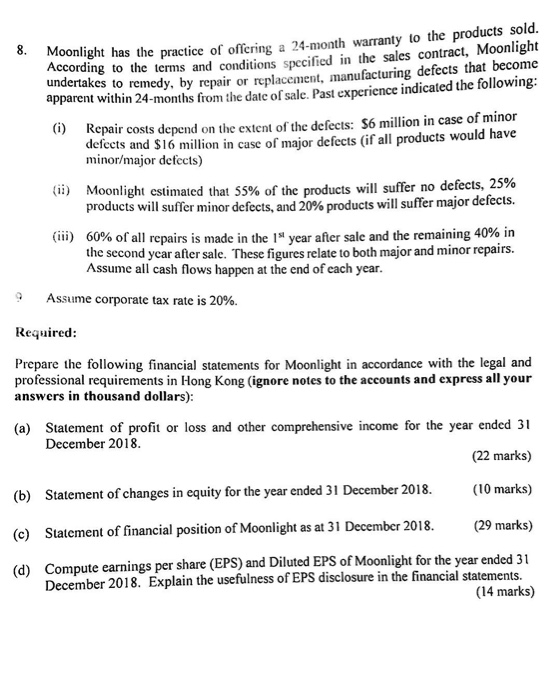

- Question 1 (75 marks) Moonlight Ltd ("Moonlight" is in the business of designing, manufacturing and supplying various types of glass products for decoration, architecture and residence uses. Diana Lo, the ccountant, is responsible for preparing the financial statements using the financial information below. Debit Credit $000 11,800 5000 4,500 950,000 246,300 Lease liability Production machine Property, plant and equipment at cost Accumulated depreciation January 2018 Inventory 31 December 2018 Trade receivables Provision for bad debts Trade payables Bank overdraft Ordinary share capital Retained profits at January 2018 5% convertible debentures Current tax Deferred tax Revenue Provision for warranty cost Bank overdraft interest Interest income Cost of sales Selling and distribution costs General and administrative costs Debenture interest paid Fixed bank deposit 433,000 222,300 6,546 142.440 14,760 360,000 250,354 300,000 1,400 7,020 1,034,440 5,100 3,600 2,250 622,150 140,480 136,480 7,500 150,000 Dividends paid 73 2,567,710 2,567,710 The following notes are also relevant: The total number of ordinary shares outstanding at 31 December 2017 is 25,000,000 shares. Moonlight made a new issue of 3,000,000 shares at its full market price of $2.80 on 1 March 2018 and a rights issue of one new for every 4 shares held on 1 August 2018. The exercise price of the rights issue is $1.80 and the full market preceding the rights issue is $2.40. I. price immediately Sunshine also issued s00,000 share options to its directors on 2 January 2018. Each option can be converted into one ordinary share on or after 1 January 2021. The exercise price of each option is $1.6. The average market price for the year is $2.56 per share. The 596 half-ycarly in arrears be converted for 200 ordinary shares at a convertible debentures were issued on I May 2018. Debenture interest is payable on 1 November and I May. Each $1,000 convertible debenture can ny date in 2021 On January 2018, Moonlight leased a production machine for 5 years with an option to renew for another 2 years under the same terms. At the inception of the lease, the management has expressed intention to renew the lease. The fair value of the machine is 14,500,000. Moonlight is required to make equal annual rental payment of $2,700.000 commencing January 2018 . The lease has an implicit interest rate of 10% and the useful life of the leased asset is 10 years. Moonlight adopted a straight-line depreciation for the icased machincry Moonlight also paid S10,000 in negotiating and signing the lease agreement, and $45.000 initial direct cost as installation and machine startup cost. Moonlight has performed the following entries in relation to the lease: Dr. Production machine Dr. Cost of sales Cr. Lease liability S14,500,000 55,000 $11,800,000 2,755,000 Cr. Bank Moonlight leased a luxury car for the use of the Managing Director under a 6-month non- cancelable lease on June 2018. Moonlight made an initial payment of $19,500 upon signing the lease followed by 6 equal monthly payment of S15,000 commencing 1 September 2018, the date the car was delivered to be used by Moonlight. According to the lease agreement, Moonlight has exclusive use of the car for 6 months. The lessor will be responsible for the repair and maintenance service 4. Moonlight elects to adopt the simplified accounting model under HKFRS 16 and charged all the lease payments as expenses. Moonlight annual incremental borrowing rate is 10%. 5. Property, plant and equipment (PPE) are depreciated over 10 years on a straight-line basis based on year-end figures. There were no additions or disposals of PPE during the year Depreciation on PPE is charged to cost of sales. 6. A 31 December 2018. Moonlight revalued its decided to measure PPE using the revaluation model and has engaged a qualified professional valuer to perform the valuation. At 16 February 2019, the management received confirmation that the fair value of the machine cost should be revalued upward by $16 million at 31 December 2018. The revaluation gain does not affect the tax base of the PPE. provision for current year ax of $3.8 million was required for the year ended 31 18. The balance on current tax in the rial balance above represented the over provision of the tax liability the ycar before. At 31 December 2018. the Deferred taxes were not expected to taxable temporary differences were $29 million. reverse in the next 24 months. Moonlight has the practice of offering a 24-month warranty to the products sold According to the terms and conditions specified in the sales contract, Moonlight undertakes to remedy, b apparent within 24-months from the date of sale. Past experience indicated the following (i) R y repair or replacement, manufacturing defects that become epair costs depend on the extent of the defects: S6 million in case of minor defects and S16 million in case of major defects (if all products would have minor/major defects) Moonlight estimated that 55% of the products will suffer no defects, products will suffer minor defects, and 20% products will suffer major defects. 25% (ii) 60% of all repairs is made in the 1st year after sale and the remaining 40% in the second ycar after sale. These figures relate to both major and minor repairs. Assume all cash flows happen at the end of cach year (iii) Assume corporate tax rate is 20%. Required: Prepare the following financial statements for Moonlight in accordance with the legal and professional requirements in Hong Kong (ignore notes to the accounts and express all your answers in thousand dollars): Statement of profit or loss and other comprehensive income for the year ended 31 (22 marks) (10 marks) (29 marks) e earnings per share (EPS) and Diluted EPS of Moonlight for the year ended 31 (14 marks) (a) December 2018 (b) (c) (d) Statement of changes in equity for the year ended 31 December 2018 Statement of financial position of Moonlight as at 31 December 2018. Comput December 2018. Explain the usefulness of EPS disclosure in the financial st - Question 1 (75 marks) Moonlight Ltd ("Moonlight" is in the business of designing, manufacturing and supplying various types of glass products for decoration, architecture and residence uses. Diana Lo, the ccountant, is responsible for preparing the financial statements using the financial information below. Debit Credit $000 11,800 5000 4,500 950,000 246,300 Lease liability Production machine Property, plant and equipment at cost Accumulated depreciation January 2018 Inventory 31 December 2018 Trade receivables Provision for bad debts Trade payables Bank overdraft Ordinary share capital Retained profits at January 2018 5% convertible debentures Current tax Deferred tax Revenue Provision for warranty cost Bank overdraft interest Interest income Cost of sales Selling and distribution costs General and administrative costs Debenture interest paid Fixed bank deposit 433,000 222,300 6,546 142.440 14,760 360,000 250,354 300,000 1,400 7,020 1,034,440 5,100 3,600 2,250 622,150 140,480 136,480 7,500 150,000 Dividends paid 73 2,567,710 2,567,710 The following notes are also relevant: The total number of ordinary shares outstanding at 31 December 2017 is 25,000,000 shares. Moonlight made a new issue of 3,000,000 shares at its full market price of $2.80 on 1 March 2018 and a rights issue of one new for every 4 shares held on 1 August 2018. The exercise price of the rights issue is $1.80 and the full market preceding the rights issue is $2.40. I. price immediately Sunshine also issued s00,000 share options to its directors on 2 January 2018. Each option can be converted into one ordinary share on or after 1 January 2021. The exercise price of each option is $1.6. The average market price for the year is $2.56 per share. The 596 half-ycarly in arrears be converted for 200 ordinary shares at a convertible debentures were issued on I May 2018. Debenture interest is payable on 1 November and I May. Each $1,000 convertible debenture can ny date in 2021 On January 2018, Moonlight leased a production machine for 5 years with an option to renew for another 2 years under the same terms. At the inception of the lease, the management has expressed intention to renew the lease. The fair value of the machine is 14,500,000. Moonlight is required to make equal annual rental payment of $2,700.000 commencing January 2018 . The lease has an implicit interest rate of 10% and the useful life of the leased asset is 10 years. Moonlight adopted a straight-line depreciation for the icased machincry Moonlight also paid S10,000 in negotiating and signing the lease agreement, and $45.000 initial direct cost as installation and machine startup cost. Moonlight has performed the following entries in relation to the lease: Dr. Production machine Dr. Cost of sales Cr. Lease liability S14,500,000 55,000 $11,800,000 2,755,000 Cr. Bank Moonlight leased a luxury car for the use of the Managing Director under a 6-month non- cancelable lease on June 2018. Moonlight made an initial payment of $19,500 upon signing the lease followed by 6 equal monthly payment of S15,000 commencing 1 September 2018, the date the car was delivered to be used by Moonlight. According to the lease agreement, Moonlight has exclusive use of the car for 6 months. The lessor will be responsible for the repair and maintenance service 4. Moonlight elects to adopt the simplified accounting model under HKFRS 16 and charged all the lease payments as expenses. Moonlight annual incremental borrowing rate is 10%. 5. Property, plant and equipment (PPE) are depreciated over 10 years on a straight-line basis based on year-end figures. There were no additions or disposals of PPE during the year Depreciation on PPE is charged to cost of sales. 6. A 31 December 2018. Moonlight revalued its decided to measure PPE using the revaluation model and has engaged a qualified professional valuer to perform the valuation. At 16 February 2019, the management received confirmation that the fair value of the machine cost should be revalued upward by $16 million at 31 December 2018. The revaluation gain does not affect the tax base of the PPE. provision for current year ax of $3.8 million was required for the year ended 31 18. The balance on current tax in the rial balance above represented the over provision of the tax liability the ycar before. At 31 December 2018. the Deferred taxes were not expected to taxable temporary differences were $29 million. reverse in the next 24 months. Moonlight has the practice of offering a 24-month warranty to the products sold According to the terms and conditions specified in the sales contract, Moonlight undertakes to remedy, b apparent within 24-months from the date of sale. Past experience indicated the following (i) R y repair or replacement, manufacturing defects that become epair costs depend on the extent of the defects: S6 million in case of minor defects and S16 million in case of major defects (if all products would have minor/major defects) Moonlight estimated that 55% of the products will suffer no defects, products will suffer minor defects, and 20% products will suffer major defects. 25% (ii) 60% of all repairs is made in the 1st year after sale and the remaining 40% in the second ycar after sale. These figures relate to both major and minor repairs. Assume all cash flows happen at the end of cach year (iii) Assume corporate tax rate is 20%. Required: Prepare the following financial statements for Moonlight in accordance with the legal and professional requirements in Hong Kong (ignore notes to the accounts and express all your answers in thousand dollars): Statement of profit or loss and other comprehensive income for the year ended 31 (22 marks) (10 marks) (29 marks) e earnings per share (EPS) and Diluted EPS of Moonlight for the year ended 31 (14 marks) (a) December 2018 (b) (c) (d) Statement of changes in equity for the year ended 31 December 2018 Statement of financial position of Moonlight as at 31 December 2018. Comput December 2018. Explain the usefulness of EPS disclosure in the financial st

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started