the solving process of question 1(a,b&c)

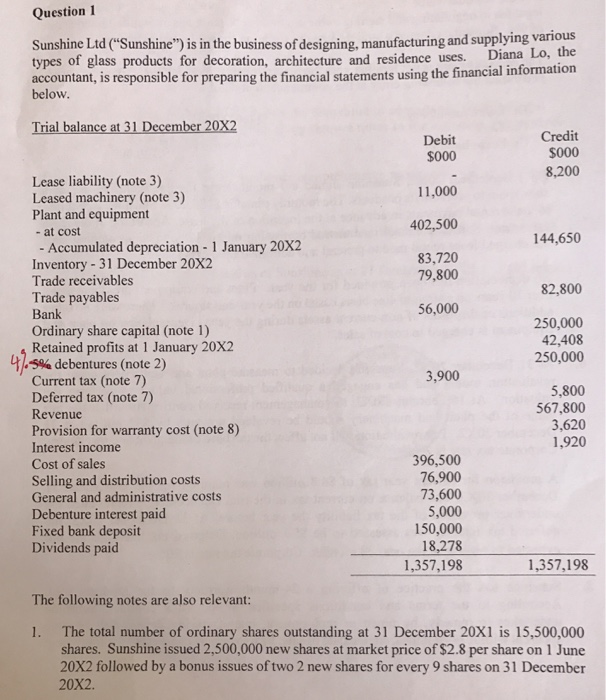

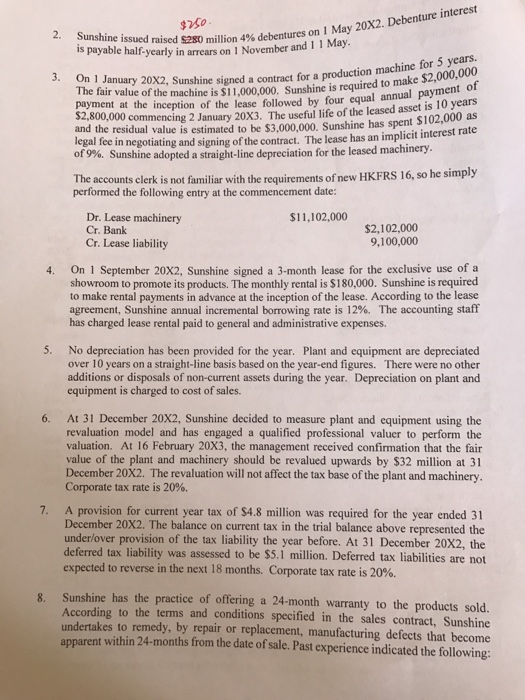

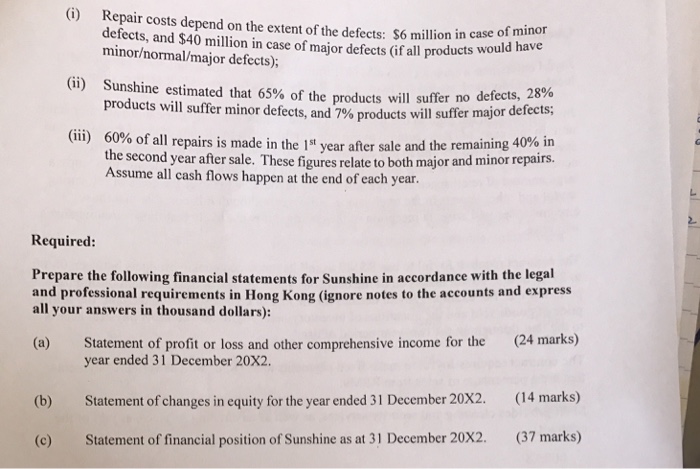

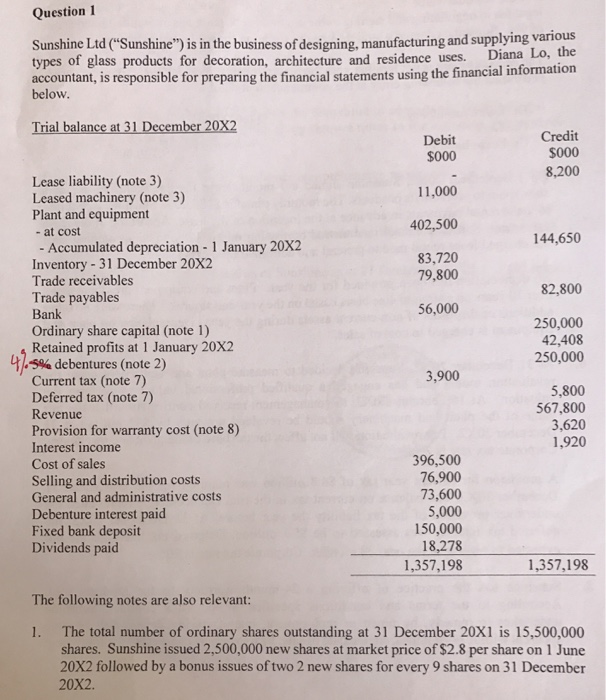

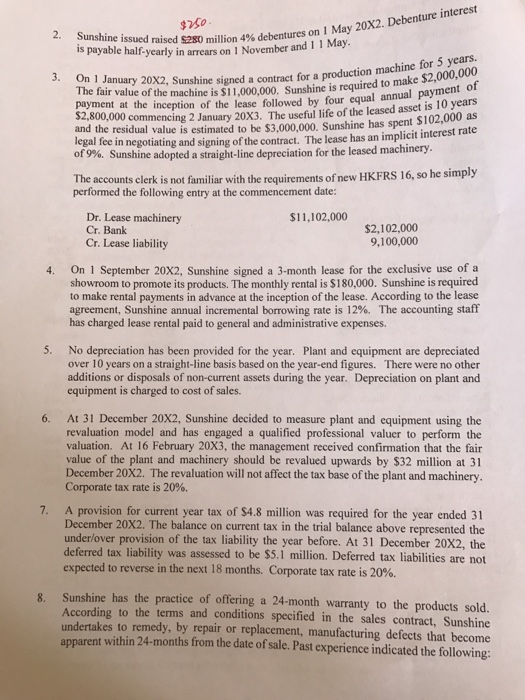

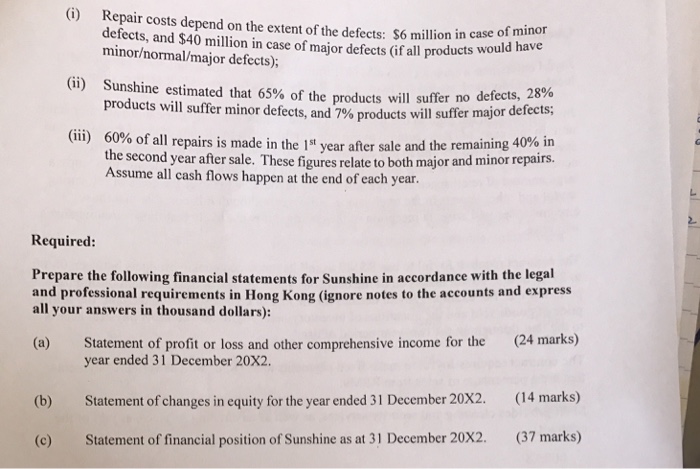

Question 1 Sunshine Ltd ("Sunshine") is in the business of designing, manufacturing and supplying various types of glass products for decoration, architecture and residence uses. Diana accountant, is responsible for preparing the financial statements using the financial informati Lo, the below. Trial balance at 31 December 20X2 Credit 5000 8,200 Debit Lease liability (note 3) Leased machinery (note 3) Plant and equipment - at cost $000 11,000 402,500 83,720 144,650 Accumulated depreciation -1 January 20X2 Inventory -31 December 20X2 Trade receivables Trade payables Bank Ordinary share capital (note 1) 79,800 82,800 56,000 250,000 42,408 250,000 4 Retained profits at 1 January 20X2 debentures (note 2) Current tax (note 7) Deferred tax (note 7) Revenue Provision for warranty cost (note 8) Interest income Cost of sales Selling and distribution costs General and administrative costs Debenture interest paid Fixed bank deposit Dividends paid 3,900 5,800 567,800 3,620 1,920 396,500 76,900 73,600 5,000 150,000 18,278 1,357,198 1,357,198 The following notes are also relevant: The total number of ordinary shares outstanding at 31 December 20X1 is 15,500,000 shares. Sunshine issued 2,500,000 new shares at market price of $2.8 per share on 1 June 20X2 followed by a bonus issues of two 2 new shares for every 9 shares on 31 December 20X2. 1. Question 1 Sunshine Ltd ("Sunshine") is in the business of designing, manufacturing and supplying various types of glass products for decoration, architecture and residence uses. Diana accountant, is responsible for preparing the financial statements using the financial informati Lo, the below. Trial balance at 31 December 20X2 Credit 5000 8,200 Debit Lease liability (note 3) Leased machinery (note 3) Plant and equipment - at cost $000 11,000 402,500 83,720 144,650 Accumulated depreciation -1 January 20X2 Inventory -31 December 20X2 Trade receivables Trade payables Bank Ordinary share capital (note 1) 79,800 82,800 56,000 250,000 42,408 250,000 4 Retained profits at 1 January 20X2 debentures (note 2) Current tax (note 7) Deferred tax (note 7) Revenue Provision for warranty cost (note 8) Interest income Cost of sales Selling and distribution costs General and administrative costs Debenture interest paid Fixed bank deposit Dividends paid 3,900 5,800 567,800 3,620 1,920 396,500 76,900 73,600 5,000 150,000 18,278 1,357,198 1,357,198 The following notes are also relevant: The total number of ordinary shares outstanding at 31 December 20X1 is 15,500,000 shares. Sunshine issued 2,500,000 new shares at market price of $2.8 per share on 1 June 20X2 followed by a bonus issues of two 2 new shares for every 9 shares on 31 December 20X2. 1