Question

The Sophia Company adopted a defined benefit pension plan on January 1, 2015, and prior service credit was granted to employees. The present value of

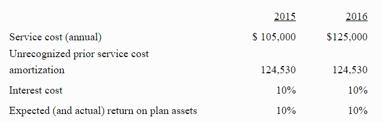

The Sophia Company adopted a defined benefit pension plan on January 1, 2015, and prior service credit was granted to employees. The present value of those benefits was calculated to be $1,245,300 at that date. The service cost is funded in full at the end of each year, plus an additional amount of $225,000 is funded each year-end. The unrecognized prior service cost is being amortized by the straight-line method over the remaining 10-year service life of the company's active employees. Additional information relating to the company's pension plan is presented below:

Refer to Exhibit 19-02. What is the pension expense for 2015?

a. $315.000

b.$ 105,000

c. $354,060

d. $229,530

2015 2016 Service cost (annual) S 105,000 $125,000 Unrecognized prior service cost amortization 124,530 124.530 Interest cost 10% 10% Expected (and actual) return on plan assets 10% 10%

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

The correct answer is Option C 354060 Workings Pens...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started