Answered step by step

Verified Expert Solution

Question

1 Approved Answer

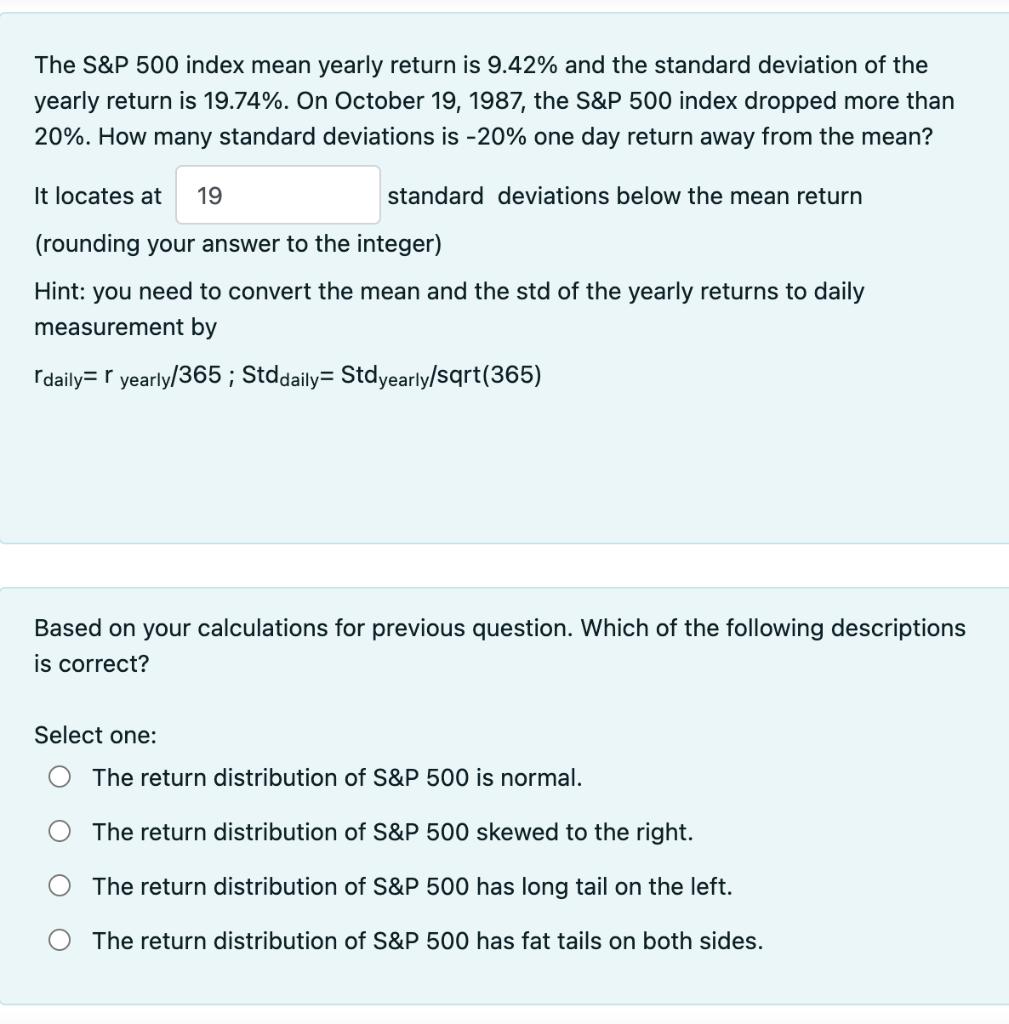

The S&P 500 index mean yearly return is 9.42% and the standard deviation of the yearly return is 19.74%. On October 19, 1987, the

The S&P 500 index mean yearly return is 9.42% and the standard deviation of the yearly return is 19.74%. On October 19, 1987, the S&P 500 index dropped more than 20%. How many standard deviations is -20% one day return away from the mean? It locates at 19 (rounding your answer to the integer) Hint: you need to convert the mean and the std of the yearly returns to daily measurement by daily= r yearly/365; Stddaily= Stdyearly/sqrt(365) standard deviations below the mean return Based on your calculations for previous question. Which of the following descriptions is correct? Select one: The return distribution of S&P 500 is normal. The return distribution of S&P 500 skewed to the right. The return distribution of S&P 500 has long tail on the left. The return distribution of S&P 500 has fat tails on both sides.

Step by Step Solution

★★★★★

3.36 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER A The return distribution of SP 500 is normal If the SP 500 is normally distributed and resem...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started