The S&P 500 was trading at 21.2 times earnings on December 31, 1993. On the same day, the dividend yield on the index was

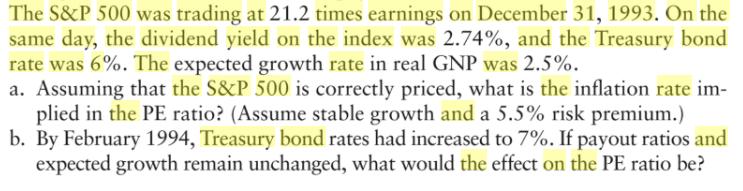

The S&P 500 was trading at 21.2 times earnings on December 31, 1993. On the same day, the dividend yield on the index was 2.74%, and the Treasury bond rate was 6%. The expected growth rate in real GNP was 2.5%. a. Assuming that the S&P 500 is correctly priced, what is the inflation rate im- plied in the PE ratio? (Assume stable growth and a 5.5% risk premium.) b. By February 1994, Treasury bond rates had increased to 7%. If payout ratios and expected growth remain unchanged, what would the effect on the PE ratio be?

Step by Step Solution

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Solution A Dividend Payout Ratio 002741212 0581 Cost of Equity 6 55 115 Solving for the Implied Gro...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started