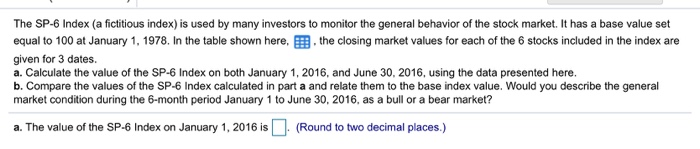

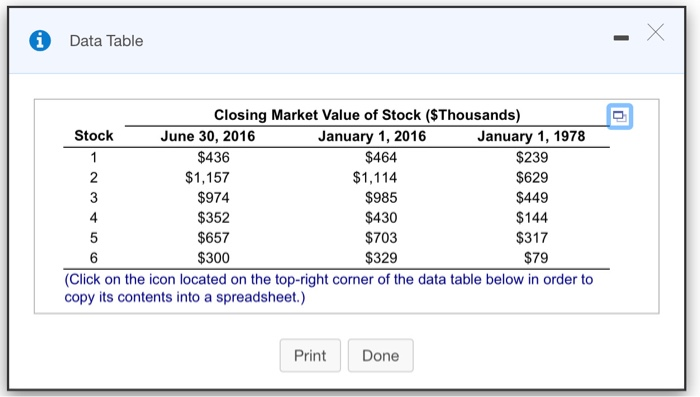

The SP-6 Index (a fictitious index) is used by many investors to monitor the general behavior of the stock market. It has a base value set equal to 100 at January 1, 1978. In the table shown here, the closing market values for each of the 6 stocks included in the index are given for 3 dates. a. Calculate the value of the SP-6 Index on both January 1, 2016, and June 30, 2016, using the data presented here. b. Compare the values of the SP-6 Index calculated in part a and relate them to the base index value. Would you describe the general market condition during the 6-month period January 1 to June 30, 2016, as a bull or a bear market? a. The value of the SP-6 Index on January 1, 2016 is (Round to two decimal places.) Data Table $239 Closing Market Value of Stock ($Thousands) Stock June 30, 2016 January 1, 2016 January 1, 1978 $436 $464 $1,157 $1,114 $629 $974 $985 $449 $352 $430 $144 $657 $703 $317 $300 $329 $79 (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Print Done The SP-6 Index (a fictitious index) is used by many investors to monitor the general behavior of the stock market. It has a base value set equal to 100 at January 1, 1978. In the table shown here, the closing market values for each of the 6 stocks included in the index are given for 3 dates. a. Calculate the value of the SP-6 Index on both January 1, 2016, and June 30, 2016, using the data presented here. b. Compare the values of the SP-6 Index calculated in part a and relate them to the base index value. Would you describe the general market condition during the 6-month period January 1 to June 30, 2016, as a bull or a bear market? a. The value of the SP-6 Index on January 1, 2016 is (Round to two decimal places.) Data Table $239 Closing Market Value of Stock ($Thousands) Stock June 30, 2016 January 1, 2016 January 1, 1978 $436 $464 $1,157 $1,114 $629 $974 $985 $449 $352 $430 $144 $657 $703 $317 $300 $329 $79 (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Print Done