On 4 January x1 firm C is expecting (with a very high probability) to purchase Alpine spruce from a European supplier. The Alpine spruce

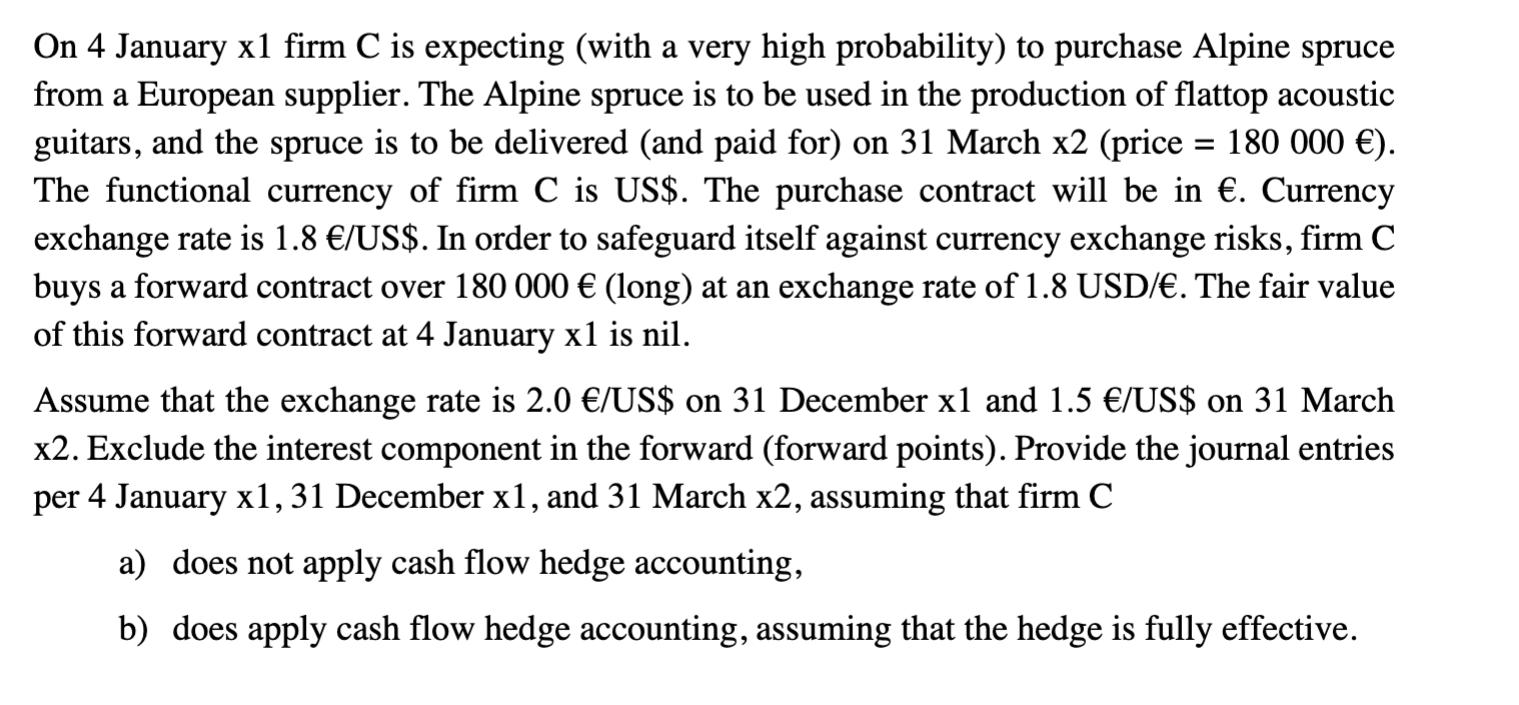

On 4 January x1 firm C is expecting (with a very high probability) to purchase Alpine spruce from a European supplier. The Alpine spruce is to be used in the production of flattop acoustic guitars, and the spruce is to be delivered (and paid for) on 31 March x2 (price 180 000 ). The functional currency of firm C is US$. The purchase contract will be in . Currency exchange rate is 1.8 /US$. In order to safeguard itself against currency exchange risks, firm C buys a forward contract over 180 000 (long) at an exchange rate of 1.8 USD/. The fair value of this forward contract at 4 January x1 is nil. = Assume that the exchange rate is 2.0 /US$ on 31 December x1 and 1.5 /US$ on 31 March x2. Exclude the interest component in the forward (forward points). Provide the journal entries per 4 January x1, 31 December x1, and 31 March x2, assuming that firm C a) does not apply cash flow hedge accounting, b) does apply cash flow hedge accounting, assuming that the hedge is fully effective.

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a 4 January x1 Purchased spruce from European supplier 180000 E 31 De...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started