Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the SPG stock is purchased on Nov 16th for .375 and is sold on Nov 18th for .4 1. Based on the date of your

the SPG stock is purchased on Nov 16th for .375 and is sold on Nov 18th for .4

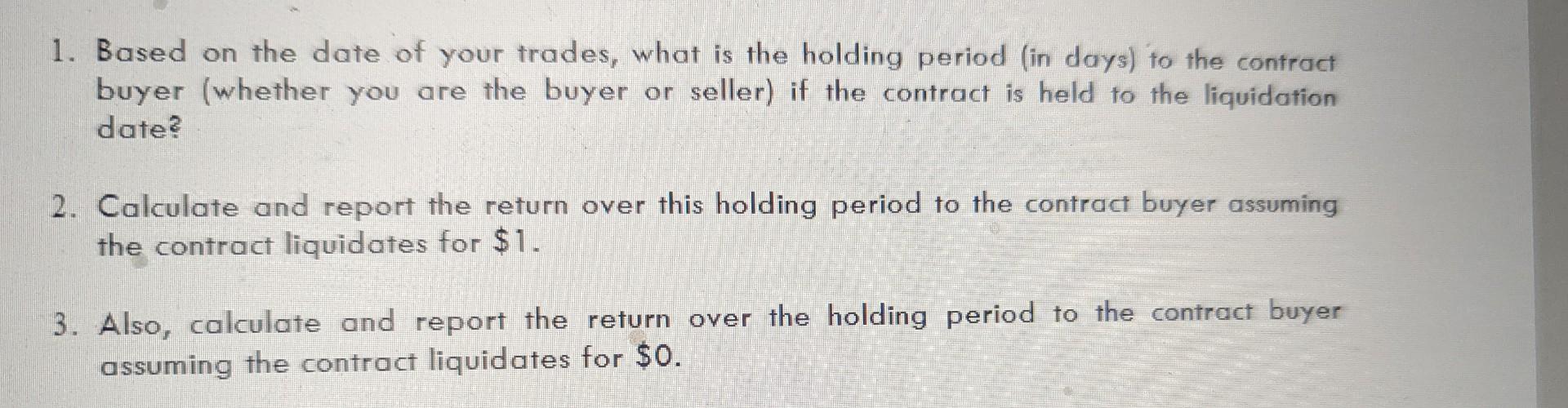

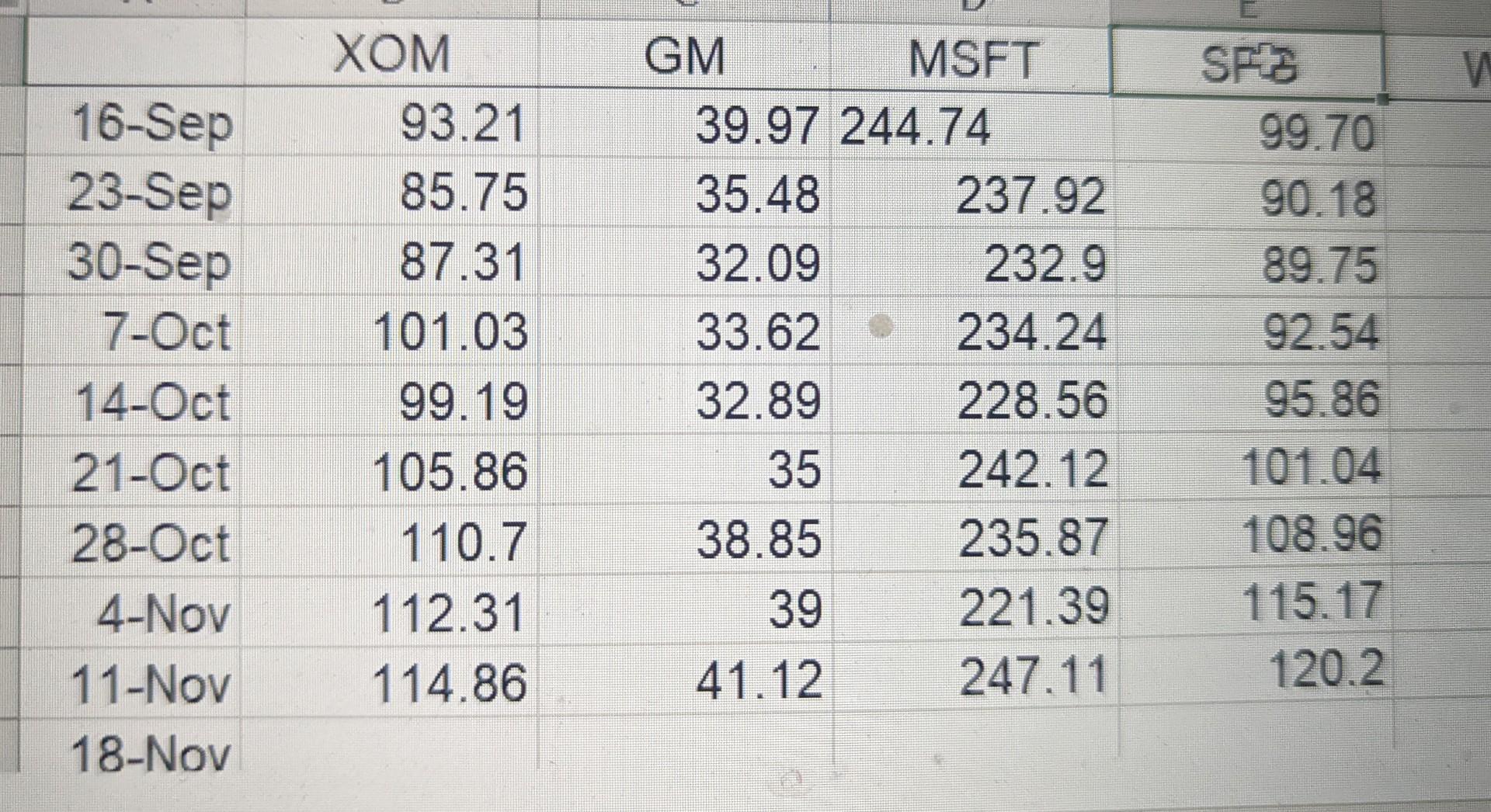

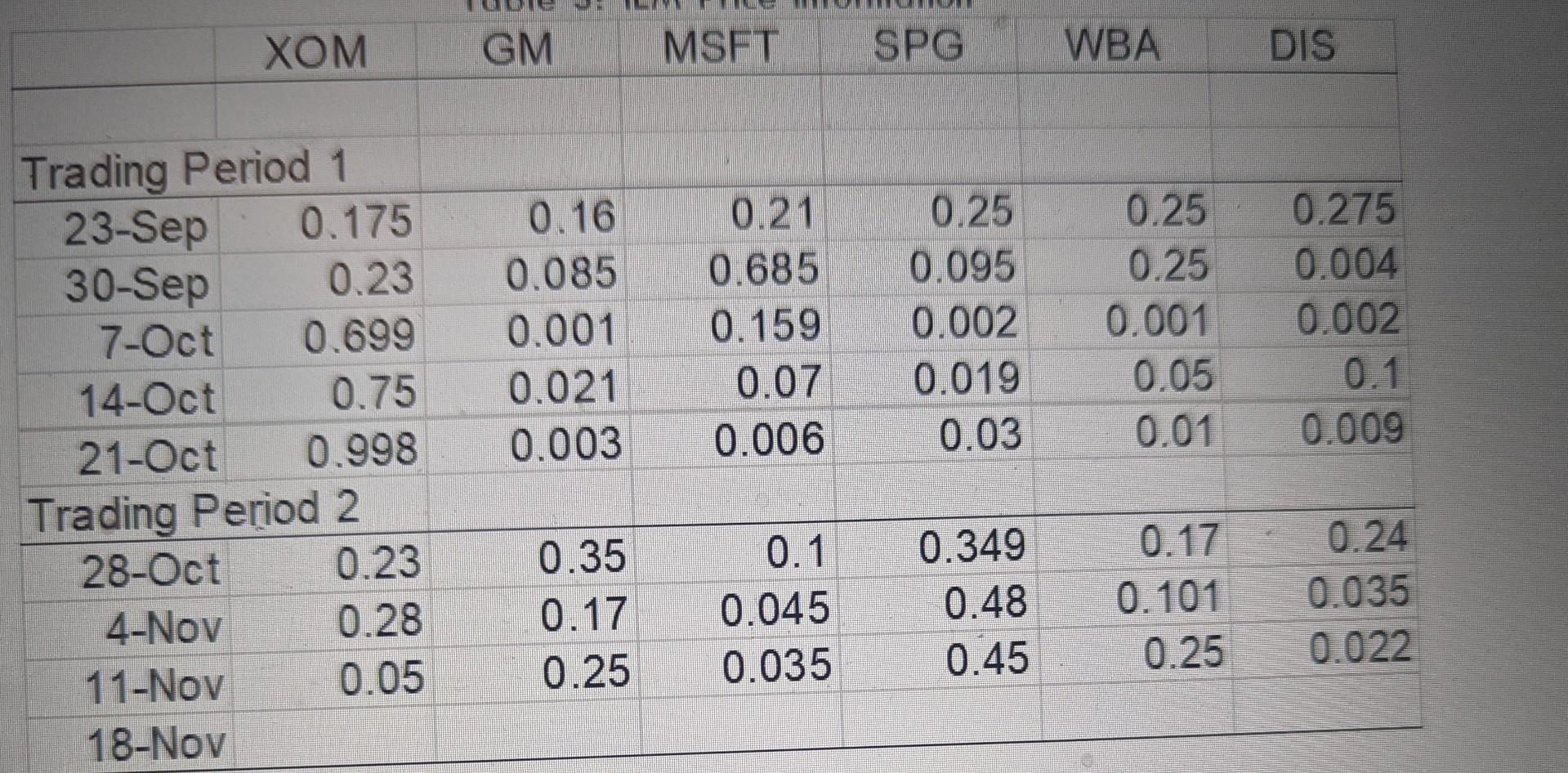

1. Based on the date of your trades, what is the holding period (in days) to the contract buyer (whether you are the buyer or seller) if the contract is held to the liquidation date? 2. Calculate and report the return over this holding period to the contract buyer assuming the contract liquidates for $1. 3. Also, calculate and report the return over the holding period to the contract buyer assuming the contract liquidates for $0. \begin{tabular}{|rrrrrr|} & \multicolumn{1}{r}{ XOM } & \multicolumn{1}{l}{ GM } & \multicolumn{1}{r|}{ MSFT } & \multicolumn{1}{c|}{ SF?3 } \\ \hline 16-Sep & 93.21 & 39.97 & 244.74 & 99.70 \\ 23-Sep & 85.75 & 35.48 & 237.92 & 90.18 \\ 30-Sep & 87.31 & 32.09 & 232.9 & 89.75 \\ 7-Oct & 101.03 & 33.62 & 234.24 & 92.54 \\ \hline 14-Oct & 99.19 & 32.89 & 228.56 & 95.86 \\ 21-Oct & 105.86 & 35 & 242.12 & 101.04 \\ 28-Oct & 110.7 & 38.85 & 235.87 & 108.96 \\ 4-Nov & 112.31 & 39 & 221.39 & 115.17 \\ 11-Nov & 114.86 & 41.12 & 247.11 & 120.2 \\ \hline 18-Nov & & & & \end{tabular} XOM GM MSFT SPG WBA DIS \begin{tabular}{rrrrrrrr} Trading Period 1 & & & & & & \\ \hline 23-Sep & 0.175 & 0.16 & 0.21 & 0.25 & 0.25 & 0.275 \\ 30-Sep & 0.23 & 0.085 & 0.685 & 0.095 & 0.25 & 0.004 \\ 7-Oct & 0.699 & 0.001 & 0.159 & 0.002 & 0.001 & 0.002 \\ 14-Oct & 0.75 & 0.021 & 0.07 & 0.019 & 0.05 & 0.1 \\ \hline 21-Oct & 0.998 & 0.003 & 0.006 & 0.03 & 0.01 & 0.009 \\ Trading Period 2 & & & & & \\ \hline 28-Oct & 0.23 & 0.35 & 0.1 & 0.349 & 0.17 & 0.24 \\ 4-Nov & 0.28 & 0.17 & 0.045 & 0.48 & 0.101 & 0.035 \\ 11-Nov & 0.05 & 0.25 & 0.035 & 0.45 & 0.25 & 0.022 \\ \hline 18-Nov & & & & & & \\ \hline \end{tabular} 1. Based on the date of your trades, what is the holding period (in days) to the contract buyer (whether you are the buyer or seller) if the contract is held to the liquidation date? 2. Calculate and report the return over this holding period to the contract buyer assuming the contract liquidates for $1. 3. Also, calculate and report the return over the holding period to the contract buyer assuming the contract liquidates for $0. \begin{tabular}{|rrrrrr|} & \multicolumn{1}{r}{ XOM } & \multicolumn{1}{l}{ GM } & \multicolumn{1}{r|}{ MSFT } & \multicolumn{1}{c|}{ SF?3 } \\ \hline 16-Sep & 93.21 & 39.97 & 244.74 & 99.70 \\ 23-Sep & 85.75 & 35.48 & 237.92 & 90.18 \\ 30-Sep & 87.31 & 32.09 & 232.9 & 89.75 \\ 7-Oct & 101.03 & 33.62 & 234.24 & 92.54 \\ \hline 14-Oct & 99.19 & 32.89 & 228.56 & 95.86 \\ 21-Oct & 105.86 & 35 & 242.12 & 101.04 \\ 28-Oct & 110.7 & 38.85 & 235.87 & 108.96 \\ 4-Nov & 112.31 & 39 & 221.39 & 115.17 \\ 11-Nov & 114.86 & 41.12 & 247.11 & 120.2 \\ \hline 18-Nov & & & & \end{tabular} XOM GM MSFT SPG WBA DIS \begin{tabular}{rrrrrrrr} Trading Period 1 & & & & & & \\ \hline 23-Sep & 0.175 & 0.16 & 0.21 & 0.25 & 0.25 & 0.275 \\ 30-Sep & 0.23 & 0.085 & 0.685 & 0.095 & 0.25 & 0.004 \\ 7-Oct & 0.699 & 0.001 & 0.159 & 0.002 & 0.001 & 0.002 \\ 14-Oct & 0.75 & 0.021 & 0.07 & 0.019 & 0.05 & 0.1 \\ \hline 21-Oct & 0.998 & 0.003 & 0.006 & 0.03 & 0.01 & 0.009 \\ Trading Period 2 & & & & & \\ \hline 28-Oct & 0.23 & 0.35 & 0.1 & 0.349 & 0.17 & 0.24 \\ 4-Nov & 0.28 & 0.17 & 0.045 & 0.48 & 0.101 & 0.035 \\ 11-Nov & 0.05 & 0.25 & 0.035 & 0.45 & 0.25 & 0.022 \\ \hline 18-Nov & & & & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started