Question

The spot price of oil is $60.80 per barrel and the cost of storing a barrel of oil for one year is $4.50, payable

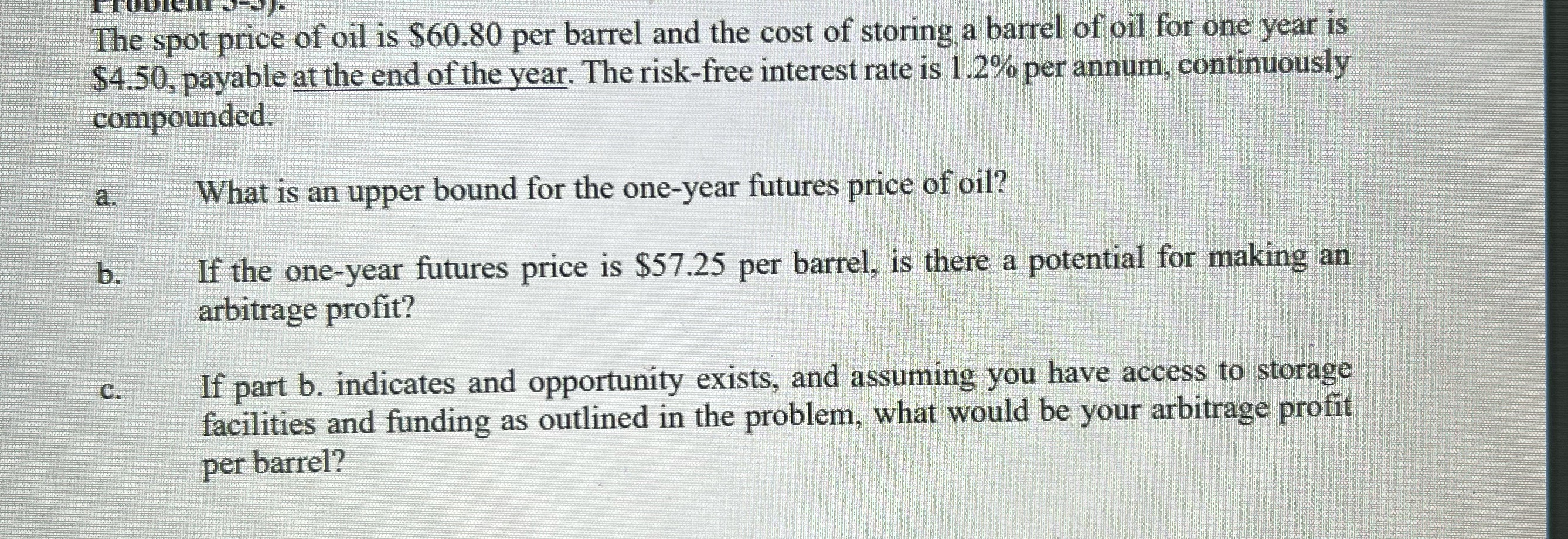

The spot price of oil is $60.80 per barrel and the cost of storing a barrel of oil for one year is $4.50, payable at the end of the year. The risk-free interest rate is 1.2% per annum, continuously compounded. a. b. C. What is an upper bound for the one-year futures price of oil? If the one-year futures price is $57.25 per barrel, is there a potential for making an arbitrage profit? If part b. indicates and opportunity exists, and assuming you have access to storage facilities and funding as outlined in the problem, what would be your arbitrage profit per barrel?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To find the upper bound for the oneyear futures price of oil we can use the co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Options Futures and Other Derivatives

Authors: John C. Hull

10th edition

013447208X, 978-0134472089

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App