Answered step by step

Verified Expert Solution

Question

1 Approved Answer

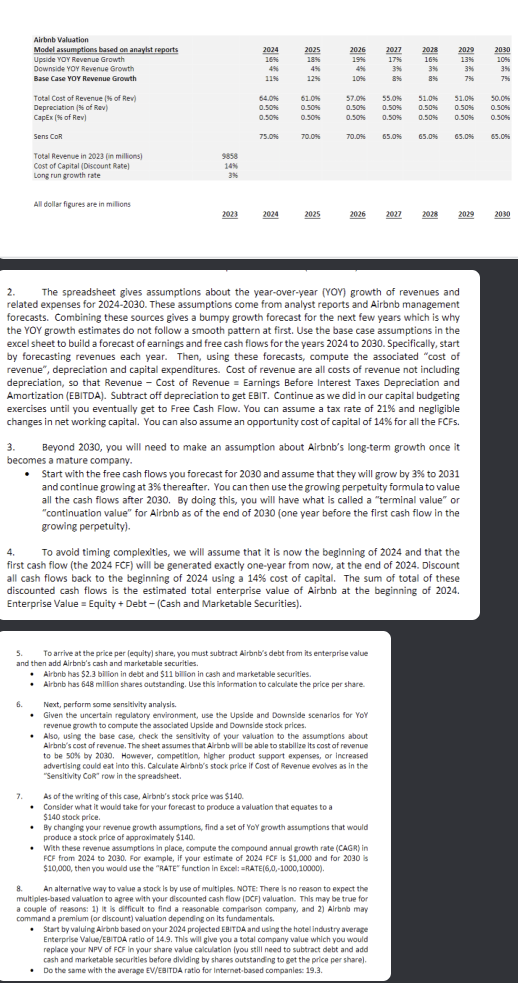

The spreadsheet gives assumptions about the year - over - year ( YOY ) growth of revenues and related expenses for 2 0 2 4

The spreadsheet gives assumptions about the yearoveryear YOY growth of revenues and

related expenses for These assumptions come from analyst reports and Airbnb management

forecasts. Combining these sources gives a bumpy growth forecast for the next few years which is why

the YOY growth estimates do not follow a smooth pattern at first. Use the base case assumptions in the

excel sheet to build a forecast of earnings and free cash flows for the years to Specifically, start

by forecasting revenues each year. Then, using these forecasts, compute the associated cost of

revenue depreciation and capital expenditures. Cost of revenue are all costs of revenue not including

depreciation, so that Revenue Cost of Revenue Earnings Before Interest Taxes Depreciation and

Amortization EBITDA Subtract off depreciation to get EBIT. Continue as we did in our capital budgeting

exercises until you eventually get to Free Cash Flow. You can assume a tax rate of and negligible

changes in net working capital. You can also assume an opportunity cost of capital of for all the FCFs

Beyond you will need to make an assumption about Airbnbs longterm growth once it

becomes a mature company.

Start with the free cash flows you forecast for and assume that they will grow by to

and continue growing at thereafter. You can then use the growing perpetuity formula to value

all the cash flows after By doing this, you will have what is called a terminal value or

continuation value for Airbnb as of the end of one year before the first cash flow in the

growing perpetuity

To avoid timing complexities, we will assume that it is now the beginning of and that the

first cash flow the FCF will be generated exactly oneyear from now, at the end of Discount

all cash flows back to the beginning of using a cost of capital. The sum of total of these

discounted cash flows is the estimated total enterprise value of Airbnb at the beginning of

Enterprise Value Equity Debt Cash and Marketable Securities

Airbnb Case MGT R Winter Page of

To arrive at the price per equity share, you must subtract Airbnbs debt from its enterprise value

and then add Airbnbs cash and marketable securities

Airbnb has $ billion in debt and $ billion in cash and marketable securities

Airbnb has million shares outstanding. Use this information to calculate the price per share.

Next, perform some sensitivity analysis.

Given the uncertain regulatory environment, use the Upside and Downside scenarios for YoY

revenue growth to compute the associated Upside and Downside stock prices.

Also, using the base case, check the sensitivity of your valuation to the assumptions about

Airbnbs cost of revenue. The sheet assumes that Airbnb will be able to stabilize its cost of revenue

to be by However, competition, higher product support expenses, or increased

advertising could eat into this. Calculate Airbnbs stock price if Cost of Revenue evolves as in the

Sensitivity CoR row in the spreadsheet.

As of the writing of this case, Airbnbs stock price was $

Consider what it would take for your forecast to produce a valuation that equates to a

$ stock price.

By changing your revenue growth assumptions, find a set of YoY growth assumptions that would

produce a stock price of approximately $

With these revenue assumptions in place, compute the compound annual growth rate CAGR in

FCF from to For example, if your estimate of FCF is $ and for is

$ then you would use the RATE function in Excel: RATE

An alternative way to value a stock is by use of multiples. NOTE: There is no reason to expect the

multiplesbased valuation to agree with your discounted cash flow DCF valuation. This may be true for

a couple of reasons: It is difficult to find a reasonable comparison company, and Airbnb may

command a premium or discount valuation depending on its fundamentals.

Start by valuing Airbnb based on your projected EBITDA and using the hotel industry average

Enterprise ValueEBITDA ratio of This will give you a total company value which you would

replace your NPV of FCF in your share value calculation you still need to subtract debt and add

cash and marketable securities before dividing by shares outstanding to get the price per share

Do the same with the average EVEBITDA ratio for Internetbased companies:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started