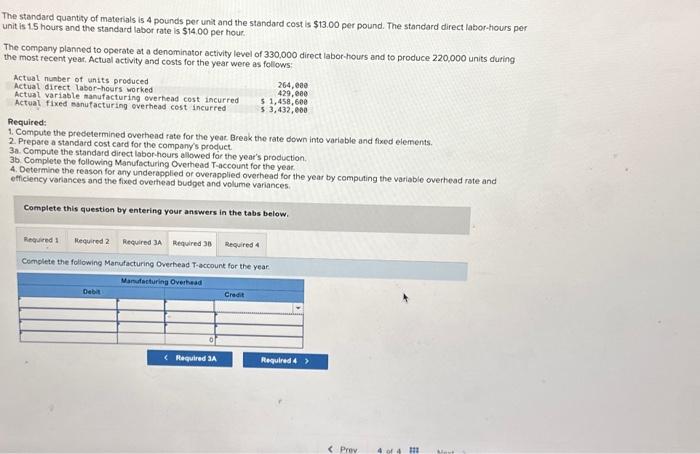

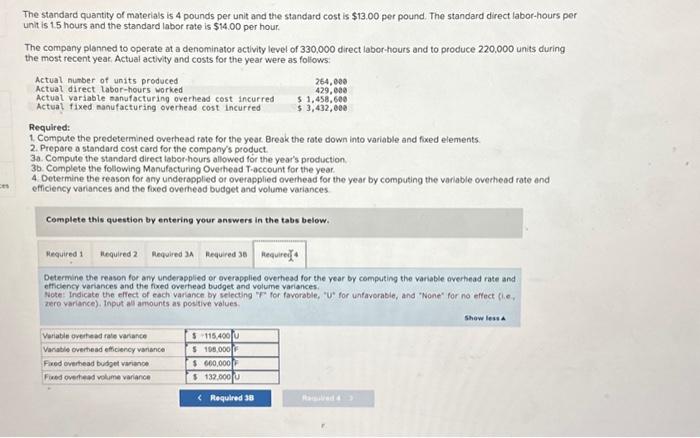

The standard quantity of materials is 4 pounds per unt and the standard cost is $13.00 per pound. The standard direct labor-hours per unit is 1.5 hours and the standard labor rate is $14,00 per hour. The company planned to operate at a denominator activity level of 330,000 direct labor-hours and to produce 220,000 units during the most recent year, Actual activity and costs for the year were as foliows: Required: 1. Compute the predetermined overhead rate for the yeat Break the rate down into variable and flxed elements. 2. Prepare a standard cost card for the companys product. 3a. Compute the standard direct labor-hours allowed for the year's production. 36. Complete the following Manufacturing Overhead T-account for the year. 4. Determine the reason for any underapplied or overapplied overhead for the year by computing the variable overhead rate and efficiency variances and the fixed overthead budpet and volume variances. Complete this question by entering your answers in the tabs below. Complete the following Manufacturing Overhead T-accouns for the year: The standard quantity of materials is 4 pounds per unit and the standard cost is $13.00 per pound. The standard direct labor-hours per unit is 1.5 hours and the standard labor rate is $14.00 per hour. The company planned to operate at a denominator activity level of 330,000 direct labor-hours and to produce 220,000 units during the most recent yeat, Actual activity and costs for the year were as follows: Required: 1. Compute the predetermined overhead rote for the yeac. Break the rate down into variable and foxed elements. 2. Prepore a standard cost card for the compony's product. 3a. Compute the standard direct labor-hours allowed for the year's production. 3b. Complete the following Manutacturing Overhead T-account for the year. 4. Determine the reason for any underapplied or overapplied overhead for the year by computing the variable overhead rate and efficiency variances and the foxed overheod budget and volume variances. Complete this question by entering your answers in the tabs below. Determine the reason for any underapplied or overapplied overhead for the year oy computing the vartable averhead rate and efficiency variances and the foxed overfead budget and volume variances. Note: Indicate the effect of each varlance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (li.e, zere variance), Input all armounts as postive volues