Question

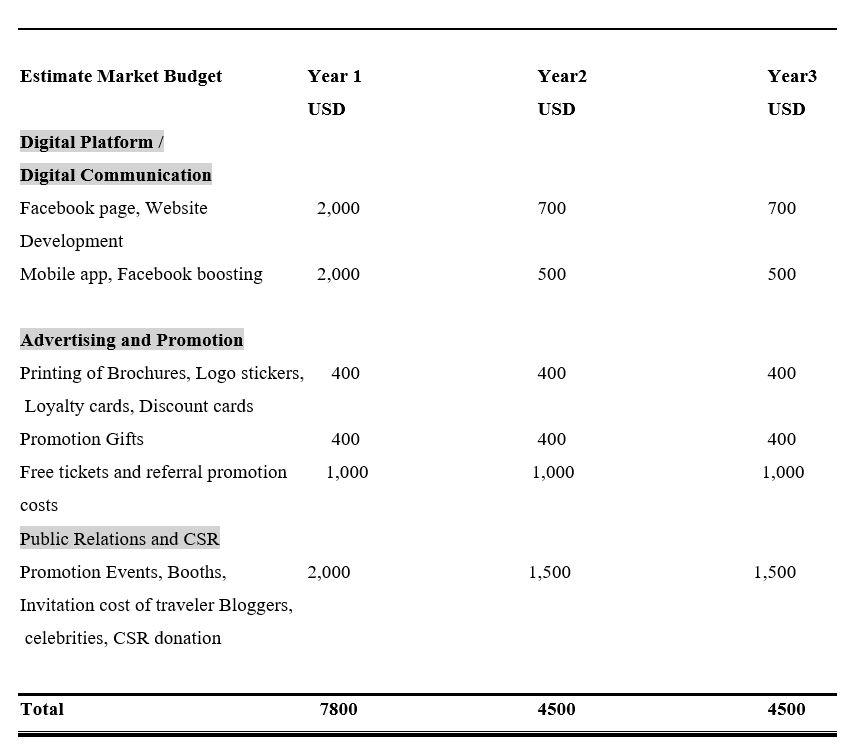

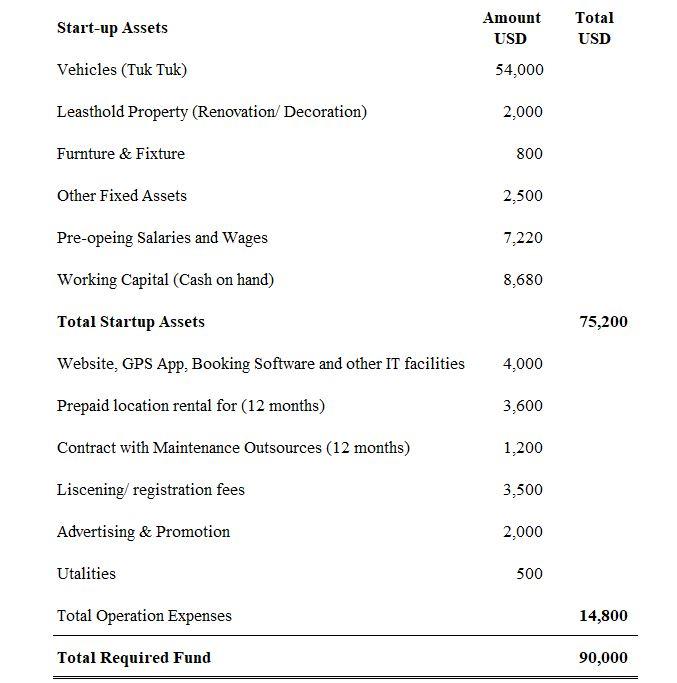

The startup company plan to use the marketing budget as follows Estimated Salaries and wages Startup expenses for Year 1 and assume Year 2

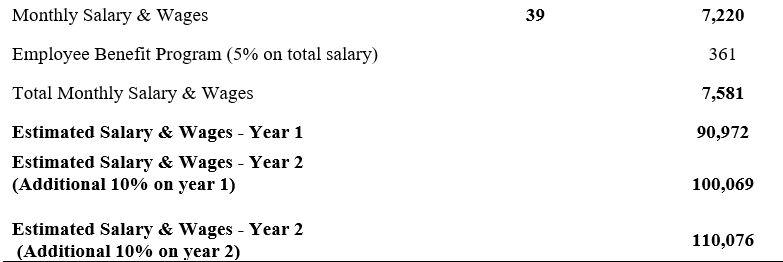

The startup company plan to use the marketing budget as follows Estimated Salaries and wages

Estimated Salaries and wages

Startup expenses for Year 1 and assume Year 2 and 3 will increase variable expenses 10%

How much the variable expenses and fixed expenses for Year 1, 2 & 3?

Expected Cash inflow is as follows:

| 100800 USD | Year 1 |

| 195120 USD | Year 2 |

| 291600 USD | Year 3 |

Prepare the cash flow statement for Year 1, 2, 3?

Please calculate the Financial ratio Payback period, Internal rate of return, Return on Equity, WACC, BEP point, Net profit margin?

How do you think about financial feasibility? and how these ratios tell about the plan?

Estimate Market Budget Digital Platform/ Digital Communication Facebook page, Website Development Mobile app, Facebook boosting Year 1 USD Total 2,000 2,000 Advertising and Promotion Printing of Brochures, Logo stickers, Loyalty cards, Discount cards Promotion Gifts 400 Free tickets and referral promotion 1,000 costs Public Relations and CSR Promotion Events, Booths, Invitation cost of traveler Bloggers, celebrities, CSR donation 400 2,000 7800 Year2 USD 700 500 400 400 1,000 1,500 4500 Year3 USD 700 500 400 400 1,000 1,500 4500

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Particular Marketting Budget Salaries wages Startup expenses Website GPS Booking soft etc Rent Maint...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started