Answered step by step

Verified Expert Solution

Question

1 Approved Answer

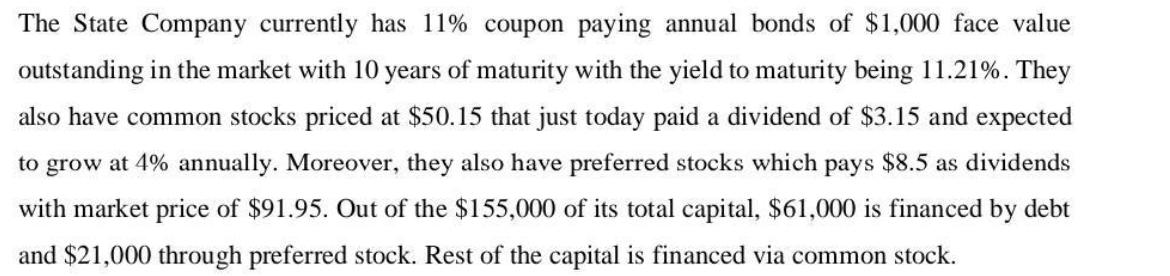

The State Company currently has 11% coupon paying annual bonds of $1,000 face value outstanding in the market with 10 years of maturity with

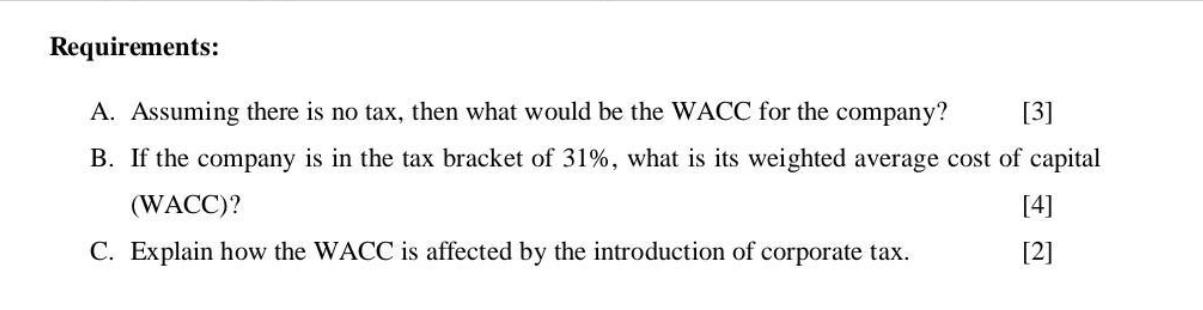

The State Company currently has 11% coupon paying annual bonds of $1,000 face value outstanding in the market with 10 years of maturity with the yield to maturity being 11.21%. They also have common stocks priced at $50.15 that just today paid a dividend of $3.15 and expected to grow at 4% annually. Moreover, they also have preferred stocks which pays $8.5 as dividends with market price of $91.95. Out of the $155,000 of its total capital, $61,000 is financed by debt and $21,000 through preferred stock. Rest of the capital is financed via common stock. Requirements: A. Assuming there is no tax, then what would be the WACC for the company? [3] B. If the company is in the tax bracket of 31%, what is its weighted average cost of capital (WACC)? C. Explain how the WACC is affected by the introduction of corporate tax. [4] [2]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The Weighted Average Cost of Capital WACC is a calculation of a companys cost of capital in which each category of capital is proportionately weighted ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started