Answered step by step

Verified Expert Solution

Question

1 Approved Answer

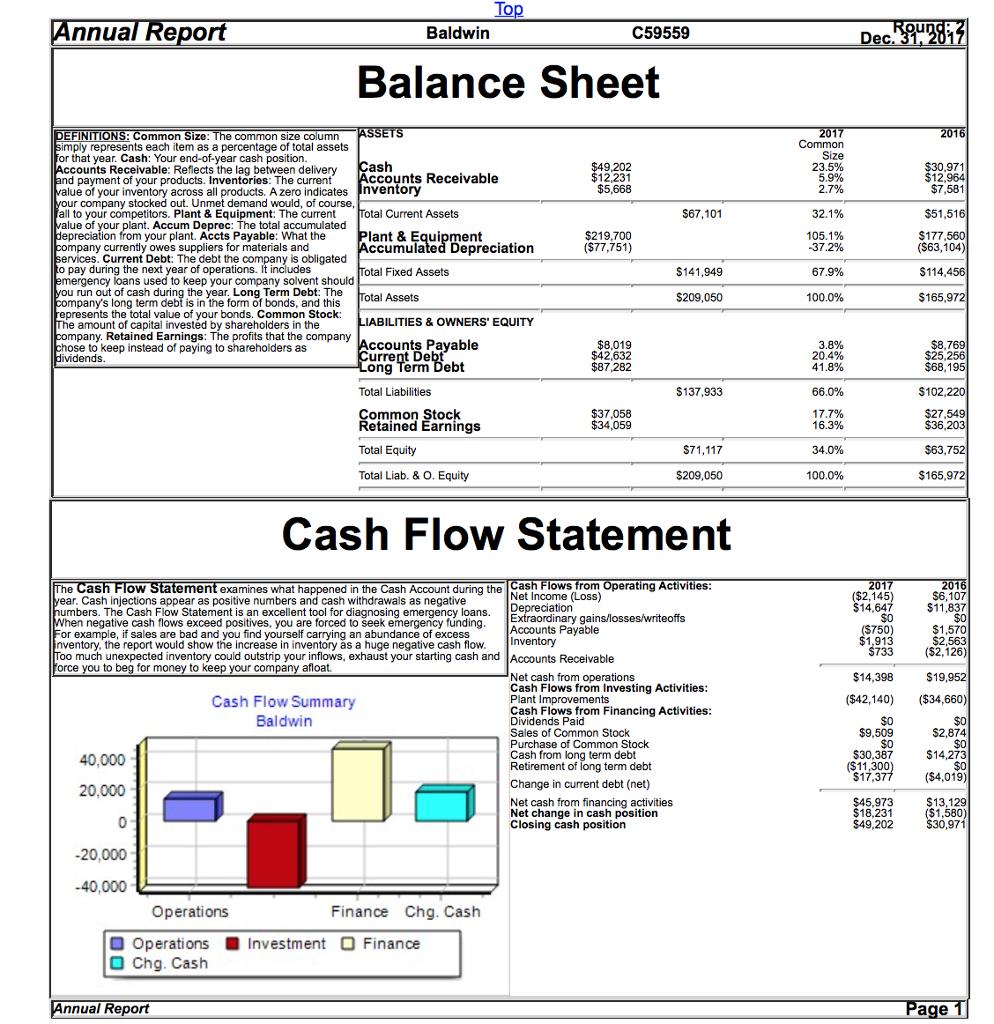

The statement of cash flows for Baldwin Company shows what happens in the Cash account during the year. It can be seen as a summary

| The statement of cash flows for Baldwin Company shows what happens in the Cash account during the year. It can be seen as a summary of the sources and uses of cash (sources of cash are added, uses of cash are subtracted). Please answer which of the following is true if Baldwin repurchases some of its common stock: | ||||||||

| Select: 1 | ||||||||

|

Annual Report Top Baldwin Round: 2 Dec. 31, 2017 C59559 Balance Sheet ASSETS 2017 Common Size 23.5% 5.9% 2.7% 2016 DEFINITIONS: Common Size: The common size column simply represents each item as a percentage of total assets for that year. Cash: Your end-of-year cash position. Accounts Receivable: Reflects the lag between delivery and payment of your products. Inventories: The current value of your inventory across all products. A zero indicates Inventory your company stocked out. Unmet demand would, of course, fall to your competitors. Plant & Equipment: The current value of your plant. Accum Deprec: The total accumulated depreciation from your plant. Accts Payable: What the company currently owes suppliers for materials and services. Current Debt: The debt the company is obligated to pay during the next year of operations. It includes emergency loans used to keep your company solvent should you run out of cash during the year. Long Term Debt: The company's long term debi is in the form of bonds, and this represents the total value of your bonds. Common Stock: The amount of capital investd by shareholders in the company. Retained Earnings: The profits that the company chose to keep instead of paying to shareholders as dividends. ash Accounts Receivable $49,202 $12,231 $5,668 $30,971 $12,964 $7,581 Total Current Assets $67,101 32.1% $51,516 Plant & Equipment Accumulated Depreciation $219,700 ($77,751) 105.1% -37.2% $177,560 (S63,104) Total Fixed Assets $141,949 67.9% $114,456 Total Assets $209,050 100.0% $165,972 LIABILITIES & OWNERS' EQUITY Accounts Payable Current Debt Cong Term Debt $8,019 $42,632 $87,282 3.8% 20.4% 41.8% $8,769 $25,256 $68, 195 Total Liabilities $137,933 66.0% $102,220 Common Stock etained Earnings $37,058 $34,059 17.7% 16.3% $27,549 $36,203 Total Equity $71,117 34.0% $63,752 Total Liab. & O. Equity $209,050 100.0% $165,972 Cash Flow Statement The Cash Flow Statement examines what happened in the Cash Account during the Cash Flows from Operating Activities: year. Cash injections appear as positive numbers and cash withdrawals as negative humbers. The Cash Flow Statement is an excellent tool for diagnosing emergency loans. When negative cash flows exceed positives, you are forced to eek emergency fnding. For example, if sales are bad and you find yourself carrying an abundance of excess nventory, the report would show the increase in inventory s a huge negative cash flow. Too much unexpected inventory could outstrip your inflows, exhaust your starting cash and Accounts Receivable Force you to beg for money to keep your company afloat. Net Income (Loss) Depreciation Extraordinary gains/losses/writeoffs Accounts Payable Inventory 2017 ($2,145) $14,647 $0 (S750) $1,913 $733 2016 $6,107 $11,837 $0 $1,570 $2,563 ($2,126) Net cash from operations Cash Flows from Investing Activities: Plant Improvements Cash Flows from Financing Activities: Dividends Paid Sales of Common Stock Purchase of Common Stock Cash from long term debt Retirement of long term debt $14,398 $19,952 ($34,660) Cash Flow Summary Baldwin ($42,140) $0 $9,509 $0 $30,387 ($11,300) $17,377 $0 $2,874 $0 $14,273 $0 ($4,019) 40,000 Change in current debt (net) 20,000 Net cash from financing activities Net change in cash position Closing cash position $45,973 $18,231 $49,202 $13,129 ($1,580) $30,971 -20,000 -40,000 Operations Finance Chg. Cash O Operations O Chg. Cash Investment O Finance Annual Report Page 1

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Whenever a company purchases inventory then it results i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d7a6a5d845_175994.pdf

180 KBs PDF File

635d7a6a5d845_175994.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started