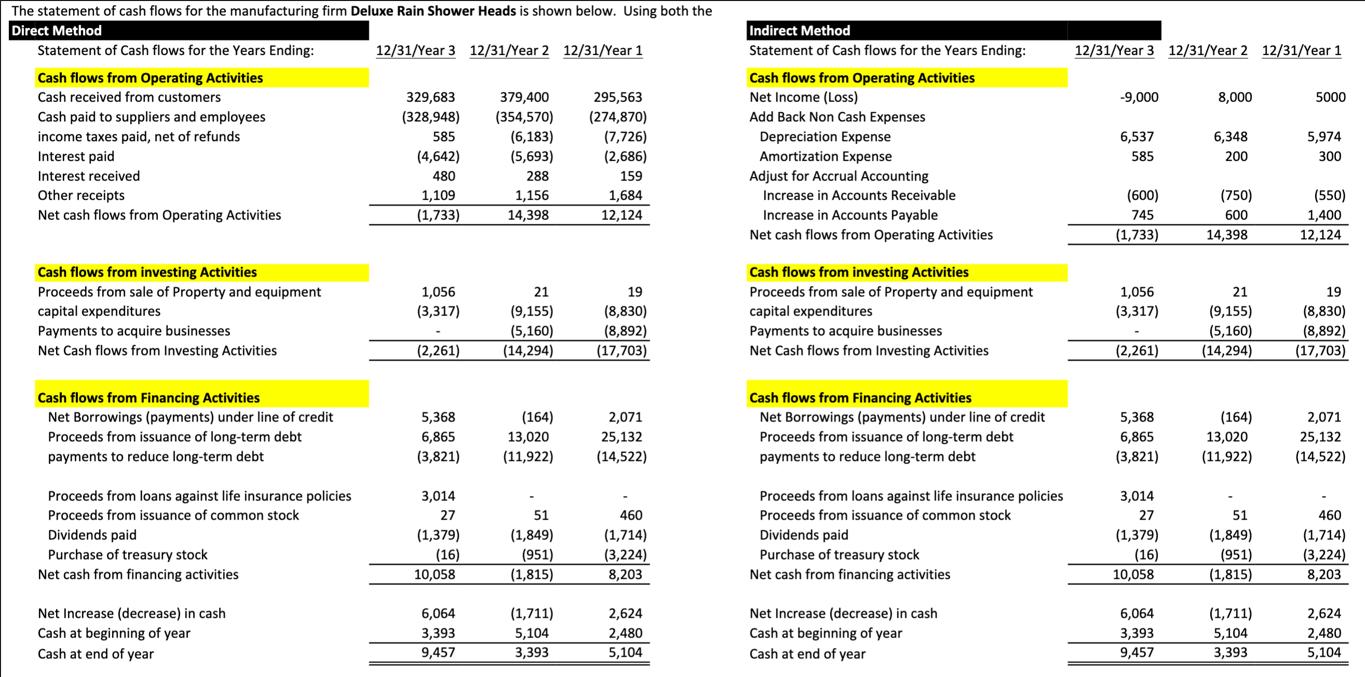

The statement of cash flows for the manufacturing firm Deluxe Rain Shower Heads is shown below. Using both the Direct Method Statement of Cash

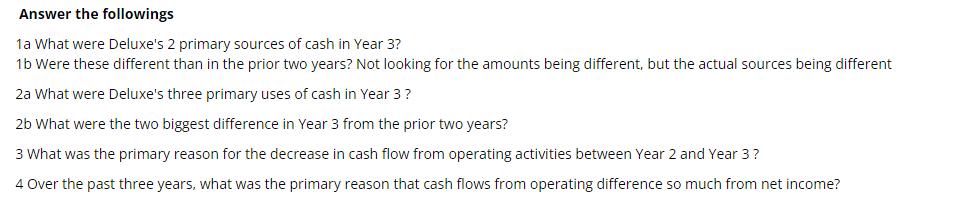

The statement of cash flows for the manufacturing firm Deluxe Rain Shower Heads is shown below. Using both the Direct Method Statement of Cash flows for the Years Ending: Cash flows from Operating Activities Cash received from customers Cash paid to suppliers and employees income taxes paid, net of refunds Interest paid Interest received Other receipts Net cash flows from Operating Activities Cash flows from investing Activities Proceeds from sale of Property and equipment capital expenditures Payments to acquire businesses Net Cash flows from Investing Activities Cash flows from Financing Activities Net Borrowings (payments) under line of credit Proceeds from issuance of long-term debt payments to reduce long-term debt Proceeds from loans against life insurance policies Proceeds from issuance of common stock Dividends paid Purchase of treasury stock Net cash from financing activities Net Increase (decrease) in cash Cash at beginning of year Cash at end of year 12/31/Year 3 12/31/Year 2 12/31/Year 1 329,683 (328,948) 585 (4,642) 480 1,109 (1,733) 1,056 (3,317) (2,261) 5,368 6,865 (3,821) 3,014 27 (1,379) (16) 10,058 6,064 3,393 9,457 379,400 (354,570) (6,183) (5,693) 288 1,156 14,398 21 (9,155) (5,160) (14,294) (164) 13,020 (11,922) 51 (1,849) (951) (1,815) (1,711) 5,104 3,393 295,563 (274,870) (7,726) (2,686) 159 1,684 12,124 19 (8,830) (8,892) (17,703) 2,071 25,132 (14,522) 460 (1,714) (3,224) 8,203 2,624 2,480 5,104 Indirect Method Statement of Cash flows for the Years Ending: Cash flows from Operating Activities Net Income (Loss) Add Back Non Cash Expenses Depreciation Expense Amortization Expense Adjust for Accrual Accounting Increase in Accounts Receivable Increase in Accounts Payable Net cash flows from Operating Activities Cash flows from investing Activities Proceeds from sale of Property and equipment capital expenditures Payments to acquire businesses Net Cash flows from Investing Activities Cash flows from Financing Activities Net Borrowings (payments) under line of credit Proceeds from issuance of long-term debt payments to reduce long-term debt Proceeds from loans against life insurance policies Proceeds from issuance of common stock Dividends paid Purchase of treasury stock Net cash from financing activities Net Increase (decrease) in cash Cash at beginning of year Cash at end of year 12/31/Year 3 12/31/Year 2 12/31/Year 1 -9,000 6,537 585 (600) 745 (1,733) 1,056 (3,317) (2,261) 5,368 6,865 (3,821) 3,014 27 (1,379) (16) 10,058 6,064 3,393 9,457 8,000 6,348 200 (750) 600 14,398 21 (9,155) (5,160) (14,294) (164) 13,020 (11,922) 51 (1,849) (951) (1,815) (1,711) 5,104 3,393 5000 5,974 300 (550) 1,400 12,124 19 (8,830) (8,892) (17,703) 2,071 25,132 (14,522) 460 (1,714) (3,224) 8,203 2,624 2,480 5,104 Answer the followings 1a What were Deluxe's 2 primary sources of cash in Year 3? 1b Were these different than in the prior two years? Not looking for the amounts being different, but the actual sources being different 2a What were Deluxe's three primary uses of cash in Year 3 ? 2b What were the two biggest difference in Year 3 from the prior two years? 3 What was the primary reason for the decrease in cash flow from operating activities between Year 2 and Year 3? 4 Over the past three years, what was the primary reason that cash flows from operating difference so much from net income?

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1a The two primary sources of cash in Year 3 for Deluxe Rain Shower Heads were Cash received from cu...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started