Answered step by step

Verified Expert Solution

Question

1 Approved Answer

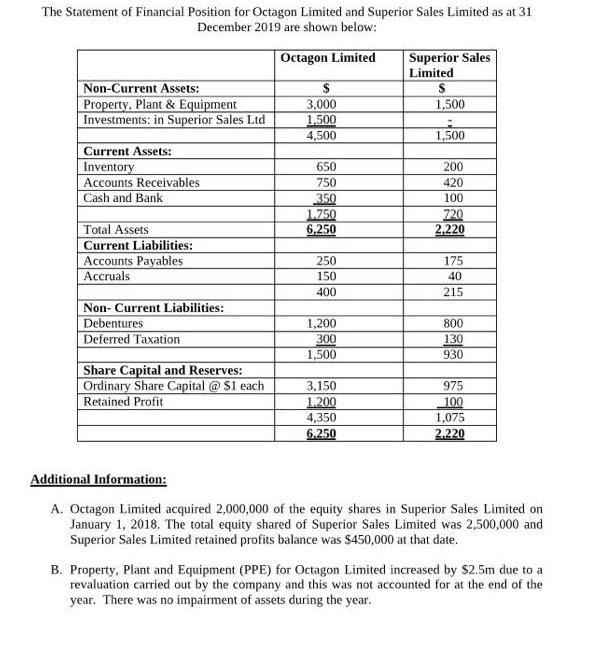

The Statement of Financial Position for Octagon Limited and Superior Sales Limited as at 31 December 2019 are shown below: Octagon Limited Superior Sales

The Statement of Financial Position for Octagon Limited and Superior Sales Limited as at 31 December 2019 are shown below: Octagon Limited Superior Sales Limited Non-Current Assets: Property, Plant & Equipment Investments: in Superior Sales Ltd 3,000 1,500 4,500 1,500 1,500 Current Assets: Inventory Accounts Receivables Cash and Bank 650 200 750 420 350 100 1.750 6,250 720 2,220 Total Assets Current Liabilities: Accounts Payables Accruals 250 175 150 40 400 215 Non- Current Liabilities: Debentures Deferred Taxation 1,200 800 130 930 300 1,500 Share Capital and Reserves: Ordinary Share Capital @$1 each 3,150 975 Retained Profit 1.200 100 4,350 1,075 6.250 2,220 Additional Information: A. Octagon Limited acquired 2,000,000 of the equity shares in Superior Sales Limited on January 1, 2018. The total equity shared of Superior Sales Limited was 2,500,000 and Superior Sales Limited retained profits balance was $450,000 at that date. B. Property, Plant and Equipment (PPE) for Octagon Limited increased by $2.5m due to a revaluation carried out by the company and this was not accounted for at the end of the year. There was no impairment of assets during the year. Required: i. Prepare Octagon Limited group consolidated Statement of Financial Position as at 31 December 2019? ii. Explain the terms "Pre-acquisition and Post Acquisition profits?

Step by Step Solution

★★★★★

3.31 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Preacquisition profit refers to the profit retained profits earned by the company prior ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started