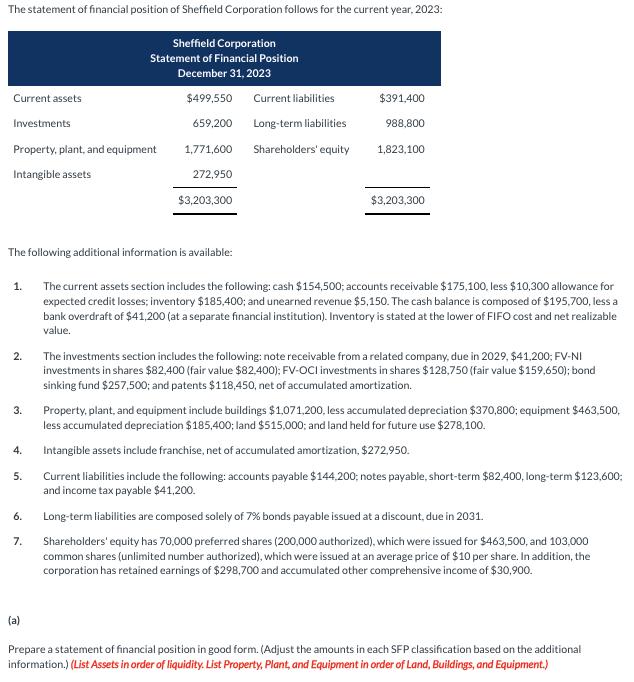

The statement of financial position of Sheffield Corporation follows for the current year, 2023: Sheffield Corporation Statement of Financial Position December 31, 2023 Current

The statement of financial position of Sheffield Corporation follows for the current year, 2023: Sheffield Corporation Statement of Financial Position December 31, 2023 Current assets $499,550 Current liabilities $391,400 Investments 659,200 Long-term liabilities 988,800 Property, plant, and equipment 1,771,600 Shareholders' equity 1,823,100 Intangible assets 272,950 $3,203,300 $3,203,300 The following additional information is available: 1. 2. 3. 4. 5. 6. 7. The current assets section includes the following: cash $154,500; accounts receivable $175,100, less $10,300 allowance for expected credit losses; inventory $185,400; and unearned revenue $5,150. The cash balance is composed of $195,700, less a bank overdraft of $41,200 (at a separate financial institution). Inventory is stated at the lower of FIFO cost and net realizable value. The investments section includes the following: note receivable from a related company, due in 2029, $41,200; FV-NI investments in shares $82,400 (fair value $82,400); FV-OCI investments in shares $128,750 (fair value $159,650); bond sinking fund $257,500; and patents $118,450, net of accumulated amortization. Property, plant, and equipment include buildings $1,071,200, less accumulated depreciation $370,800; equipment $463,500, less accumulated depreciation $185,400; land $515,000; and land held for future use $278,100. Intangible assets include franchise, net of accumulated amortization, $272,950. Current liabilities include the following: accounts payable $144,200; notes payable, short-term $82,400, long-term $123,600: and income tax payable $41,200. Long-term liabilities are composed solely of 7% bonds payable issued at a discount, due in 2031. Shareholders' equity has 70,000 preferred shares (200,000 authorized), which were issued for $463,500, and 103,000 common shares (unlimited number authorized), which were issued at an average price of $10 per share. In addition, the corporation has retained earnings of $298,700 and accumulated other comprehensive income of $30,900. (a) Prepare a statement of financial position in good form. (Adjust the amounts in each SFP classification based on the additional information.) (List Assets in order of liquidity. List Property, Plant, and Equipment in order of Land, Buildings, and Equipment.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Id be happy to help you with the questions 1 Current Assets The current assets of the company are Cash 154500 including overdraft of 41200 Accounts Re...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

66427b7450f61_979914.pdf

180 KBs PDF File

66427b7450f61_979914.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started