Answered step by step

Verified Expert Solution

Question

1 Approved Answer

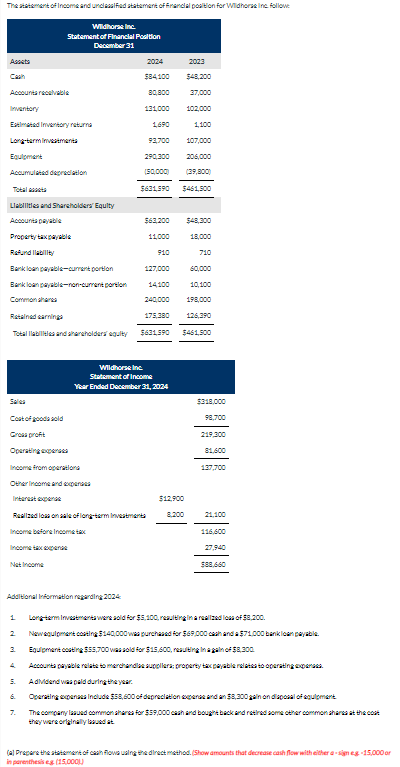

The statement of Income and unclassified statement of financial position for Wildhorse Inc. followe Wildhorse Inc. Statement of Financial Position December 31 Assets 2024

The statement of Income and unclassified statement of financial position for Wildhorse Inc. followe Wildhorse Inc. Statement of Financial Position December 31 Assets 2024 2023 Cash $84,100 $48,200 Accounts receivable 80,800 37,000 Inventory 131,000 102,000 Estimated Inventory returna 1,690 1100 Long-term investments 93,700 107,000 Equipment 290,300 206,000 Accumulated depreciation (50,000) (39,800) Total $631,590 $461,500 Liabilities and Shareholders' Equity Accounts payable $63,200 $48,300 Property tax payable 11,000 18,000 Refundlability 910 710 Bank loan payable-current portion 127,000 60,000 Bank loan payable-non-current portion 14,100 10,100 Common shares 240,000 198,000 Retained earnings 175,380 126,390 Total abilities and shareholders' equity $631,590 $461,500 Sales Cost of goods sold Gross profit Operating expe Wildhorse Inc. Statement of Income Year Ended December 31, 2024 $318,000 98,700 219,300 81,600 137,700 Income from operationa Other Income and exp Interest expense $12,900 Realized loss on sale of long-term investments 8.200 21,100 Income before Income tax 116,600 Income tax expense 27.940 Net Income $88,660 Additional Information regarding 2024 1 Long-term Investments were sold for $5,100, resulting in a realized loss of $8,200. 2 New equipment costing $140,000 was purchased for $69,000 cash and a $71,000 bank loan payable. 3. Equipment costing $55,700 was sold for $15,600, resulting in a gain of $8,300 4. Accounts payable relate to merchandise suppliers; property tax payable relates to operating expenses. 5. Adividend was peld during the year. 6. Operating expenses include $58,600 of depreciation expense and an $8,300 gain on disposal of equipment 7. The company issued common shares for $59,000 cash and bought back and retired some other common shares at the cost they were originally saved at (a) Prepare the statement of cash flows using the direct method. (Show amounts that decrease cash flow with either a-sign eg-15,000 or in parenthesis eg (15,000)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started