Question

The statements of financial position for Hi Plc, Fi Ltd and Ti Ltd as at 31 December 2018 are given below: Hi Plc acquired 75%

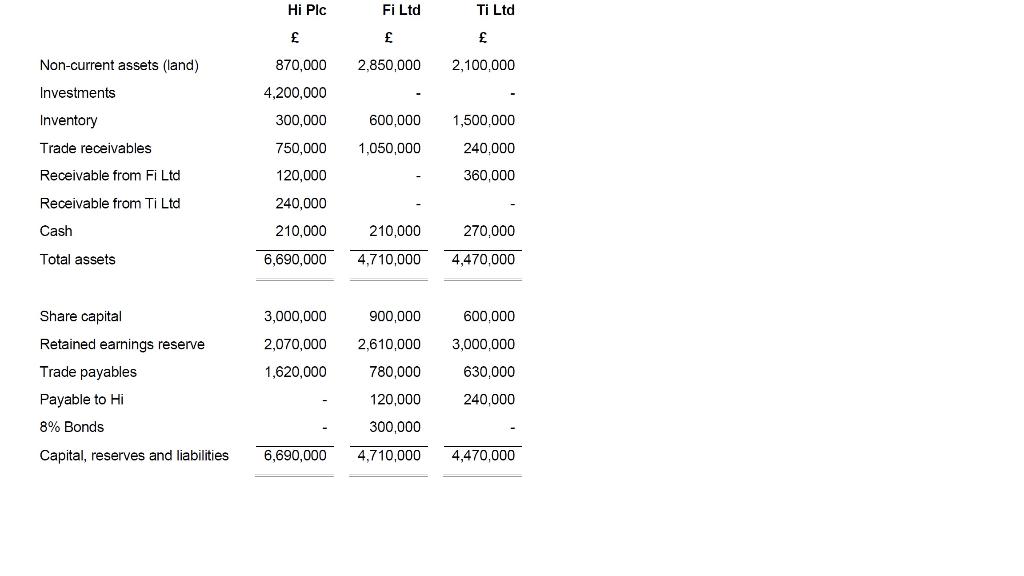

The statements of financial position for Hi Plc, Fi Ltd and Ti Ltd as at 31 December 2018 are given below:

Hi Plc acquired 75% of Fi Ltd on 1 January 2015 for 2,505,000, gaining significant influence over Fi Ltd. Fi Ltd's share capital and reserves were 960,000 on 1 January 2015. The fair value of Fi Ltds non-current assets on 1 January 2015 was 3,630,000 and this revaluation has not been incorporated into Fi Ltds accounts. At the same time, Hi Plc acquired 10% of the bonds in Fi Ltd for 30,000. No goodwill arose on this transaction.

Bond interest payable by Fi Ltd for 2018 is outstanding as at 31 December 2018. The bond interest payable by Fi Ltd and interest receivable by Hi Plc has not been accounted for as at 31 December 2018.

Hi Plc acquired 40% of Ti Ltd on 1 January 2011 for 1,200,000, gaining partial influence over Ti Ltd. Ti Ltds share capital and reserves were 900,000 on this date.

Hi Plcs policy is to capitalise goodwill. Impairment of 50% of all goodwill is seen in 2018.

In 2018, Hi Plcs inventory includes inventory acquired from Fi Ltd for 50,000 which had cost Fi Ltd 30,000 and inventory from Ti Ltd for 100,000 which had cost Ti Ltd 10,000.

Required: Prepare the consolidated statement of financial position for Hi Plc as at 31 December 2018.

Hi PIC Fi Ltd Ti Ltd Non-current assets (land) 870,000 2.850,000 2,100,000 Investments 4,200,000 Inventory 300,000 600,000 1,500,000 Trade receivables 1,050,000 240,000 750,000 120,000 Receivable from Fi Ltd 360,000 Receivable from Ti Ltd 240,000 Cash 210,000 210,000 270.000 Total assets 6,690,000 4,710,000 4,470,000 3,000,000 900,000 600,000 2,070,000 3,000,000 Share capital Retained earnings reserve Trade payables Payable to Hi 8% Bonds 2,610,000 780,000 1,620,000 630,000 120,000 240,000 300,000 Capital, reserves and liabilities 6,690,000 4,710,000 4,470,000 Hi PIC Fi Ltd Ti Ltd Non-current assets (land) 870,000 2.850,000 2,100,000 Investments 4,200,000 Inventory 300,000 600,000 1,500,000 Trade receivables 1,050,000 240,000 750,000 120,000 Receivable from Fi Ltd 360,000 Receivable from Ti Ltd 240,000 Cash 210,000 210,000 270.000 Total assets 6,690,000 4,710,000 4,470,000 3,000,000 900,000 600,000 2,070,000 3,000,000 Share capital Retained earnings reserve Trade payables Payable to Hi 8% Bonds 2,610,000 780,000 1,620,000 630,000 120,000 240,000 300,000 Capital, reserves and liabilities 6,690,000 4,710,000 4,470,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started