Answered step by step

Verified Expert Solution

Question

1 Approved Answer

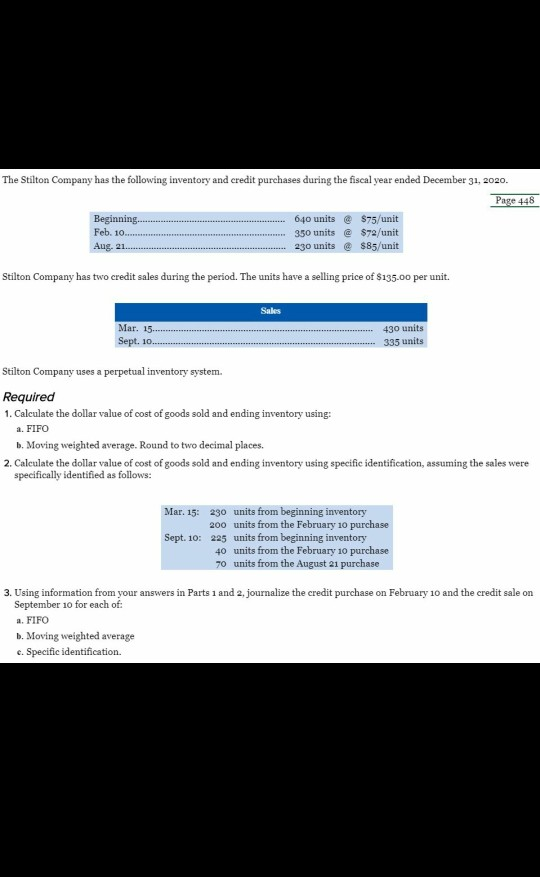

The Stilton Company has the following inventory and credit purchases during the fiscal year ended December 31, 2020. Page 448 Beginning. 640 units @ $75/unit

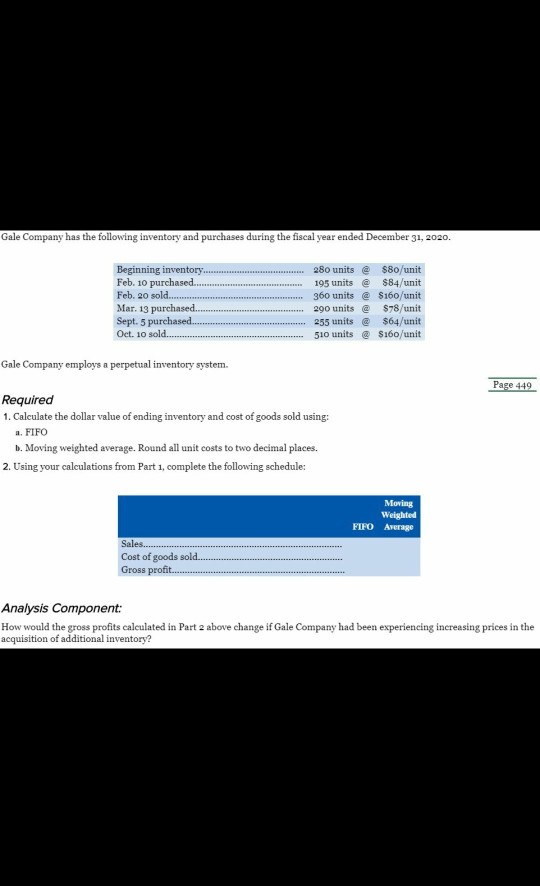

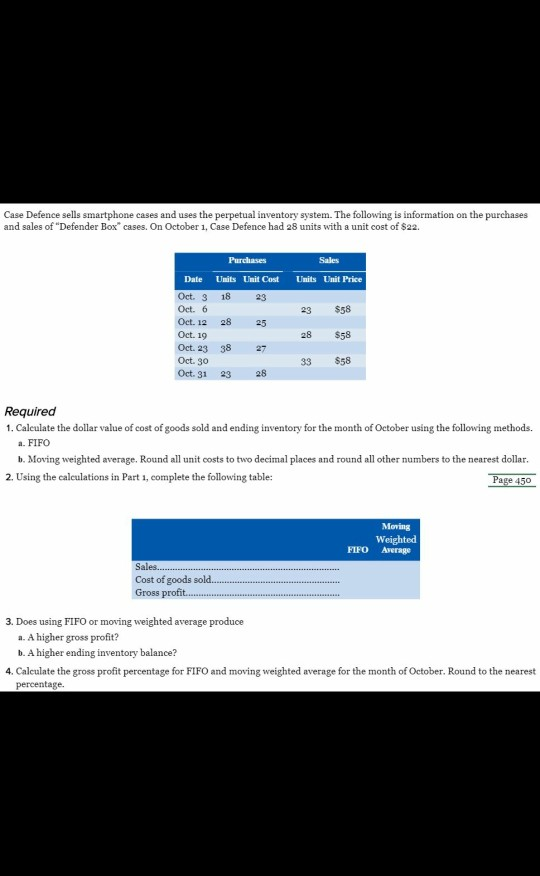

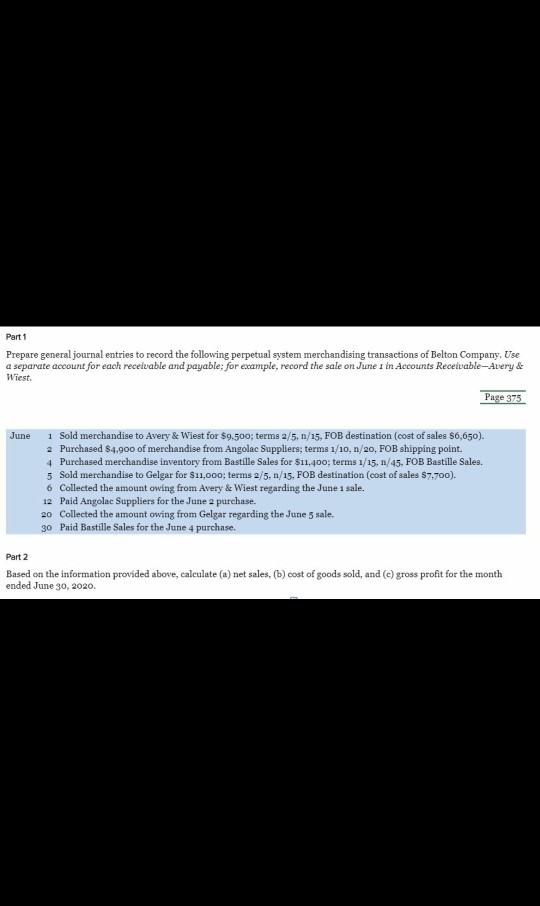

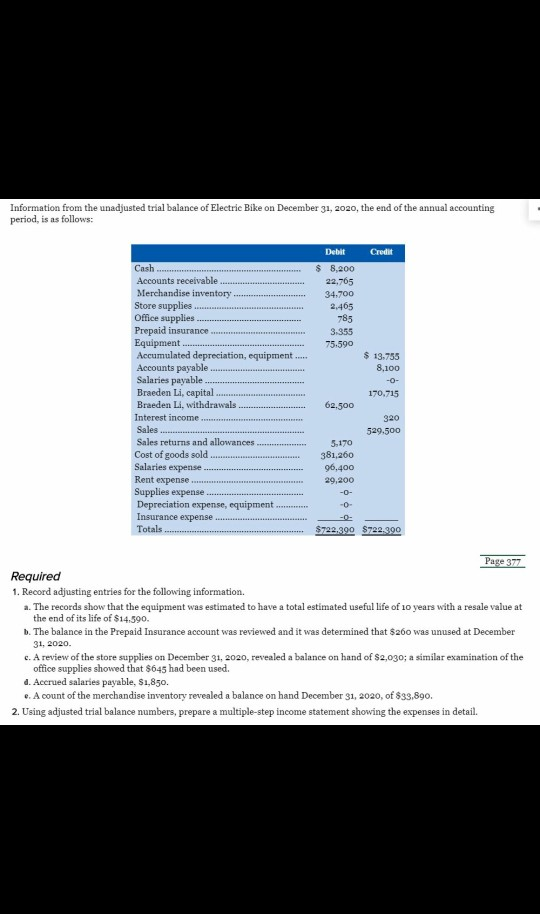

The Stilton Company has the following inventory and credit purchases during the fiscal year ended December 31, 2020. Page 448 Beginning. 640 units @ $75/unit Feb. 10 350 units @ $72/unit Aug. 21. 230 units @ $85/unit Stilton Company has two credit sales during the period. The units have a selling price of $135.00 per unit. Sales Mar. 15 Sept. 10. 430 units 335 units Stilton Company uses a perpetual inventory system. Required 1. Calculate the dollar value of cost of goods sold and ending inventory using: a. FIFO b. Moving weighted average. Round to two decimal places. 2. Calculate the dollar value of cost of goods sold and ending inventory using specific identification, assuming the sales were specifically identified as follows: Mar. 15: 230 units from beginning inventory 200 units from the February 10 purchase Sept. 10: 225 units from beginning inventory 40 units from the February 10 purchase 70 units from the August 21 purchase 3. Using information from your answers in Parts 1 and 2, journalize the credit purchase on February 10 and the credit sale on September 10 for each of a. FIFO b. Moving weighted average c. Specific identification. Gale Company has the following inventory and purchases during the fiscal year ended December 31, 2020. Beginning inventory... Feb. 10 purchased. Feb. 20 sold. Mar. 13 purchased.. Sept. 5 purchased. Oct. 10 sold... 280 units @ $80/unit 195 units @ $84/unit 360 units @ $160/unit 290 units @ $78/unit 255 units @ $64/unit 510 units $160/unit Gale Company employs a perpetual inventory system. Page 449 Required 1. Calculate the dollar value of ending inventory and cost of goods sold using: a. FIFO .. Moving weighted average. Round all unit costs to two decimal places. 2. Using your calculations from Part 1, complete the following schedule: Moving Weighted FIFO Average Sales.. Cost of goods sold... Gross profit.. Analysis Component: How would the gross profits calculated in Part 2 above change if Gale Company had been experiencing increasing prices in the acquisition of additional inventory? Case Defence sells smartphone cases and uses the perpetual inventory system. The following is information on the purchases and sales of "Defender Box" cases. On October 1, Case Defence had 28 units with a unit cost of $22. Sales Units Unit Price $58 Purchases Date Units Unit Cost Oct. 3 18 Oct. 6 Oct. 12 28 Oct. 19 Oct. 23 38 27 Oct. 30 Oct. 31 28 23 25 27 23 28 $58 33 $58 23 Required 1. Calculate the dollar value of cost of goods sold and ending inventory for the month of October using the following methods. a. FIFO b. Moving weighted average. Round all unit costs to two decimal places and round all other numbers to the nearest dollar. 2. Using the calculations in Part 1, complete the following table: Page 450 Moving Weighted FIFO Average Sales..... Cost of goods sold. Gross profit. 3. Does using FIFO or moving weighted average produce 1. A higher gross profit? b. A higher ending inventory balance? 4. Calculate the gross profit percentage for FIFO and moving weighted average for the month of October. Round to the nearest percentage. Part 1 Prepare general journal entries to record the following perpetual system merchandising transactions of Belton Company. Use a separate account for each receivable and payable, for example, record the sale on June 1 in Accounts Receivable-Avery & Wiest. Page 375 June 1 Sold merchandise to Avery & Wiest for $9,500; terms 2/5, n/15, FOB destination (cost of sales $6,650). 2 Purchased $4.900 of merchandise from Angolac Suppliers; terms 1/10,n/20, FOB shipping point 4 Purchased merchandise inventory from Bastille Sales for $11,400; terms 1/15, n/45. FOB Bastille Sales. 5 Sold merchandise to Gelgar for $11,000; terms 2/5, n/15, FOB destination (cost of sales $7.700). 6 Collected the amount owing from Avery & Wiest regarding the June 1 sale. 12 Paid Angolac Suppliers for the June 2 purchase. 20 Collected the amount owing from Gelgar regarding the June 5 sale. 30 Paid Bastille Sales for the June 4 purchase. Part 2 Based on the information provided above, calculate (a) net sales, (b) cost of goods sold, and (c) gross profit for the month ended June 30, 2020 Information from the unadjusted trial balance of Electric Bike on December 31, 2020, the end of the annual accounting period, is as follows: Debit Credit $ 8,200 22,765 34.700 2,465 785 3.355 75.590 Cash Accounts receivable Merchandise inventory Store supplies Office supplies Prepaid insurance Equipment. Accumulated depreciation, equipment Accounts payable Salaries payable Braeden Li, capital Braeden Li, withdrawals Interest income Sales Sales returns and allowances Cost of goods sold Salaries expense Rent expense Supplies expense Depreciation expense, equipment Insurance expense.... Totals $ 13.755 8.100 -O- 170,715 62.500 320 529.500 5.170 381,260 96,400 29,200 -0- $722.390 $722,390 Page 377 Required 1. Record adjusting entries for the following information. a. The records show that the equipment was estimated to have a total estimated useful life of 10 years with a resale value at the end of its life of $14.590. . The balance in the Prepaid Insurance account was reviewed and it was determined that $260 was unused at December c. A review of the store supplies on December 31, 2020, revealed a balance on hand of $2,030; a similar examination of the office supplies showed that $645 had been used. 4. Accrued salaries payable, $1,850. c. A count of the merchandise inventory revealed a balance on hand December 31, 2020, of $33,890. 2. Using adjusted trial balance numbers, prepare a multiple-step income statement showing the expenses in detail. 31, 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started