Question

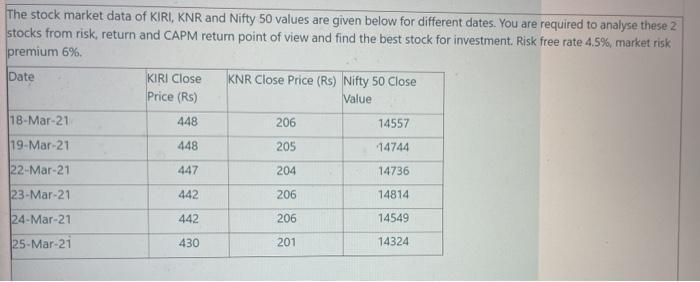

The stock market data of KIRI, KNR and Nifty 50 values are given below for different dates. You are required to analyse these 2

The stock market data of KIRI, KNR and Nifty 50 values are given below for different dates. You are required to analyse these 2 stocks from risk, return and CAPM return point of view and find the best stock for investment. Risk free rate 4.5%, market risk premium 6%. Date 18-Mar-211 19-Mar-21 22-Mar-21 23-Mar-21 24-Mar-21 25-Mar-21 KIRI Close Price (Rs) 448 448 447 442 442 430 KNR Close Price (Rs) Nifty 50 Close Value 206 205 204 206 206 201 14557 14744 14736 14814 14549 14324

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To analyze the stocks KIRI and KNR from a risk return and CAPM perspective we need to calculate the following metrics Daily Returns Calculate the daily returns for each stock and the Nifty 50 index Av...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

An Introduction To Statistical Methods And Data Analysis

Authors: R. Lyman Ott, Micheal T. Longnecker

7th Edition

1305269470, 978-1305465527, 1305465520, 978-1305269477

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App