Answered step by step

Verified Expert Solution

Question

1 Approved Answer

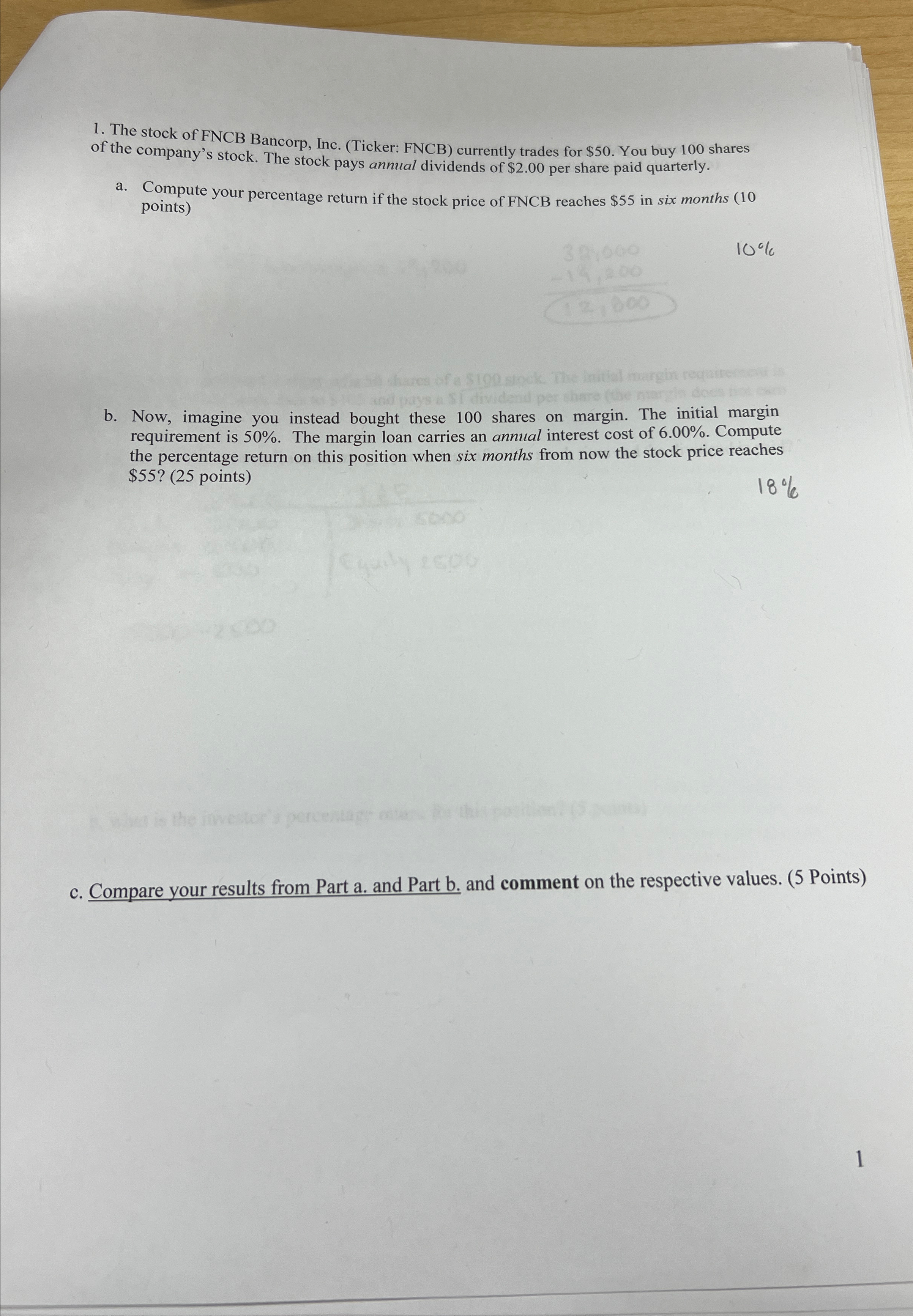

The stock of FNCB Bancorp, Inc. ( Ticker: FNCB ) currently trades for $ 5 0 . You buy 1 0 0 shares of the

The stock of FNCB Bancorp, Inc. Ticker: FNCB currently trades for $ You buy shares of the company's stock. The stock pays annual dividends of $ per share paid quarterly.

a Compute your percentage return if the stock price of FNCB reaches $ in six months points

b Now, imagine you instead bought these shares on margin. The initial margin requirement is The margin loan carries an annual interest cost of Compute the percentage return on this position when six months from now the stock price reaches $ points

c Compare your results from Part a and Part b and comment on the respective values. Points

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started