Question

The stock picked is OFX Group ltd DPS is the total annual dividend per share paid for the financial year. Based on the previous 5-year

The stock picked is OFX Group ltd

DPS is the total annual dividend per share paid for the financial year. Based on the previous 5-year pattern of DPS payments, estimate the intrinsic values using 1-stage models (the constant dividend growth model), and the 2-stage non-constant dividend growth model. Please use the 10-year Government bond yield as the Dividend growth rate in the equilibrium stage. You need to choose which model is the most appropriate one to use, and compare the intrinsic value versus the share price as of November 2020 ('current price'). Would you recommend to buy or sell the shares in November 2020?

Reference:https://au.finance.yahoo.com/quote/OFX.AX/

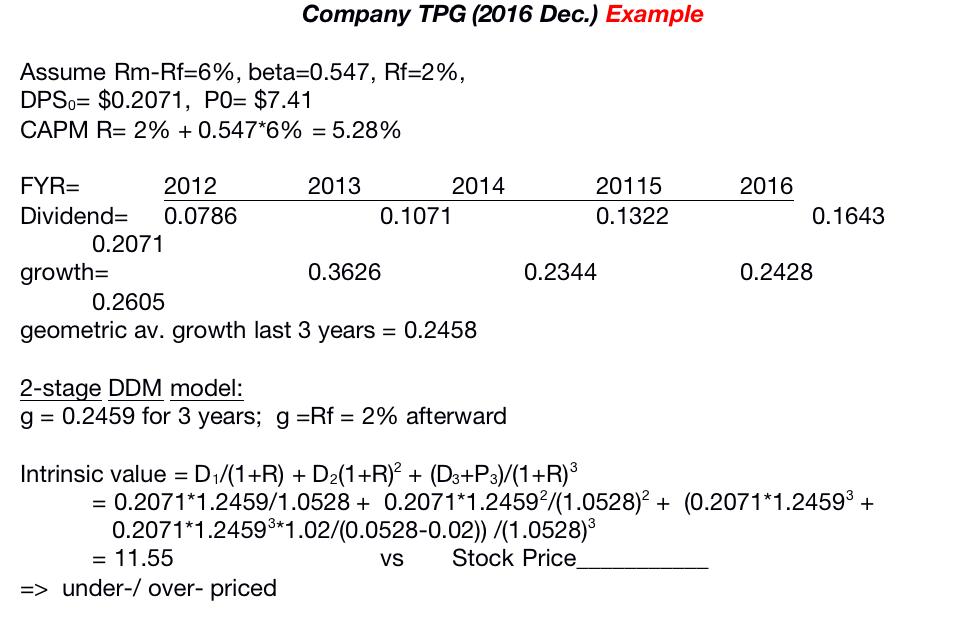

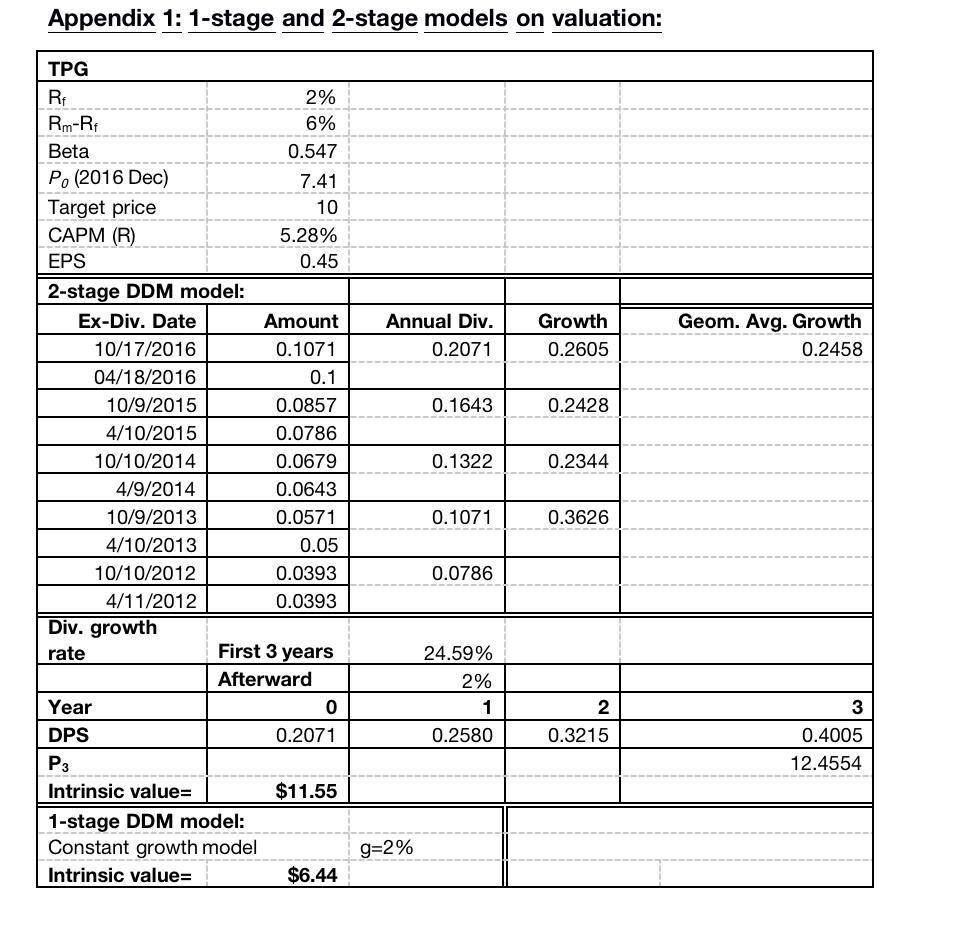

Assume Rm-Rf=6%, beta=0.547, Rf=2%, DPS= $0.2071, P0= $7.41 CAPM R= 2% +0.547*6% = 5.28% FYR= 2012 Dividend= 0.0786 0.2071 Company TPG (2016 Dec.) Example 2013 0.1071 growth= 0.2605 geometric av. growth last 3 years = 0.2458 0.3626 = 11.55 => under-/ over-priced 2014 2-stage DDM model: g = 0.2459 for 3 years; g =Rf = 2% afterward VS 20115 0.1322 0.2344 0.2071*1.2459*1.02/(0.0528-0.02))/(1.0528) Intrinsic value = D/(1+R) + D(1+R) + (D3+P3)/(1+R) = 0.2071*1.2459/1.0528+ 0.2071*1.24592/(1.0528) + (0.2071*1.2459 + Stock Price 2016 0.1643 0.2428

Step by Step Solution

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

1 Gather data on OFX Group Ltd OFXAX from the given URL Current share price as of Nov 20...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started